USD/CAD bulls gear down near 1.3900

- USD/CAD stabilizes ongoing recovery near 1.3900.

- Short-term bias is positive, but bulls may soon lose steam.

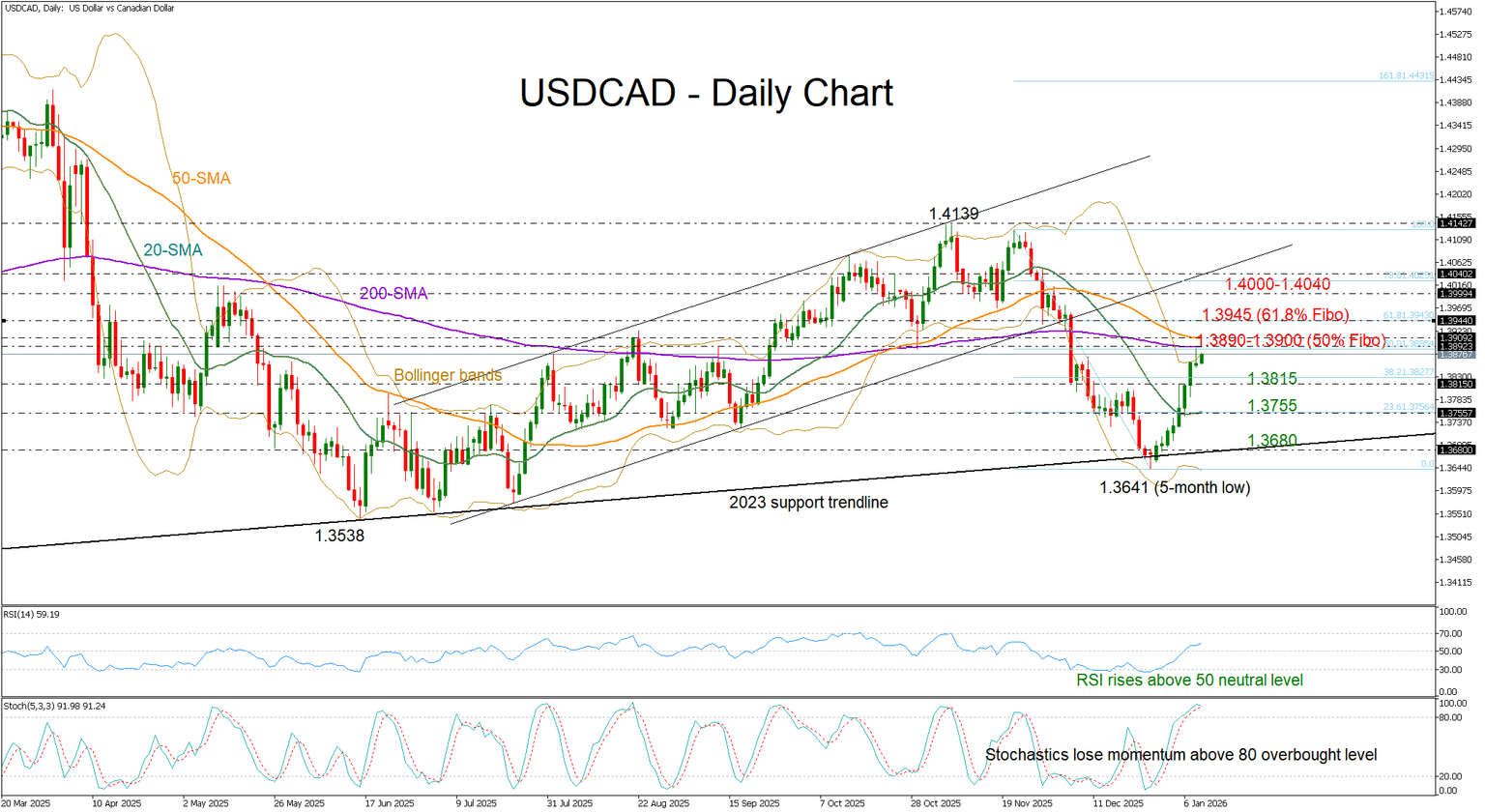

USD/CAD extended its post-Christmas rally to a one-month high of 1.3887 on Thursday, retracing half of the November–December decline as the US dollar strengthened and traders reduced exposure to risk-sensitive currencies such as the loonie.

With attention shifting to the US and Canadian jobs data and a possible Supreme Court ruling on Trump’s import tariffs, traders are watching the 1.3890–1.3900 zone, where the 50- and 200-day simple moving averages (SMAs) are converging. A break higher could target the 61.8% Fibonacci level at 1.3945 and potentially the 1.4000 psychological mark, with the broken support trendline at 1.4040 likely coming next on the radar.

However, upside momentum may fade as the stochastic oscillator is leaning to the downside in the overbought territory and the price itself is trading around the upper Bollinger band. Failure to clear 1.3900 could see support tested at 1.3815, with further losses exposing the 20-day SMA at 1.3755. If the latter gives way too, the bears may next head for the crucial 2023 support trendline seen near 1.3680.

Overall, USD/CAD is maintaining a positive short-term bias, though profit-taking may limit gains near the 1.3900 area.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.