USD/CAD Weekly Forecast: Has Canada strength been stimulated?

- Canada's Net Change in Employment more than doubles forecast.

- US dollar falls on rekindled hopes for an economic stimulus package.

- West Texas Intermediate gains almost 10% on the week.

- Canadian unemployment improves to 9% from 10.2%

- FXStreet Forecast Poll predicts Friday's decline.

The Canadian Dollar gained 1.4% against its southern counterpart this week aided by strong employment in September, a 9.8% rise in crude oil and the revived, but not completed, stimulus negotiations in the US Congress. Friday's USD/CAD close at 1.3122 was the best for the loonie since September 7.

West Texas Intermediate, (WTI), the North American crude oil pricing standard, rose 9.8% on the week. It opened at $37.13 on Monday and increased each day to a high of $41.53 on Thursday before minor profit-taking on Friday brought it to close at $40.78.

In the United States Congress, the on-again-off-again stimulus negotiations between the House Democrats led by Speaker Pelosi and the White House were the main market focus. President Trump's withdrawal from the talks on Tuesday sent the US Dollar higher on the risk-off safety trade while the return to the discussion on Thursday and Friday extracted the earlier premium.

Technically the USD/CAD close below former support at 1.3145 opens a move lower particularly if the US Congress can complete its election calculations and provide the stimulus that both sides agree is needed. Traders have treated the stimulus talks as a risk event with defensive buying of the US dollar when they falter and reversing those purchases when a deal seems imminent.

USD/CAD outlook

This week's decline in the USD/CAD brings it to about the mid-point of its July 2019 to February 2020 range. The economic performance of the Canadian economy, especially the labor market, and the surge in oil prices combined with the entry into the lowest portion of the post-pandemic range argues strongly for further losses.

The September 1 low of 1.2994 and the August 27 to September 7 general range of 1.3040 to 1.3170 are the immediate goals.

The disparity between the Canadian labor economy which has recovered 76% of its lost employment and that of the US which is at 51.4% underscores the tilt in the statistics to the loonie. Job losses are the most visible and important factor in the recovery of both economies and until the US can show more substantial improvement the currency advantage will stay north of the border.

Except for the brief period in late August and early September mentioned above, support beneath the current level of the USD/CAD stems from the months before the pandemic and even that was limited to the first two weeks in January. It is weaker for its distance and its brevity.

Unless there is an external event that reignites the US dollar safety trade, the returning spread of the virus in Europe or the US are some possibilities or an unexpected election development in the US is another, the factors depressing the USD/CAD should prevail.

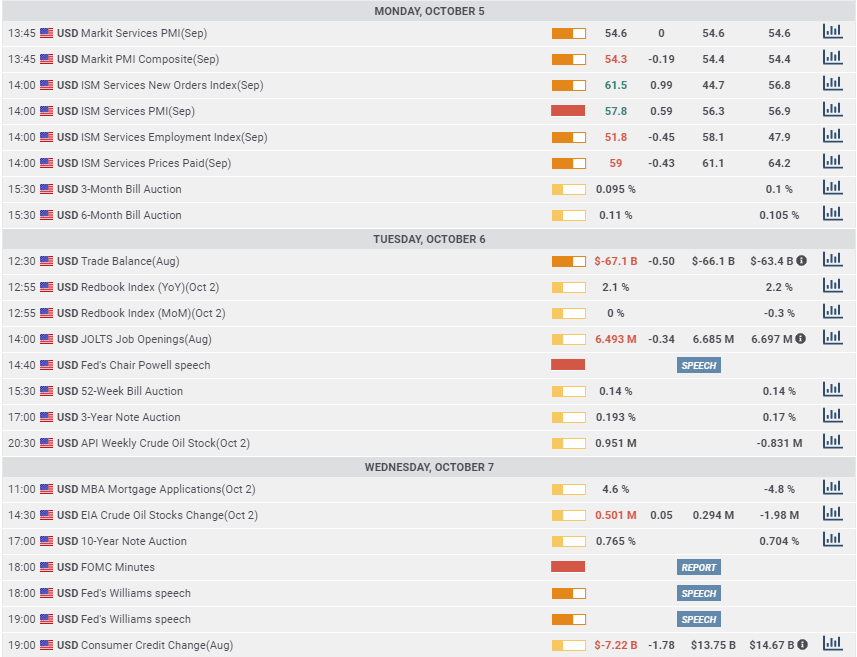

Canadian and US statistics October 5-October 9

Canadian and US statistics October 5-October 9

The unexpectedly weak Canadian International Merchandise Trade figures for August and Ivey Purchasing Managers' Index and Housing Starts for September were discounted by markets as the Canadian labor economy was far more productive than anticipated last month.

