USD/CAD Elliott Wave view: Entering into a wave five lower [Video]

![USD/CAD Elliott Wave view: Entering into a wave five lower [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDCAD/dollars-9871878_XtraLarge.jpg)

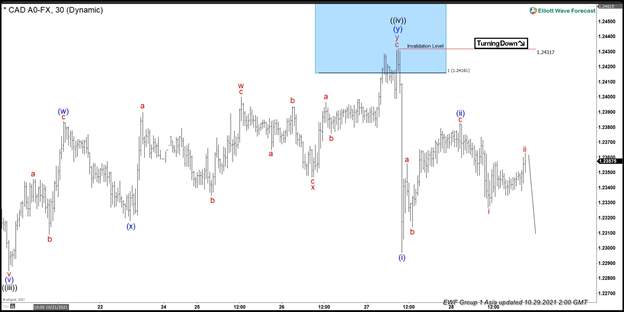

Short-term Elliott wave view in USDCAD suggests that the decline from September 20, 2021, high is unfolding as an impulse structure favoring some more downside. Down from 9/20/2021 high, wave ((i)) ended in 5 waves at $1.2590 low. Wave ((ii)) ended at $1.2774 high, and wave ((iii)) ended in 5 waves at 1.2309 low. Then above from there, the pair made a bounce in wave ((iv)) in a shorter cycle. The internals of that bounce unfolded as a double three structure.

Whereas the initial 3 waves bounce to $1.2383 ended wave (w). Then a pullback to $1.2318 low ended wave (x). Up from there, the pair started the (y) leg higher & reached the 100%-161.8% Fibonacci extension area of (w)-(x) at $1.2416- $1.2476 blue box area. The pair got rejected within the blue box area & ended (y) leg at $1.2431 high thus completing the wave ((iv)) bounce. Below from there, we believe wave ((v)) has started lower where lesser degree wave (i) ended at $1.2297 low. And wave (ii) ended at $1.2382 high. Near-term, as far as bounces fail below $1.2382 high and more importantly below $1.2431 high the pair is expected to see more downside towards $1.2248- $$1.2191 inverse 123.6%- 161.8% Fib ext area of ((iv)) minimum. Before the pair completes its 5 waves impulse sequence from 9/20/2021 high & does a bounce.

USD/CAD 1 Hour Elliott Wave chart

USD/CAD Elliott Wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com