USD/CAD Weekly Forecast: Oil's the thing, but it's not everything

- Crude oil gains on Monday enabled a small rise in the Canadian dollar.

- West Texas Intermediate rises 10.8% to Wednesday, 7.35% on the week.

- USD/CAD climbs 1% to a seven-session high by Friday.

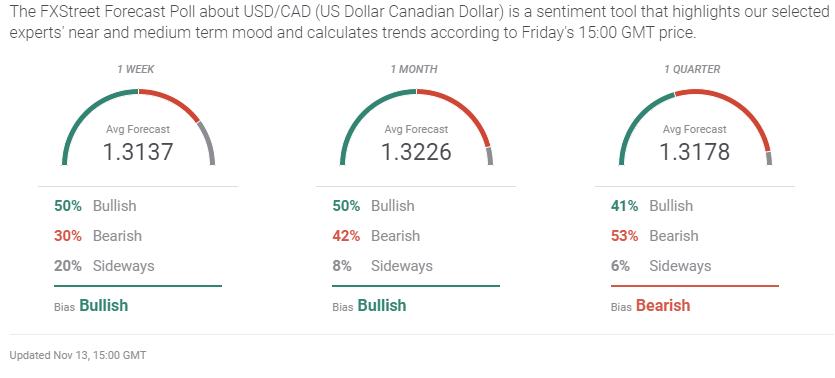

- FXStreet Forecast Poll predicts modest strength.

The rally in crude oil on Monday gave the Canadian dollar an offset to the general flood to the greenback from the COVID-19 vaccine, but fading petroleum prices in the latter part of the week returned the USD/CAD to a modest gain by Friday.

West Texas Intermediate (WTI) rose 6.7% on Monday as the Pfizer announcement of a successful COVID-19 vaccine trial sparked a huge rally in equities and the US dollar. The prospect of an end to the pandemic and hopes for a global economic recovery played to US dollar which rose in every major pair on Monday except the USD/CAD.

The surge in WTI peaked on Wednesday at $41.78%, up 10.8% from the week's open at $37.70 but then profit-taking and OPEC's reduction in its demand estimates for 2021 brought the commodity sliding back to finish at $40.47 on Friday, 7.4% higher for the five days.

WTI

Canadian statistics were non-existent this week.

In the US, Initial Jobless and Continuing Claims continued to decline but in the face of potential closures that may reverse. Inflation was lower than forecast with CPI weaker in October for all categories, which was true of the Producer Price Index also. Friday's Preliminary Michigan Sentiment Index for November at 77 on a 82 forecast was an indication that the dispiriting election campaign and rising COVID-19 counts may influence the holiday shopping season.

The Trump administration has said it will not impose a national lockdown and the Biden camp seemed to be backing off from its campaign promise to force a coast-to-coast shutdown, though there is doubt that Washington has the legal power to do so.

Currency markets are undecided between the potential end of the pandemic and a global economic recovery which would favor the US dollar and the rising COVID-19 diagnoses around the world, which, since March, has also benefited the risk-off safety trade to the dollar. For the moment they are in concert. When the current virus wave retreats, as it tentatively seems to be doing in Europe, the two dollar scenarios will diverge. The economic case for a stronger US dollar should remain.

Currency market diffidence contrasted with equities and Treasuries. Stocks finished on a winning week, with the Dow up 399,64 points on Friday and 1.156.41 on the week, 4.1%, closing at 29,479.81. Treasury yields were also higher with the 10-year at 0.898%, up almost eight points from last Friday's close at 0.820% though down from Tuesday's high finish at 0.972%.

Equities and bonds are looking through to the eventual success of the vaccine in curbing and then ending the pandemic and restoring normal economic activity, albeit with major changes in many industrial and commercial sectors.

Federal Reserve Chairman Jerome Powell has said the economy warrants additional assistance, though whether he is alluding to an increase in the bond purchase program to lower interest rates or urging fiscal help from Congress is not sure. In recent statements, he has promoted both but the emphasis has been on Congress. If Fed policy and the bond market diverge, bonds will prevail because in the long-run the economy has always improved much faster than analysts, including those at the Fed, anticipate.

Technically, the twin descending channels are the main motif, as they have been since late March. Neither the prior week's decline in the USD/CAD nor this week's partial recovery approached the upper or lower boundaries.

There has been a good deal of back and forth for the last three months in the area immediately above the Friday close at 1.3143 with two weak resistance lines at 1.3175 and 1.3200 before a more substantial impediment at 1.3230.

USD/CAD outlook

The rebound in USD/CAD this week aligned two major themes from either side of the pandemic divide.

