USD/JPY Forecast: Bullish case stronger once above 109.35

USD/JPY Current price: 109.14

- Financial markets are waiting for US employment and Durable Goods data.

- US Treasury yields bounced modestly from weekly lows but remain depressed.

- USD/JPY consolidates gains above the 109.00 figure, but dollar’s weakness limits the upside.

The USD/JPY consolidates modest gains above the 109.00 figure, still poised to advance although without enough momentum. Financial markets have been pretty quiet since the latest Wall Street’s close, as the macroeconomic calendar remained quite scarce. Investors are now waiting for US data, as the country will publish Initial Jobless Claims for the week ended May 21, foreseen at 425K and April Durable Goods Orders, expected to have increased 0.7% in the month.

Meanwhile, Asian and European indexes trade mixed around their opening levels, while US government bond yields have bounced from their weekly lows, but remain depressed. The yield on the benchmark 10-year Treasury note currently stands at 1.59%.

USD/JPY short-term technical outlook

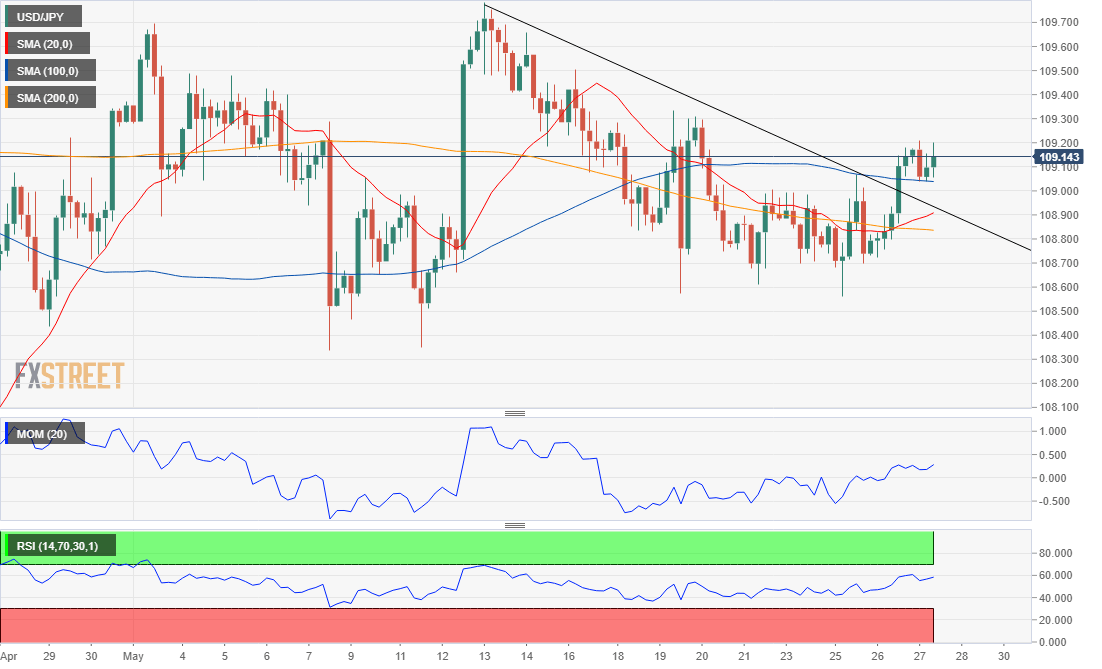

The USD/JPY is hovering around 109.15, maintaining the positive tone in the near-term. The 4-hour chart shows that it has been finding buyers around a flat 100 SMA, while the 20 SMA slowly grinds higher below it. The Momentum indicator aims north within positive levels, while the RSI is flat at around 59. Bulls will have better chances should the pair break above 109.35, the immediate resistance level. Limited dollar’s demand is putting a cap on the pair.

Support levels: 109.00 108.55 108.20

Resistance levels: 109.35 109.80 110.15

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.