USD/JPY circling south of ¥150.00

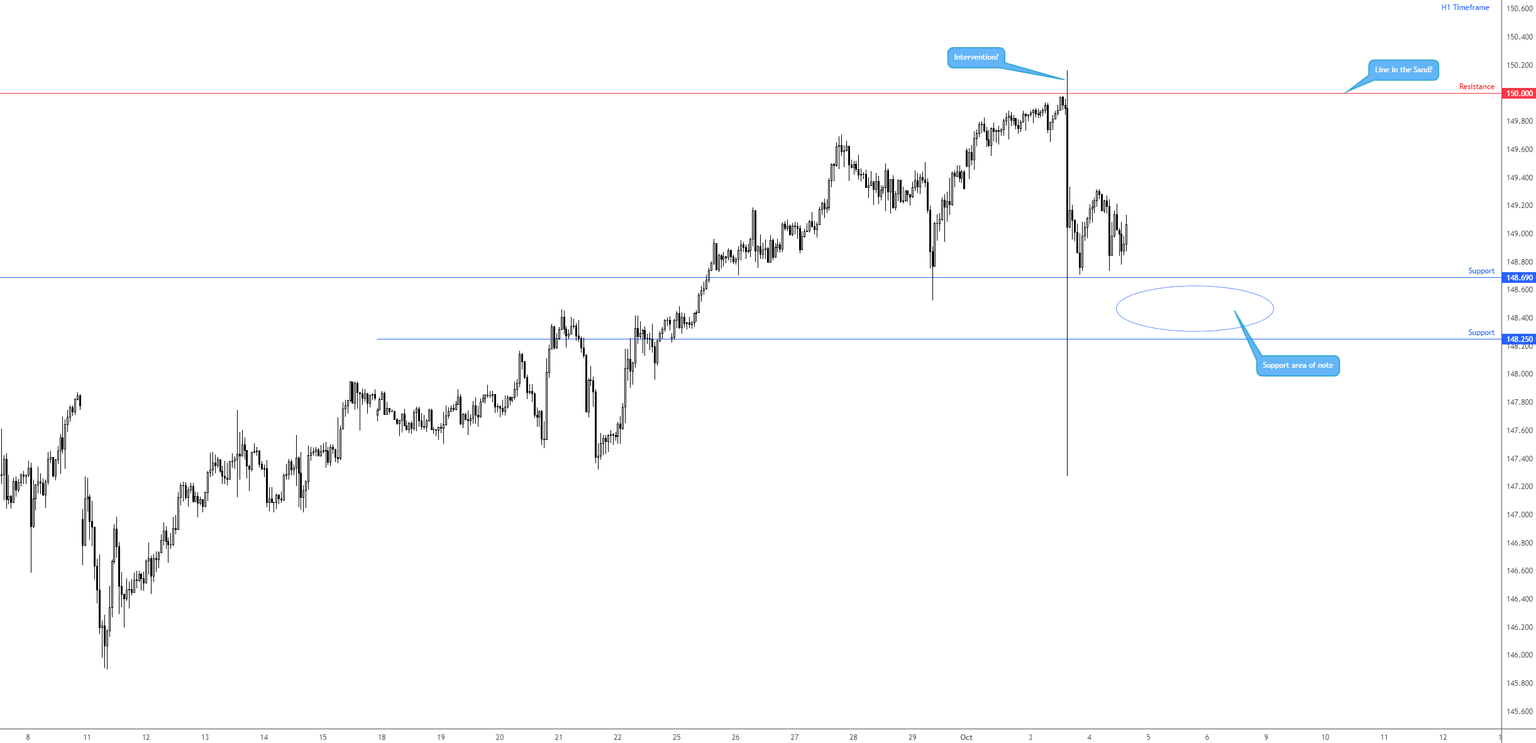

While speculation amid a possible intervention yesterday by the Japanese Government remains a talking point—as of writing, there has been no official confirmation—recent price action witnessed a near-300-pip move from just north of the ¥150.00 handle to a low of ¥147.27. There was also mention from a Bloomberg article that the move lower could have been triggered by pending sell orders resting at (and above) the psychological threshold on the back of possible action from the Japanese government.

Following yesterday’s spike lower, subsequent price action has seen buyers and sellers squaring off around H1 support at ¥148.69, with a break of here opening the door for another layer of H1 support coming in at ¥148.25.

Price action seems to largely be a play on rate differentials for this currency pair at the moment.

With the Fed’s tightening bias still on the table and the Bank of Japan’s (BoJ) loose monetary policy, what direction this currency pair will head in the medium to long term will likely depend on who will crack first.

Will the Fed hike once more this year and hold the Fed Funds target range higher for longer (which supports further USD buying), as recently highlighted by not only the Fed’s so-called dot plot but also recently by the Federal Reserve Bank of Cleveland President Loretta Mester. Mester noted that the Fed will likely need to raise rates again this year and then ‘hold it there for some time as we [the Fed] accumulate more information on economic developments’. She added: ‘Whether the Fed Funds rate needs to go higher than its current level and for how long policy needs to remain restrictive are going to depend on how the economy evolves relative to the outlook’. On the other side of the fence, will the BoJ begin unwinding its ultra-loose monetary policy?

Technically, given the strength of the buck of late—higher for eleven consecutive weeks—the support area between ¥148.25 and ¥148.69 on the USD/JPY could hold steady and eventually welcome additional bids into the market to challenge the mettle of the ¥150.00 level once again. Any defined breakout north of the aforementioned base could attract breakout buying.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,