US stocks drop hard, Tesla and Oracle lead tech sell-off amid shutdown [Video]

- U.S. stocks took a breather after record highs as investors locked in profits amid government shutdown uncertainty.

- Tech weakness led the drop, with Tesla and Oracle sparking a sector-wide cooldown after months of heavy gains.

- NASDAQ’s pullback remains healthy, with price still holding key 24,720 support — signaling a pause, not a full reversal.

![US stocks drop hard, Tesla and Oracle lead tech sell-off amid shutdown [Video]](https://editorial.fxsstatic.com/images/i/Public-Figures_Elon-Musk_1_XtraLarge.jpg)

A pause after record highs

U.S. stocks finally took a breather last night after climbing to all-time highs. The S&P 500, Nasdaq, and Dow Jones all moved lower as traders decided to lock in profits.

The main reason? Uncertainty around the U.S. government shutdown.

Because the shutdown has halted some federal operations, key economic data like inflation or jobs reports might be delayed. Without those reports, traders don’t know how the economy is really doing — and when that happens, investors usually play it safe.

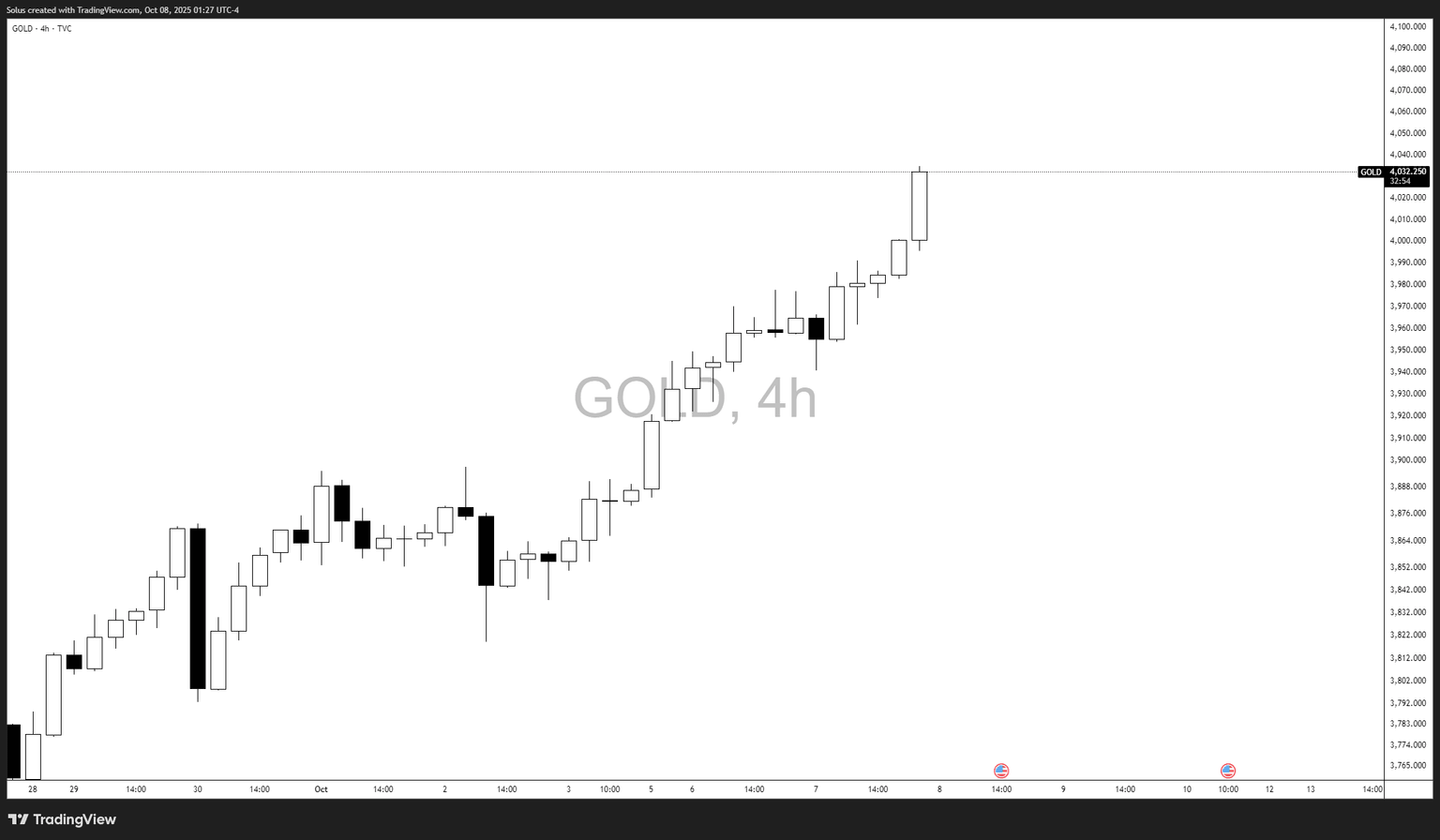

That’s exactly what we saw: a “risk-off” move where money left stocks and went into safer assets like gold, which just broke above $4,000 per ounce for the first time.

What happened to tech stocks?

Tech was also one of the reasons markets fell.

For months, big tech companies have carried the stock market — thanks to strong demand for AI, semiconductors, and growth expectations. But recently, that optimism got ahead of itself, and last night’s sell-off showed signs of cooling.

- Tesla fell sharply after launching cheaper car models. Investors worried that lower prices mean lower profit margins, which hurts future earnings.

- Oracle also dropped after its update showed rising AI costs with slower-than-expected returns. That raised questions about whether the AI boom is paying off as quickly as investors hoped.

- Together, these moves caused a broader rotation away from tech into more stable sectors like health care, utilities, and consumer staples — the kind of stocks that tend to hold up better during uncertain times.

In short, this wasn’t panic — it was profit-taking and portfolio rebalancing. Investors are simply adjusting after months of heavy gains in tech.

The bigger picture

The government shutdown added another layer of worry.

