USD/CAD Outlook: 100-day SMA holds the key for bulls, US/Canadian jobs data awaited

- USD/CAD reverses an intraday dip on Friday amid strong follow-through USD buying.

- An uptick in crude oil prices underpins the Loonie and acts as a headwind for the pair.

- Traders also seem reluctant ahead of the monthly jobs data from the US and Canada.

The USD/CAD pair struggles to capitalize on the overnight goodish rebound from a one-month low and meets with some supply during the Asian session on Friday. Crude oil prices edge higher for the second straight day amid hopes that the easing of strict COVID-19 restrictions in China will boost fuel demand. This, in turn, underpins the commodity-linked Loonie and acts as a headwind for the major. The downside, however, remains cushioned amid some follow-through US Dollar buying, bolstered by the upbeat US macro data released on Thursday.

In fact, Automatic Data Processing (ADP) reported that the US private sector employers added 235K jobs in December against consensus estimates for a reading of 150K. Furthermore, Initial Jobless Claims unexpectedly declined to 204K in the last week of December from the previous week's downwardly revised print of 223 K. This pointed to a resilient US labour market and indicated that the economy ended 2022 on solid footing, which could allow the Federal Reserve to stick to its aggressive rate hike path and is seen lending support to the buck.

That said, a modest recovery in the global risk sentiment - as depicted by a positive tone around the US equity futures - keeps a lid on the safe-haven USD. Traders also seem reluctant and prefer to wait on the sidelines ahead of the key employment details from the US and Canada, due later during the early North American session on Friday. The popularly known US NFP report could influence the Fed's policy outlook and drive USD demand. This, along with oil price dynamics, should help determine the next leg of a directional move for the USD/CAD pair.

Technical Outlook

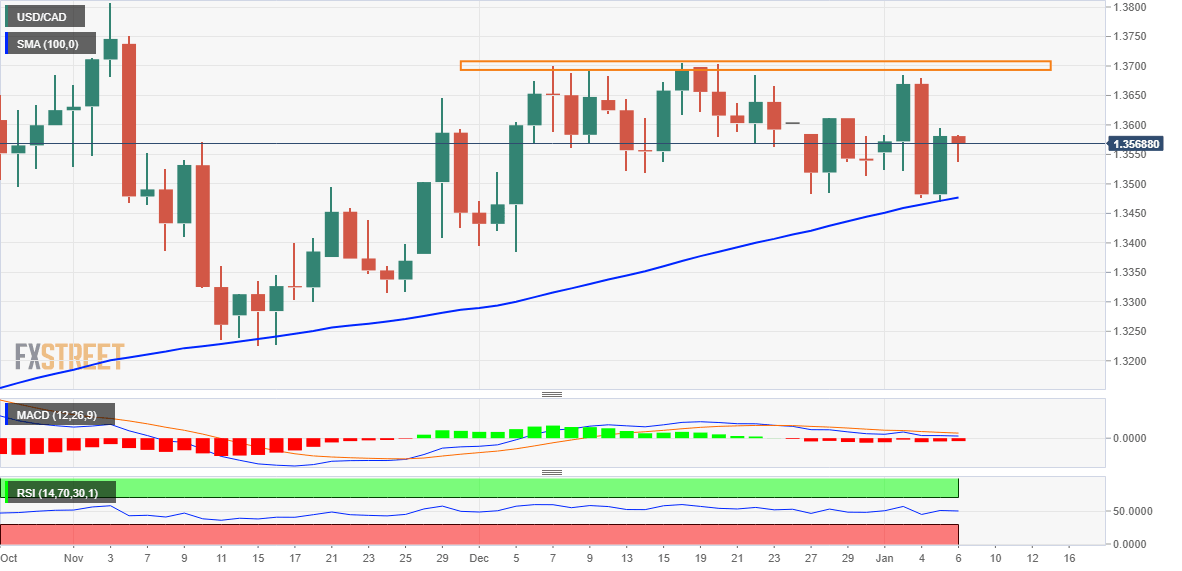

From a technical perspective, the overnight solid bounce from the vicinity of the 100-day SMA and the emergence of some dip-buying on Friday favours bullish traders. That said, it will still be prudent to wait for a sustained strength beyond the 1.3600 mark before positioning for any further gains. The USD/CAD pair might then climb to the next relevant hurdle near the 1.3660-1.3665 region and eventually aim to conquer the 1.3700 round figure. Some follow-through buying will mark a fresh breakout and pave the way for a meaningful appreciating move in the near term.

On the flip side, the 1.3500 psychological mark could protect the immediate downside ahead of the 1.3470-1.3465 region (100 DMA). A convincing break below the latter will negate the positive outlook and shift the near-term bias in favour of bearish traders. The USD/CAD pair might then slide to the 1.3400 level and extend the decline further towards the 1.3335-1.3330 support zone en route to the 1.3300 mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.