US stocks hover at all-time high after strong earnings

US stocks closed at a record high after technology companies continued to report strong earnings. Early this week, companies like Tesla, Alphabet, Microsoft, and Apple reported strong quarters of double-digit growth. And yesterday, Amazon reported strong quarterly results as its revenue grew by 44% to $108.52 billion while its earnings almost doubled from $9.54 to $15.79. The company also boosted its forward guidance for the second quarter as it expects revenue to jump to between $110 billion and $116 billion. Stocks also rose after the strong US GDP data that showed that the economy expanded by 6.4% in the first quarter.

The Japanese yen strengthened against the US dollar after the relatively strong employment numbers. According to the country’s statistics bureau, the unemployment rate dropped from 2.9% in February to 2.6% in March. This makes it one of the best figures globally. In the same period, the jobs to applications ratio increased from 1.09 to 1.10. Further data revealed that the country’s manufacturing PMI rose from 53.3 to 53.6 in April. However, the country is still going through a period of low inflation. The headline Tokyo CPI declined from -0.2% to -0.6%.

The economic calendar will have some key events today. Data published in the Asian session showed that the manufacturing PMI increased from 50.6 to 51.9 in April. Separate data by China Logistics revealed that the PMI declined from 51.9 to 51.1. These numbers show that the economy is doing well since a reading of 50 and above is usually hawkish. Later today, we will receive the latest Swiss retail sales numbers and preliminary Spanish and German GDP, and Norway’s unemployment figures. Eurostat and the Canadian GDP data will also publish the preliminary GDP numbers.

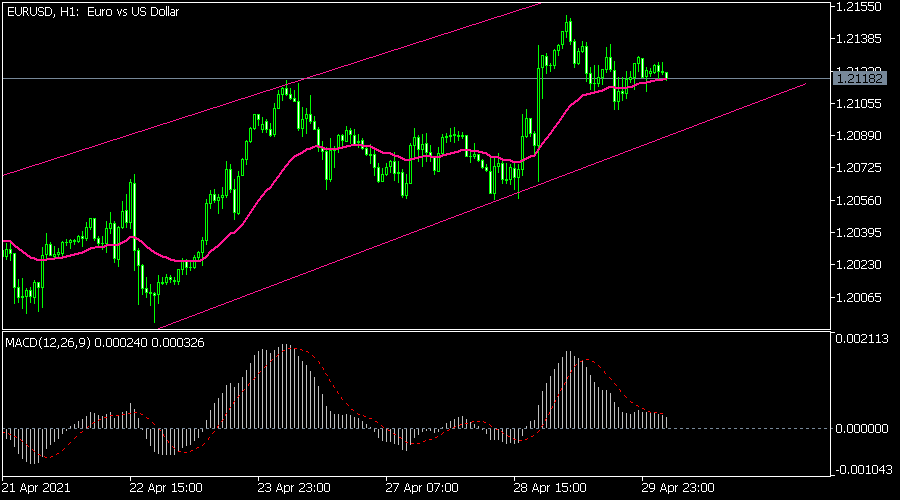

EUR/USD

The EUR/USD pair was little changed as traders waited for the latest EU GDP numbers. It is trading at 1.2118, which is slightly below this week’s high of 1.2150. On the hourly chart, the price is along the 21-day moving average and between the ascending channel shown in pink. The signal and main line of the MACD have made a bearish crossover but they are still above the neutral level. The pair may drop as bears target the lower side of the channel.

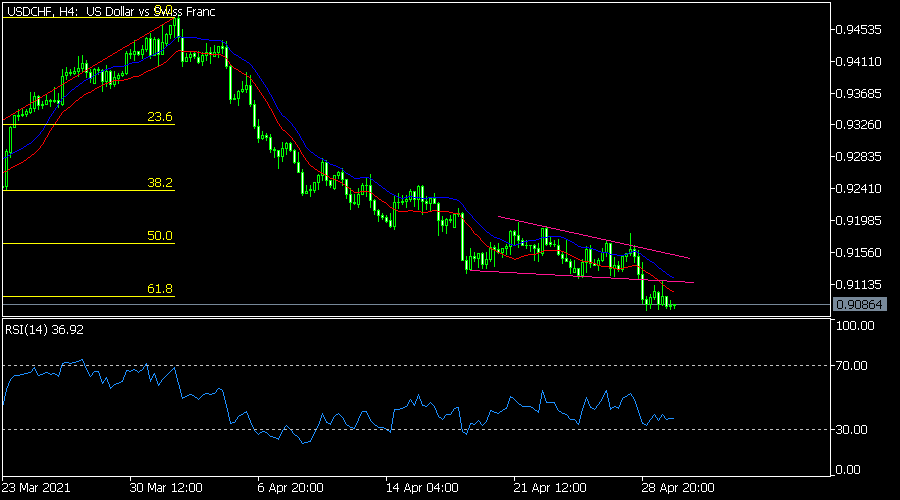

USD/CHF

The USD/CHF pair declined to an intraday low of 0.9085, which was the lowest level since March 1. On the four-hour chart, the price has moved below the 61.8% Fibonacci retracement level. It has also broken out below the important triangle pattern that is shown in pink. The pair is also below the 25-day and 15-day moving averages while the RSI is slightly above the oversold level. Therefore, the price may keep falling as bears target the next key support at 0.9050.

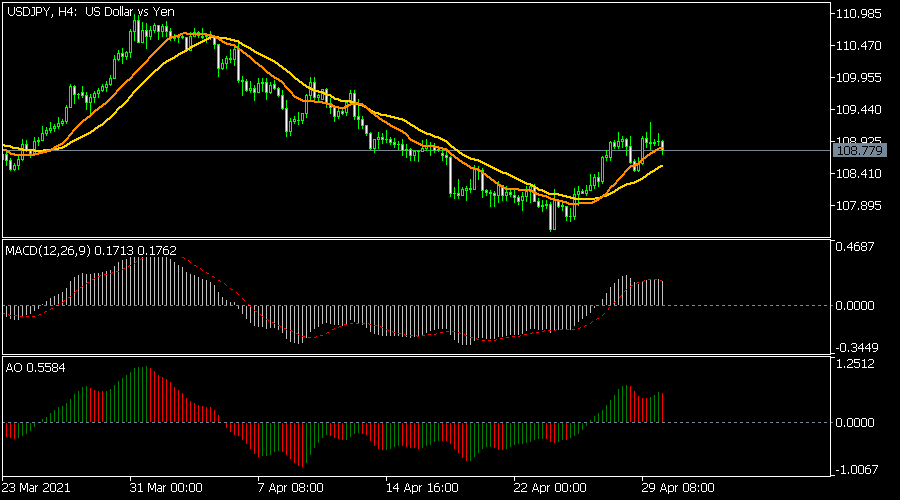

USD/JPY

The USD/JPY pair is trading at 108.78, which is slightly below the day’s high of 109.20. On the four-hour chart, the pair has moved slightly above the 25-day and 15-day moving averages while the MACD and the awesome oscillator have moved above the neutral level. The pair has also formed a small head and shoulders pattern, which means that it could soon pull back.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.