When parts of the government close, agencies that publish reports on jobs, inflation, and growth can’t operate. That means fewer clues for the Federal Reserve and for traders who rely on that data to forecast the next rate move.

So right now, markets are in wait-and-see mode — not crashing, but cautious. Gold’s strength and the slight dip in Treasury yields show that investors are hedging rather than running.

Technical outlook: Still a correction, not a reversal

The Nasdaq 100 (NAS100) remains in a cooling phase, but price action does not yet confirm a reversal. The recent sharp drop from the all-time high near 25,080 created a visible fair value gap (FVG) between 24,879 – 24,978, which price is now retesting.

This area represents a premium zone of interest where sellers previously took control. The current price behavior shows consolidation just below that gap — signaling indecision rather than trend change.

As long as NAS100 stays above 24,720 (key structural support), the higher-timeframe bullish bias remains intact. The market is simply digesting gains after an extended rally, not yet forming consistent lower-highs and lower-lows that would confirm bearish structure.

Bullish scenario: Gap fill and rebound

If price continues to respect 24,720 support, buyers could use this pullback as a reaccumulation phase before another push higher.

- A reclaim above 24,978 (upper boundary of the FVG) signals bullish momentum returning.

- Breaking through 25,080 (all-time high) would confirm a trend continuation targeting 25,200 – 25,250 in the next leg up.

This would reflect the broader narrative that markets are still in a structural uptrend — consolidating before another potential rally once risk sentiment stabilizes.

Bearish scenario: Failure at the FVG zone

If price rejects from the 24,879 – 24,978 FVG zone and breaks below 24,720 support, the short-term structure shifts bearish.

- A confirmed close below 24,720 could trigger a deeper correction toward 24,500 – 24,400, where the next liquidity pocket sits.

- However, this would still be considered a retracement within a larger bullish leg, not a full reversal, unless a new lower-high forms below 24,900 and sellers maintain momentum.

In simple terms

- NAS100 is pausing, not reversing.

- The market is retesting a supply gap created by last night’s sell-off.

- A bounce above 24,978 confirms buyers are regaining strength.

- A drop below 24,720 signals sellers taking over temporarily.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.