USD/CAD Elliott Wave: Can the Loonie break free?

Executive summary

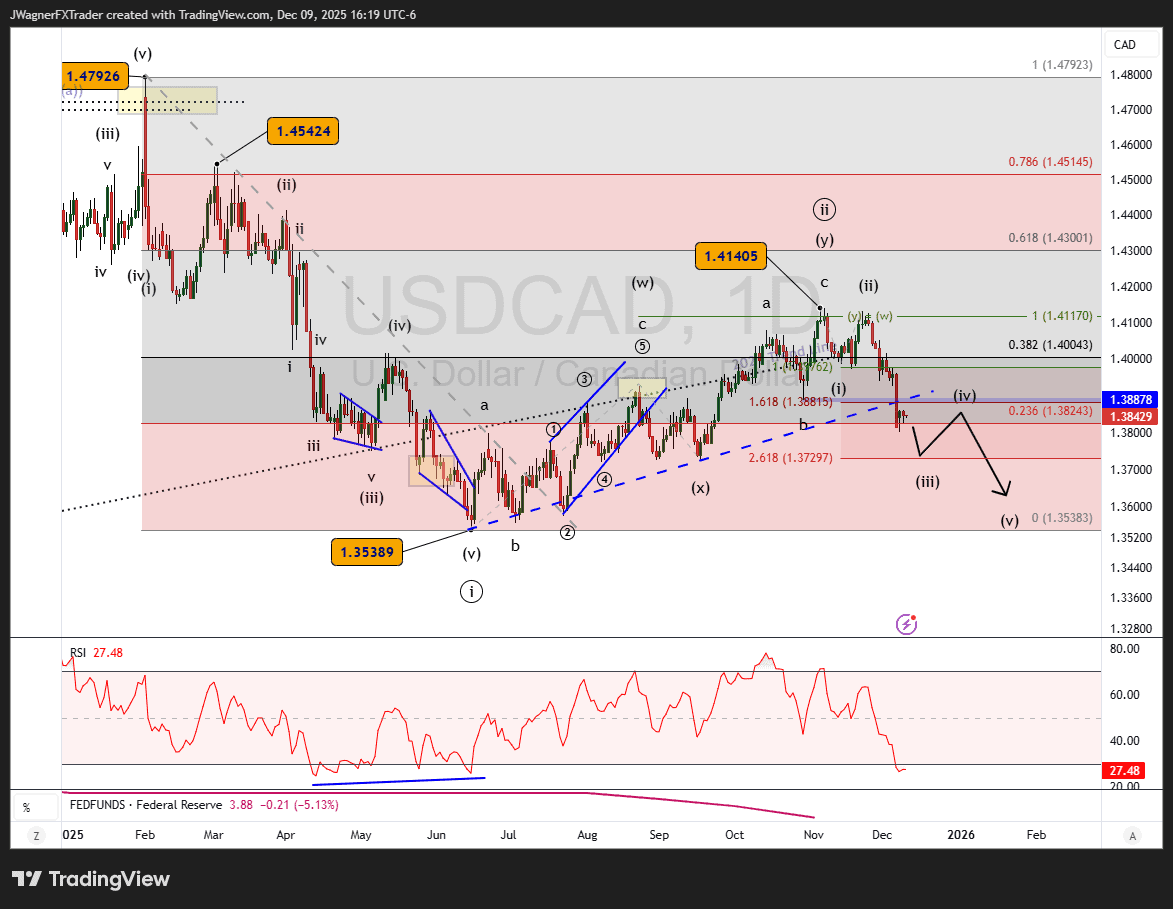

- USD/CAD appears to be carving out a developing five-wave decline from the 1.4140 high.

- Trend bias is bearish, with wave (iii) and (v) targeting the 1.37–1.35 support zone.

- A move above 1.3985 would invalidate the bearish sequence and require reassessment.

Current Elliott Wave analysis

The chart shows USDCAD forming an Elliott wave impulsive decline, beginning from the 1.4140 swing high. Subdivisions suggest the pair has completed waves ((i)) and ((ii)), and is now declining in a wave ((iii)).

Wave ((ii)) retraced near the 38.2% Fibonacci retracement of the wave ((i)) drop, consistent with a shallow corrective rebound. The break below the rising dashed blue trendline reinforces the shift in sentiment, aligning with a typical acceleration phase toward the center of a third wave.

At the lower degree, price has likely completed a small wave (i)–(ii) structure and is now driving into wave (iii) of a lower-degree impulse. The chart’s Fibonacci extension projections show confluence around 1.3729 (2.618 extension) for wave (iii). Eventually, wave (v) may fall to retest lows near 1.3539.

Momentum confirms the wave structure: RSI is oversold yet trending lower, a common signature during the middle portion of a bearish impulse.

If the path continues as labeled, expect a minor wave (iv) bounce to be corrective and remain capped beneath 1.3870–1.3975 before wave (v) extends lower.

Bottom line

USD/CAD remains positioned for continued downside as a five-wave decline matures from the 1.4140 high. Unless price breaks above 1.4140, rallies remain corrective, with 1.37 – 1.35 as the high-probability termination zone. The bearish impulse should complete there before a larger-degree recovery begins.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.