Canada's August trade deficit at -C$2.45 billion was larger than the -C$2 billion forecast but in line with the July deficit of C$2.53 billion. The Ivey Purchasing Managers' Index for September at 54.3 was a sharp drop from August's 67.8 and July's post-crisis high of 68.5. Housing starts in September were also weaker at 209,000 than the 240,000 prediction. The August annualized rate of 261,500 was the highest since September 2007.

Net Change in Employment added 378,200 jobs in September and the Unemployment Rate fell to 9% from 10.2%, both results considerably better than expected and a major reason for the Friday gain in the Canadian Dollar.

Overall, US economic statistics continued to improve, except, and it is a very important caveat, in the labor market.

Purchasing Mangers' Indexes in services improved, as had manufacturing last week, with the overall rising to 57.8 in September. New orders at 61.5 far outstripped the consensus estimate for at drop to 44.7 from 56.8 in August. Employment climbed into expansion at 51.8 for the first time since February though much lower than the forecast of 58.1.

The minutes of the September FOMC meeting provided little insight into the Fed's new inflation averaging policy or its extension of rate guidance to 2023.

Initial jobless claims recorded 840,000 in the first week of October, 20,000 more than anticipated and the prior week was revised from 837,000 to 849,000. The four-week moving average decreased to 857,000 from 870,250.

The continuation of close to one million layoffs each week seven months after the lockdowns began and five months after the recovery started, combined with the more than 50% drop in payroll additions from August's 1.489 million to 661,000 in September, is clear evidence of a slowing labor market. It raises the possibility that the improvement in employment could reverse in the coming months.

Canada statistics October 12-October 16

A sparse week is ahead in Canadian economics.

Monday is a holiday, Canadian Thanksgiving Day. Private payroll changes for September from ADP on Tuesday will have no impact on the market view of the Canadian labor economy. This statistic has recorded losses in every month from March and its -205,400 result for August bears no relation to the 245,800 addition in the national statistics.

Manufacturing sales for August are forecast to rise 8.7% after climbing 7% in July.

In the US next week sees the Consumer Price Index for September on Tuesday, but with the Fed's new policy and guidance, there will be no market impact.

Thursday's initial and continuing jobless claims and Friday's Retail Sales for September and Michigan Consumer Sentiment for October are the only other releases of note.

Sales have recovered from their plunge in March and April and the expected 0.5% gain following August's 0.6% increase is a return normal consumption. The GDP component control group is forecast to climb 0.5% after August's unexpected 0.1% decline. Michigan Sentiment is expected to edge higher to 81 from 80.4 in September.

Sales will be watched for any sign of weakness. With nearly 11 million Americans out of work, the essentially normal growth of consumption over the past six months is a source of wonder and concern. Any substantial over or undershoot in sales could impact the dollar.

USD/CAD technical outlook

USD/CAD technical outlook

The pandemic down-channel that was deserted on September 21 may return to relevance this week as the upper border coincides with the initial support line at 1.3080. The steep down-angle of the Relative Strength Index at 38.28 suggests further losses. Moving averages have faded in importance trailing the market by notable amounts. The 21-day average at 1.3270 reinforces the resistance line at 1.3260 and the 100-day at 1.3392 backs the line at 1.3400. The 200-day average at 1.3536 is out of the current picture.

The USD/CAD break of support at 1.3145 on Friday transmutes the former support into resistance as is traditional in technical analysis. The generally weaker support lines beneath the Friday close and the quick crossing of the 1.3140-1.3200 range makes an initial move lower likely early in the week.

Resistance: 1.3145; 1.3200; 1.3260; 1.3325; 1.3400

Support: 1.3080; 1.3040; 1.3000; 1.2960

USD/CAD Forecast Poll

There is an interesting prediction in the expert opinions of our FXStreet Forecast Poll . The rapid descent of the USD/CAD in the second half of last week supports a continuation in the prospective action. However, Friday's plunge and close at 1.3122 has already passed the one-week forecast at 1.3132 and a further decline to 1.3080 or 1.3040 can now be expected. The one-month and one-quarter views anticipate that the 1.2950 low of December 31, 2019, will ultimately hold.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.