US Services and Manufacturing PMI, ADP Employment: Disappointment is relative

- ADP misses forecast in April but March adjusted 48,000 higher.

- Services ISM below estimate, employment, new orders much better than expected.

- Manufacturing Purchasing Managers’ Indexes beneath predictions except prices.

- Dollar and equities mixed in restrained trading, Treasury yields slip.

- Markets await April Nonfarm Payrolls on Friday, 978,000 projected.

Sometimes a little disappointment works to enhance reality.

Private employment recorded by Automatic Data Processing (ADP) expanded a bit less than anticipated in April and business executives tracked by the Institute for Supply Management (ISM) lost some of their optimism. The retreat still left all three measures at their best levels in months.

American clients of ADP hired 742,000 new workers in April, slightly fewer than the 800,000 predicted by economists. Even so it was the best total since last September. The March and April combination averaged 654,000, the strongest two months since the lockdown rebound in May and June last year.

Manufacturing PMI

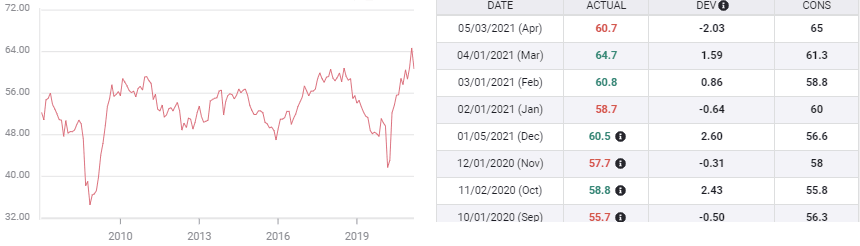

April’s ISM Purchasing Managers’ Indexes (PMI) in manufacturing were lower than their March results and missed forecasts in three of four categories.

ISM Manufacturing PMI

The overall index dropped to 60.7 in April from March’s 64.7, eliding the 65 forecast. New Orders fell to 64.3 from 68, missing the 66.6 estimate. Employment tumbled to 55.1 after 59.6 in March, missing its 61.5 prediction.

Only the Prices Paid Index beat its estimate coming in at 89.6 after 85.6 prior and an 86.1 prediction.

Absent from the single March-April comparison is the sharp improvement in the manufacturing outlook since the third quarter of last year.

Optimism in the factory sector over the past six months has been the highest three decades. Executives have responded to the general expectation that the US economy will expand more than 6% this year and to the specific encouragement of a ten-month tide of incoming orders.

Manufacturing PMI averaged 60.62 for the six months to April, the best sustained half-year since March 1984. The New Orders Index averaged 65.2 over the same half-year and just a trifle less, 64.6, over the last ten months, which is the highest comparable period since August 2004.

The March Employment Index rating of 59.6 was the best score since March 2018 and the six-month average of 53.6 is a return to the level of mid-2019 for this normally lagging indicator..

The Prices Paid Index has soared 12 points this year from 77.6 in December to 89.6 in April. From the April 2020 low of 35.30 the index is up 253%. The only comparable price gains were in the aftermath of 2008-2009 financial crisis and recession.

Services PMI

In the far larger services sector the April ISM indexes split direction.

The overall index at 62.7 missed its 64.3 prediction and March’s 63.7 score. New Orders at 63.2 was lower than March’s 67.2, the all-time high, but it was much stronger than the 56.6 forecast.

Employment was better on both counts in April, 58.5 vs 57.2 in March and a 55 estimate. Prices Paid also scored twice, 76.8 in April, 74 in March and a 73.3 forecast.

Service Employment PMI

Here again the six-month tracks in three of the four indexes are the best in years.

For the overall PMI the half-year average of 59.2 is the highest since November 2018. In New Orders 60.3 is the best since 2011 and for Prices Paid the average of 69.2 is the highest in over a decade.

As in the manufacturing sector the Employment Index turned in the weakest performance. At 54 in April, the six-month average has just returned to its level in the middle of 2019.

