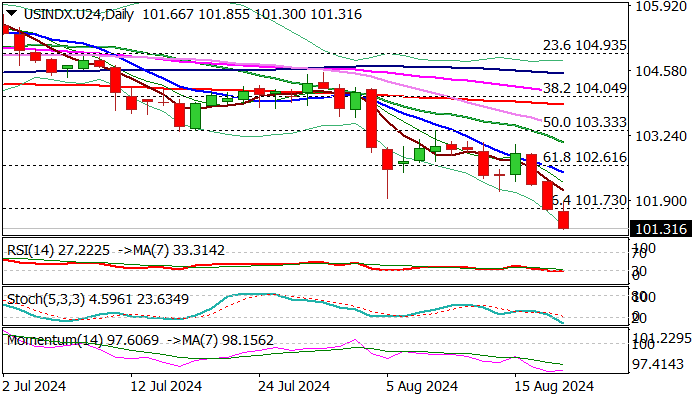

USD Index outlook: DXY hits new multi-month low, all eyes on FOMC minutes and Fed Chair Powell's speech

The dollar index fell to new multi-month low on Tuesday, moving in a steep bear-leg which extends into third consecutive day.

Near-term sentiment remains negative on renewed risk appetite, while markets fully price in 25 basis points rate cut by the US central bank in September, but with growing talks about possibly more aggressive action by Fed.

Minutes of July FOMC meeting (due on Wednesday) to show the opinion of Fed policymakers while speech of Fed Chair Powell in Jackson Hole symposium (Friday) to provide more clues about the pace of Fed’s easing cycle, which is widely expected to start in September.

Technical picture on daily chart is firmly bearish and adds to expectations for further weakness towards key supports at 100.29/18 (Dec 28 low / 200WMA) and psychological 100 level, with repeated close below Fibo level at 101.73 (76.4% of 100.29/106.36) to further weaken near-term structure.

Meanwhile, a partial profit-taking on oversold daily studies should be anticipated in coming sessions.

Res: 10173; 101.94; 102.48; 102.86

Sup: 101.01; 100.29; 100.18; 100.00

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.