USD/CAD Price Forecast: Move beyond 200-day SMA will set the stage for additional gains

- USD/CAD lacks firm intraday direction and is influenced by a combination of diverging forces.

- An uptick in Oil prices is seen underpinning the Loonie and acting as a headwind for the major.

- Rebounding US bond yields and a softer risk tone benefits the USD, lending support to the pair.

The USD/CAD pair struggles to capitalize on Friday's sharp move up of over 100 pips and oscillates in a narrow trading band at the start of a new week. Crude Oil prices gain some positive traction and move away from the lowest level since June 2023 set on Friday amid a potential hurricane in the US Gulf Coast, which accounts for around 60% of US refining capacity. This is seen underpinning the commodity-linked Loonie and capping the currency pair, though a combination of factors favor bullish traders and supports prospects for some meaningful upside.

OPEC+ delayed plans to increase production by 180,000 barrels per day until December, albeit has failed to reassure the market about the global supply amid concerns about slowing oil demand in China – the world’s largest crude importer. Furthermore, Friday's rather unimpressive US jobs data raised worries about flagging fuel demand in the world's biggest consumer, which, in turn, keeps a lid on any meaningful upside for Crude Oil prices. In fact, the closely watched US Nonfarm Payrolls (NFP) report provided clear evidence of a sharp deterioration in the labor market.

The US Bureau of Labor Statistics (BLS) reported that the economy added 142K jobs in August against 160K expected and the previous month's reading was revised down to 89K. Other details of the report showed that the Unemployment Rate edged lower to 4.2% from 4.3% in July and wage inflation, as measured by the change in Average Hourly Earnings, rose to 3.8% from the 3.6% previous. The data, meanwhile, reduced the likelihood of a larger 50 basis points (bps) rate cut by the Federal Reserve (Fed) at its upcoming policy meeting on September 17-18.

According to the CME Group's FedWatch tool, the markets are pricing around a 70% chance of a 25-basis-points rate cut by the Federal Reserve later this month and the probability of a 50-bps reduction stands at 30%. This, in turn, triggers a modest rise in the US Treasury bond yields, which, along with a softer risk tone, assists the US Dollar (USD) to build on Friday's bounce from over a one-week low. Against the backdrop of persistent geopolitical tensions, worries about an economic downturn in the US tempers investors' appetite and benefits the safe-haven buck.

The Canadian Dollar (CAD), on the other hand, is pressured by Friday's weaker Canadian jobs data, which raised hopes for additional interest rate cuts by the Bank of Canada (BoC). This, in turn, validates the near-term positive outlook for the USD/CAD pair and supports prospects for a further intraday appreciating move. Moving ahead, there isn't any relevant market-moving economic data due for release on Monday, either from the US or Canada, leaving the currency pair at the mercy of the USD and Crude Oil price dynamics.

Technical Outlook

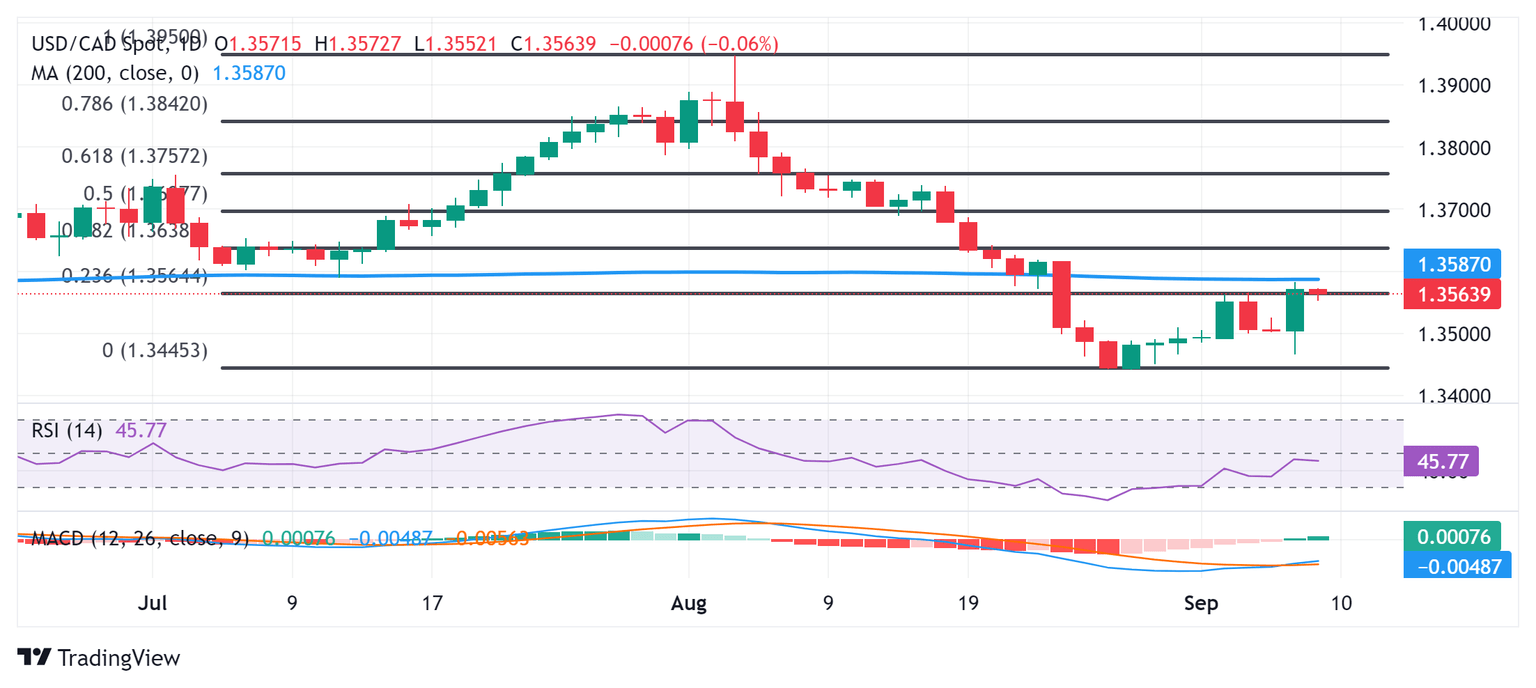

From a technical perspective, oscillators on the daily chart – though have been recovering from lower levels – are yet to confirm a positive bias. This makes it prudent to wait for some follow-through strength beyond the very important 200-day Simple Moving Average (SMA), currently pegged ahead of the 1.3600 mark, before positioning for any further gains. The USD/CAD pair might then accelerate the positive move towards the 38.2% Fibonacci retracement level of the steep decline witnessed in August. The subsequent move up could extend further towards reclaiming the 1.3700 mark, which coincides with the 50% Fibo. level.

On the flip side, the 1.3550 area is likely to protect the immediate downside, below which the USD/CAD pair could slide back to the 1.3500 psychological mark. A convincing break below the latter will suggest that the recent bounce witnessed over the past two weeks or so has run its course and expose the 1.3440-1.3435 region, or the lowest level since March touched last month.

USD/CAD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.