USD/JPY Forecast: At November’s high, heading toward 110.00

USD/JPY Current Price: 109.55

- Better-than-expected US data hurt demand for safe-haven assets.

- US indexes flirted with all-time highs ahead of the Thanksgiving holiday.

- USD/JPY trades at around 109.50, November monthly high.

The USD/JPY pair jumped to its November’s high, rallying in the US afternoon, following the release of solid US data indicating steady economic growth. Additionally, Wall Street remained in the green, and while indexes’ rallies were not too relevant, they flirted with all-time highs. Safe-haven assets remained out of the speculative radar, and even Treasury yields managed to post intraday gains.

Japan will release October Retail Trade during the upcoming Asian session, seen flat monthly basis and down by 4.4% when compared to a year earlier. Large Retailers’ Sales in the same month are expected to post a modest 1.2% advance after rising by 10% in the previous month.

USD/JPY short-term technical outlook

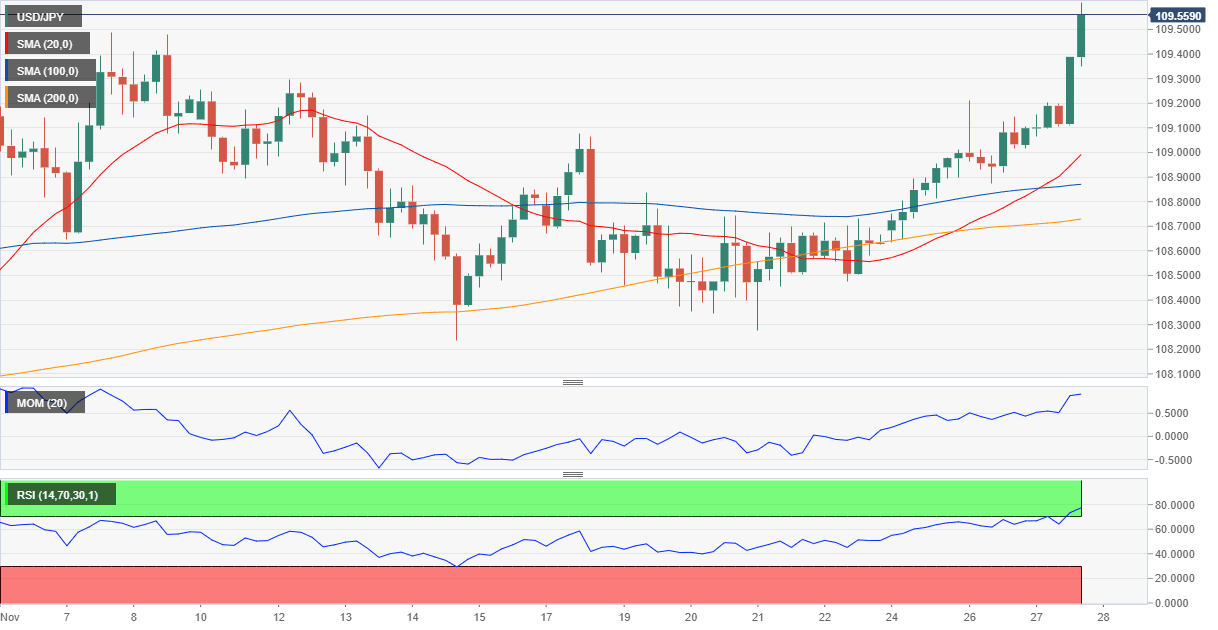

The USD/JPY pair is trading just below 109.50, retaining its short-term bullish stance. Technical readings in the 4-hour chart support additional gains ahead, as the pair has moved well above all of its moving averages, while the 20 SMA accelerated above the larger ones. Technical indicators lack momentum but remain well into positive ground, with the RSI, in fact, consolidating in overbought territory. Pullbacks should be contained by buyers in the 109.10/20 price zone to support a test of the 110.00 figure in the upcoming sessions.

Support levels: 109.15 108.85 108.50

Resistance levels: 109.85 110.05 110.40

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.