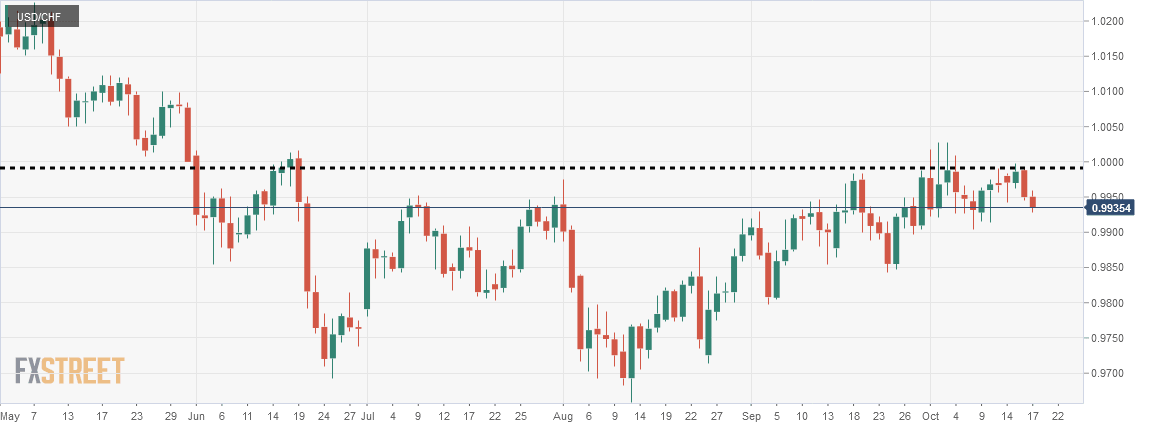

USD/CHF: Big round number and channel breakout to watch

USD/CHF has produced a Double Top on the Daily chart. The price consolidated at the resistance for some days. Then, it came down with moderate selling pressure. At the second rejection, the price after producing a daily engulfing candle has been heading towards the South with good selling pressure. Today’s intraday price action has been bearish. Thus, the pair may end producing another daily bearish candle. Let us have a look at the USD/CHF Daily chart.

Chart 1 USD/CHF Daily Chart

The level of 1.0000 has been the resistance here. This is a massive psychological level. Yesterday's daily candle is obeying the resistance level engulfed day before yesterday's candle. Moreover, the price had a rejection at the same level earlier. These two rejections produce the Double Top. A Double Top at a massive psychological level may keep driving the price towards the South. The neckline of the Double Top has not been breached yet. However, the way the price action has been, a breakout seems to be imminent. Here is another equation that may attract sellers.

Chart 2 USD/CHF Daily Chart

The price has been obeying the ascending Equidistant Channel. Several touches at the upper as well as at the lower band have confirmed it as a vital equidistant channel. Yesterday's daily candle closed right at the lower band, meaning at the support. The price is to make a decision as far as the Equidistant Channel is concerned. The strength of horizontal resistance and today’s intraday price action suggest that we may get a breakout at the support of the ascending Equidistant Channel. A breakout at the support of the Equidistant Channel may make the pair get very bearish.

Let us observe the H4 chart.

Chart 3 USD/CHF H4 Chart

The H4 chart shows that the price had rejections twice at the same resistance. Moreover, the neckline has been breached. The price has been heading towards the South with a good selling momentum. The sellers may add more short positions from the value areas. The broken neckline may work as a level of resistance. An H4 bearish reversal candle at the broken neckline may drive the price towards the South further.

The H4 chart’s Double Top, Daily Chart’s Double Top, and resistance at a big round number all these equations favour the sellers. Equidistant Channel’s support breakout on the daily chart is going to be another factor that the sellers will be eyeing at eagerly.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and