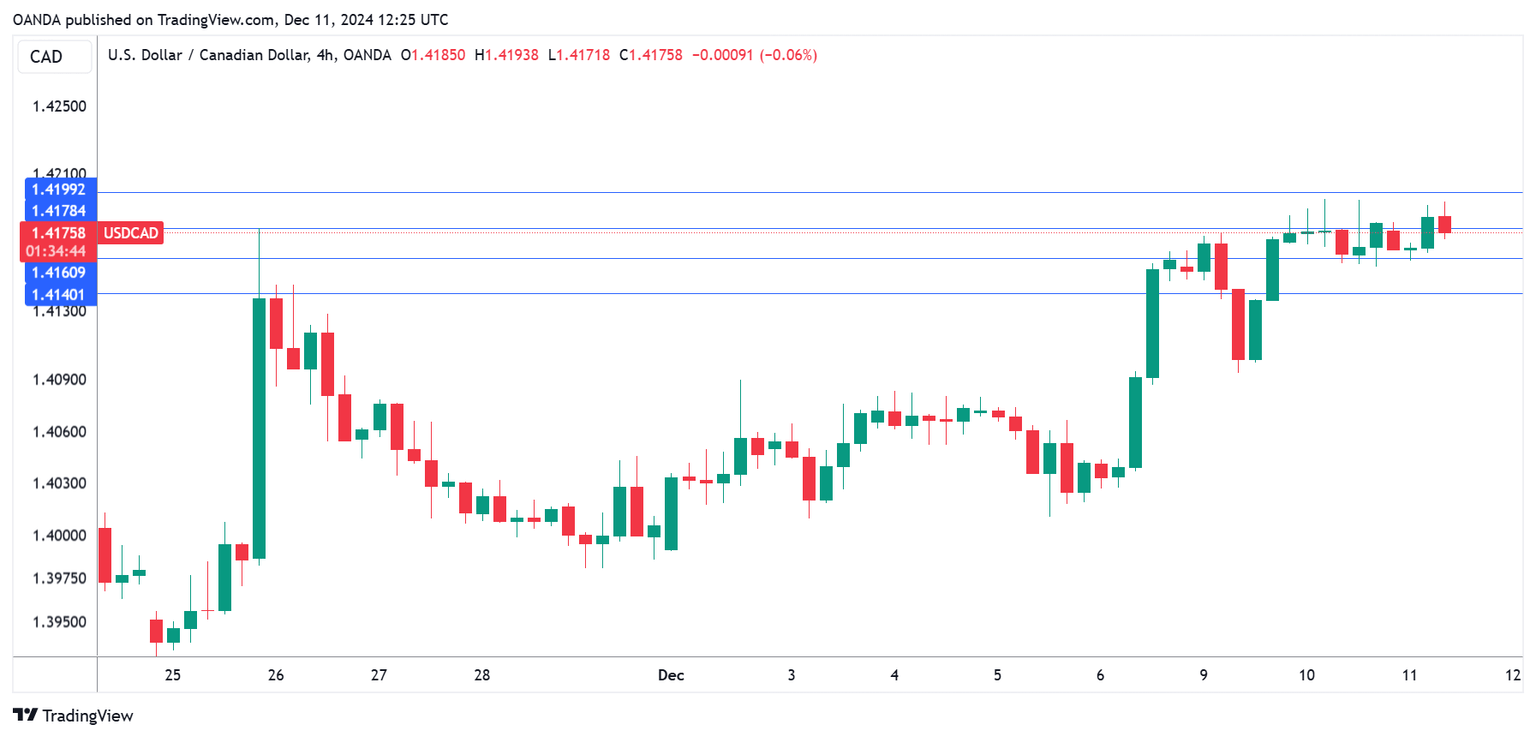

USD/CAD steady ahead of BoC rate decision

The Canadian dollar is drifting on Wednesday, ahead of the Bank of Canada rate decision later today. In the European session, USD/CAD is trading at 1.4181, up 0.10% at the time of writing.

BoC expected to slash rates by 50 basis points

The Bank of Canada is widely expected to end the year on a bang with a dramatic 50-bp cut at today’s rate meeting. The markets have priced in a 50-bp cut at 90%, so it would be a massive surprise if the BoC opts for a modest cut of 25 basis points. The BoC has cut interest rates four times this year, including a jumbo 50-basis point rate cut in October.

BoC policymakers can point to low inflation and a cool labor market to support the case for an oversized 50-bp cut. At the same time, the central bank doesn’t want to get too aggressive in its easing cycle, as core inflation remains around 2.5%, above the BoC’s target of 2%. If the BoC delivers a 50-bp cut, we could see the Canadian dollar lose ground.

Investors are keeping a close eye on the US inflation report which also will be released today. The November report is expected to show that CPI ticked higher. The market estimate stands at 2.7% y/y (vs. 2.6% in Oct.) and 0.3% m/m (vs. 0.2% in Oct.). This is somewhat about the Federal Reserve’s target of 2% but that hasn’t prevented the Fed from cutting rates twice this year. The Fed meets on Dec. 18 and the odds of a 25-bp cut are 86%, according to the CME’s FedWatch tool. A surprising drop in inflation would raise expectations of a 50-bp cut but the Fed appears on track for a modest 25-bp cut.

USD/CAD technical

-

USD/CAD is testing resistance at 1.4178. Next, there is resistance at 141.99

-

1.4160 and 1.4139 are the next support levels

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.