US Services Purchasing Managers’ Index March Preview: Expectations are high

- Services PMI expected to rise to 58.5 from 55.3, Employment to 53.9.

- Manufacturing PMI for March was the highest in 38 years, New Orders Index average best in 17 years.

- Nonfarm Payrolls March increase at 916,000 largest since August 2020.

- Vaccinations, employment and consumer confidence unlimber the US economy.

- Dollar and Treasury rates will follow expanding economy higher.

The US economy seems to have broken free of its pandemic restraints in March with manufacturing optimism at a four decade high, payrolls adding nearly one million workers and unemployment at a 12-month low.

Service sector Purchasing Managers’ Indexes (PMI) from the Institute for Supply Management (ISM) are expected to reflect this economic recovery. The overall index is forecast to climb to 58.5 from 55.3. The Employment Index is projected to rise to 53.9 from 52.7 and the Prices Paid Index to drop to 68.3 from 71.8. The New Orders Index was 51.9 in February.

The excellent and unexpected March Manufacturing PMI results should be duplicated in the service sector.

Manufacturing PMI

Factory production, though only about 15% of US economic activity, is considered a reliable indicator for the whole economy and a good predictor for the far larger service sector.

At 64.7 March Manufacturing PMI registered the highest reading since 1983, in the midst of the Reagan economic boom. A far more modest gain to 61.3 from February’s 60.8 had been predicted.

Reuters

Component indexes were equally strong.The New Orders Index at 68 was the highest since January 2004 and more importantly the nine-month average was the best in 17 years.

Reuters

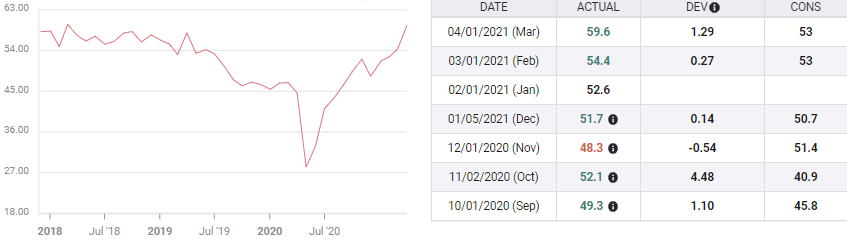

The Employment Index provided the greatest surprise. From 54.4 in February, the consensus expectation called for a decline to 53 in March. Instead it jumped to 59.6.

Employment Situation Report

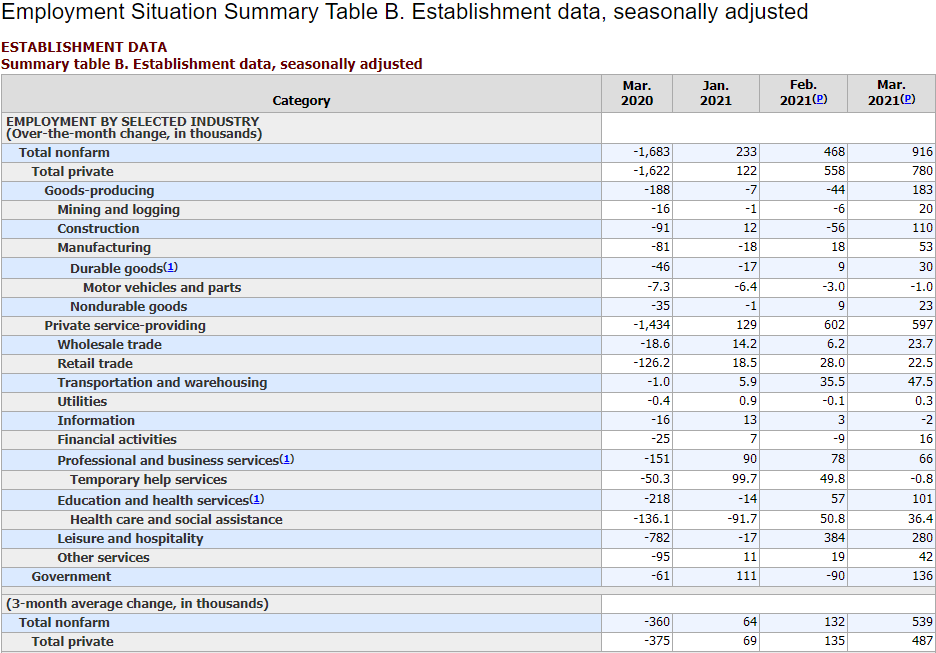

American employers fulfilled the most optimistic expectations for hiring in March in a revival led by the long dormant leisure and hospitality sector.

Nonfarm Payrolls increased 916,000, more than 40% over the 647,000 consensus forecast. It was the largest monthly increase since1.58 million last August. Revisions raised the January and February totals by another 156,000 bringing the first quarter total to 1.617 million.

The unemployment rate (U-3) fell to 6% from 6.2% and the more broadly based underemployment rate (U-6) dropped to 10.7% from 11.1%.

Employment gains were spread throughout the economy, with one very positive sign the 280,000 new positions in the hotel and travel industry, where the lockdowns and social restrictions had wrought the most grief. Bars and restaurants, probably the second most damaged sector, added 176,000 workers. Construction jobs increased 110,000 after 56,000 largely weather related losses in February. Factory work added 53,000 hires and retail jobs climbed 23,000 following the prior month’s 28,000 .

Bureau of Labor Statistics

Consumer Confidence

Consumer Confidence rin March reflected the buoyant labor market in March.

The Conference Board March Consumer Confidence index jumped to 109.7 from 91.3 in February, easily surpassing the 96.9 forecast. Sentiment is now mid-way between the February 2020 score of 132.6 and the April panic low of 85.7.

Reuters

Separate indexes for the Present Situation and Expectations also rose sharply in March, to 110.0 from 89.6 and to 109.6 from 90.9.

The Michigan Consumer Sentiment Survey seconded the Conference Board results. Its headline survey reached 84.9 in March, the highest score in a year, from 76.8 prior, outpacing the 78.5 forecast. This index is also about half-way between 101 in February 2020 and the April low at 71.8.

These two consumer indexes, released before the Labor Department data, mirror the reality which showed up in the payroll report. Employment is the most important factor in consumer sentiment.

Market response to payrolls

Reactions in the credit and currency markets to the excellent NFP report were muted.

Equities were closed for the Good Friday holiday and though open, bonds and the dollar markets were understaffed with most institutions and traders waiting for the new week before responding. On Friday the benchmark 10-year Treasury rose three basis points to 1.714%.

Dollar rates edged higher. The EUR/USD slipped from 1.1777 to 1.1763, the USD/JPY rose seven points to 110.68, the sterling shed two points to 1.3831 and the USD/CAD opened at 1.2547 and finished at 1.2575.

Conclusion

European markets again start the week closed for Easter Monday. Asian and US markets are open but reaction will probably wait for the more volatile New York session.

The remarkably upbeat NFP report has confirmed the Manufacturing Employment Index and the same improvement should be anticipated for the Service Sector PMIs.

Service payrolls rose an impressive 597,000 in March out of a total 780,000 private jobs. Government employment accounted for the balance of 136,000.

In effect, the ISM Service Employment Index has already been reported in the March NFP data. It and the rest of the service sector indexes should be considerably stronger than the consensus estimates.

The dollar and US yields will take their cues from the labor market.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.