In the early stages of a global recovery, the US dollar traditionally fares well as its economy has always performed better than its major competitors in Europe and Japan.

Even if the direct link to Fed interest rate policy is disabled, credit markets will push US rates higher regardless of Fed inaction providing the dollar with additional support. The yield on the 10-year Treasury on Friday was 0.898%, 38 basis points above its August 4 close at 0.515%, despite the Fed's purchase of $120 in debt each month.

The second theme has been the risk-off safety-dollar scenario in activity since March. This market response has been waning through the summer and early fall, but with the worldwide rise in COVID-19 diagnoses and hospitalizations it will likely resuscitate.

With both scenarios in play, the USD/CAD immediate prospect is higher.

Canada statistics November 9-November 13

There were no economic releases this week

US statistics November 9-November 13

American data provided no trading hooks this week with most information retrograde or unsurprising.

The JOLTS Job Openings for September was about as expected with 6.436 openings on a 6.5 million forecast and August's 6.352 million.

Inflation was slightly weaker than thought in October with the Consumer Price Index (CPI) at zero on the month form 0.2% in September and 1.2% on the year from 1.4%. Core CPI was also flat from 0.2% and 1.6% from 1.7%.

The Producer Price Index (PPI) which measures price pressures further up the supply chain was mixed in October. The monthly change was 0.3% from 0.4% in September and the annual was 0.5% from 0.4%. The core rate was 0.1% from 0.4% and 1.1% from 1.2% on the year. Retail pricing power remains weak despite the relatively healthy sales figures from the past five months.

Canada statistics November 16-November 20

Retail, Wholesale and Manufacturing Sales figures this week are for September and almost two months out of date. Housing Starts for October are pertinent, the fell 13% in September after the three best months since the financial crisis, but they will not affect markets. With the Bank of Canada on long-term hold, the CPI numbers for October are not policy information.

On Monday Manufacturing Sales for September are released, in August were down 2%, the first drop in four months. Sales are up 1.3% for the six months from March through August.

Housing Starts and Wholesale Sales for September are out on Thursday. Starts were 209,000 and Sales were 0.3% in August. Bank of Canada Governor Tiff Macklem speaks at a Public Policy Forum.

The Consumer Price Index (CPI) for October is issued on Wednesday. Overall CPI is forecast to be -0.1% on the month and 0.4% on the year. The Bank of Canada Core CPI is forecast to be 0.4% monthly and 0.9% annually.

The ADP Employment Change for October will be out on Thursday. In September the firm reported a loss of 240,800.

Retail Sales ex Autos for September on Friday are projected to climb 0.9%. Total Sales rose 0.4% in August.

US statistics November 16-November 20

The consumer sector is in the spotlight with Retail Sales for October with under-performance the chief market and dollar risk. Initial Jobless Claims for the second week of November will also garner attention for signs that the rising COVID-19 diagnoses are causing layoffs.

Retail Sales for October are expected to rise 0.5% in October following the surprise 1.9% gain in September. The ex-Autos number is forecast to be 0.6% after 1.5%. The Retail Sales Control Group is projected to be 0.5% after September's 1.4% increase.

Industrial Production for October should rise 1% after the 0.6% drop prior. Capacity Utilization is expected to rise to 72.3% from 71.5%.

Initial Jobless Claims are forecast to be essentially unchanged at 707,000 in the November 13 week from 709,000. Continuing Claims were 6.786 million in the November 6 week.

Existing Home Sales, nine-tenths of the US housing market, are forecast to slip to 6.45 million annualized in October. Home sales have been very strong for three months with July's 5.86 million, August's 5.98 million and September's 6.54 million above all rates since June 2007.

USD/CAD technical outlook

Within the descending channels, the USD/CAD has been trading in a 1.3050 to 1.3400 band since early August. The brief intra-day dip below 1.3000 on Monday (low 1.2928, close 1.3013) and the week's finish nearly a figure-and-a-half above argue for a coming test higher. Resistance lines are more plentiful and have a good deal more trading involvement. Support is scattered and, except for a brief period in late August and early September and even shorter period just ended, more than ten months old.

The Relative Strength Index at 48.48 is essentially neutral after a nine-session wave to the sell-side. The 21-day moving average at 1.3157 is just above Friday's finish, and as it was already crossed by the day's high at 1.3176, will offer no block. The 100-day average at 1.3281 backs up resistance at 1.3270. The 200-day at 1.3538 is not relevant.

Support: 1.3065; 1.3000; 1.2960

USD/CAD Forecast Poll

The immediate bullish outlook in the FXStreet Forecast poll reflects the technical bounce that followed Monday's brief penetration of 1.3000. The longer-term situation is unresolved much as it has been for four months.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.