USD/JPY: are there signs of stability starting to form? [Video]

![USD/JPY: are there signs of stability starting to form? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/japanese-yen4_XtraLarge.jpg)

USD/JPY

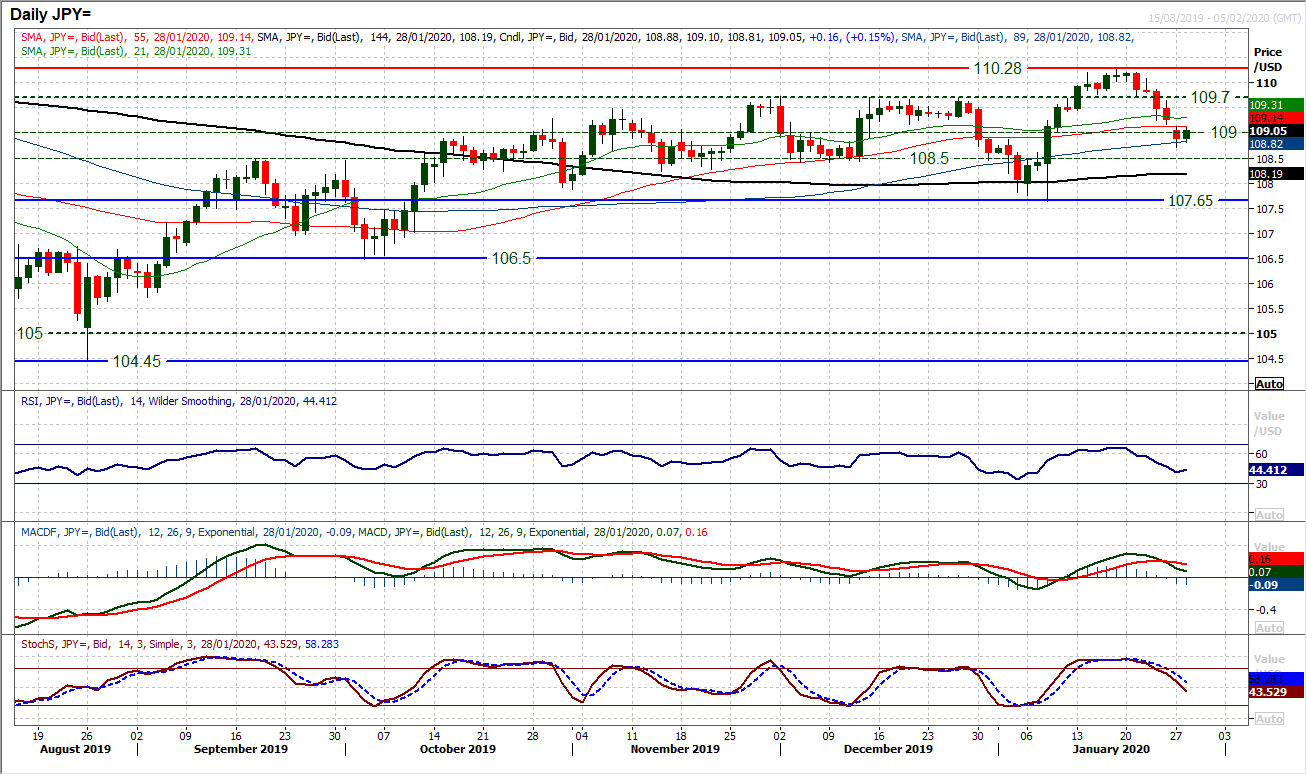

After a week of decisive selling pressure, are there signs of stability starting to form? A mild rebound during the Asian session brings the Europeans to the table looking at a small positive candle this morning. The market is still corrective and momentum indicators continue to slide but the hourly chart shows that since support formed at 108.70 more than 24 hours ago, there is more of a holding pattern developing. Given the degree of selling pressure throughout the past week where the market continued to decline, how the market now closes today could be an important turning point. There is resistance at 109.15/109.20 which is a near term gauge to watch. An old pivot and still an open gap from yesterday, a close above this resistance today would be a positive near term signal. Hourly indicators need to be watched too. The Hourly RSI pulling decisively above 60, whilst MACD lines decisively above neutral would be a real improvement. The has been support forming 108.70/108.80 now and if this can hold then the bulls have an argument at a recovery. 109.65/109.70 is then the next resistance.

Author

Richard Perry

Independent Analyst