USD/CAD Forecast: Investors eye employment releases

The Canadian dollar posted gains throughout the week, as USD/CAD fell by 1.0 percent. There are five Canadian events in the upcoming week, including tier-1 employment releases. Here is an outlook for the highlights and an updated technical analysis for USD/CAD.

There were no Canadian events last week.

In the US, the Chicago PMI rose to 59.5 in December, up from 58.2 and beating the forecast of 56.6 points. Pending Home Sales declined for a third straight month, with a reading of -2.6%. The week ended on a positive note, as unemployment claims dropped for a second straight week, falling to 787 thousand. Still, there are serious concerns about the health of the US labor market as we move into 2021.

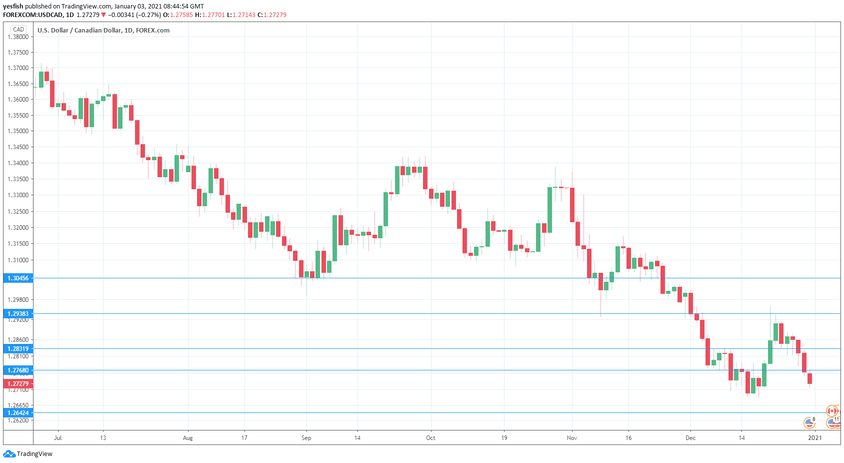

USD/CAD daily graph with resistance and support lines on it. Click to enlarge:

- Manufacturing PMI: Monday, 14:30. Manufacturing improved slightly in November, climbing from 55.5 to 55.8. Will the upturn continue in December?

- Raw Materials Price Index: Tuesday, 13:30. This inflation indicator rebounded in October with a gain of 0.5%, after a decline of 2.2% beforehand. We now await the November data.

- Trade Balance: Thursday, 13:30. Canada continues to post trade deficits. In October, the deficit rose to C$-3.8 billion, its highest level since March 2019. Will we see an improvement in November?

- Ivey PMI: Thursday, 15:00. The PMI slowed to 52.7 in November, its lowest level since May. This points to weak expansion, as the 50-level separates expansion from contraction. We now await the December data.

- Employment Report: Friday, 13:30. Employment Change slowed to 62.1 thousand in November, but easily surpassed the forecast of 22.0 thousand. In November, the unemployment rate fell for a sixth straight month, dropping from 8.9% to 8.5%. The December data could affect the movement of USD/CAD.

Technical lines from top to bottom:

We start with resistance at 1.3046.

1.2938 switched to resistance at the start of December, when USD/CAD started its slide.

1.2831 is the first line of support.

1.2768 (mentioned last week) is next.

1.2642 has held in support since April 1.

1.2578 is next.

1.2490 is the final support level for now.

I am neutral on USD/CAD

The US dollar remains under pressure, and we could see some movement around the pair in mid-week, with the US runoff election in Georgia on Tuesday. The results will determine which party will control the US Senate. Traders can also expect volatility on Friday, with the release of key employment data in both Canada and the US.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.