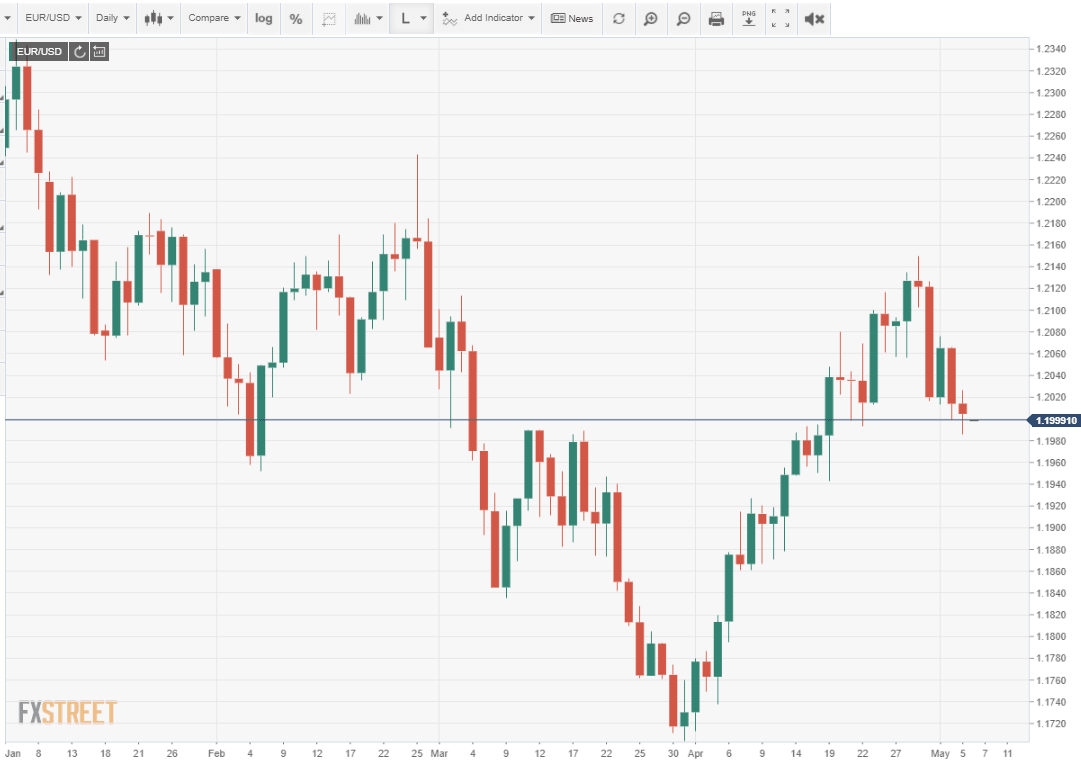

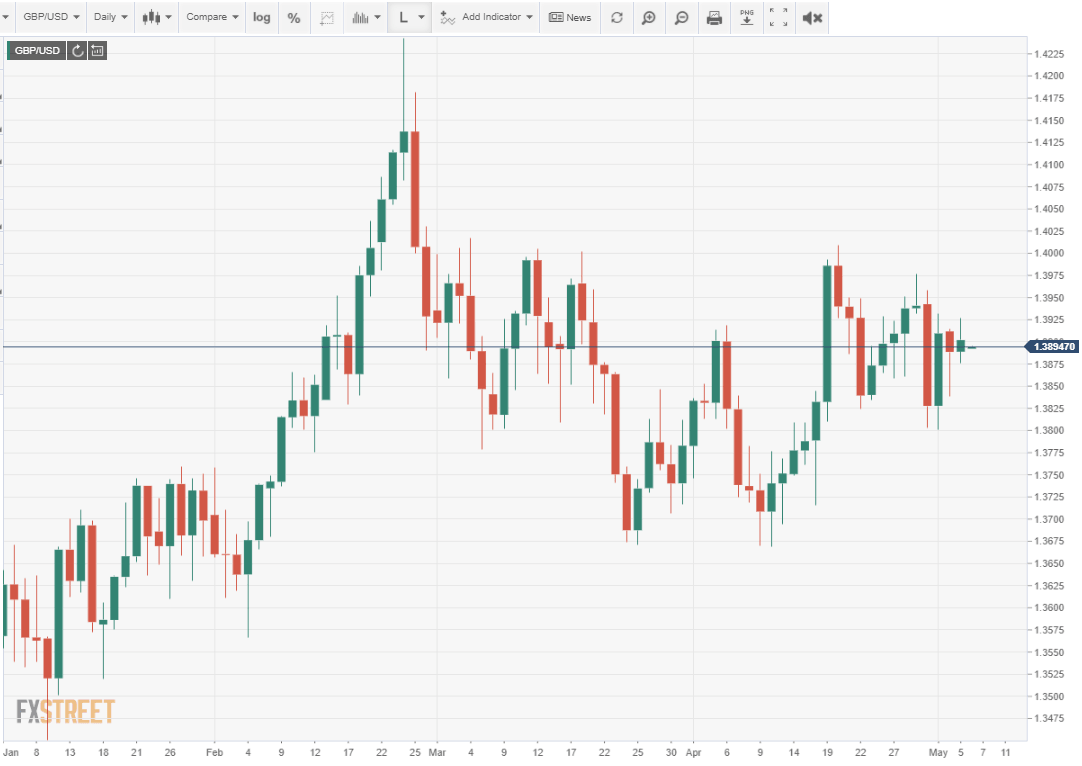

Market response

Neither the forecast disappointments nor the improved performance of these three indicators had appreciable market impact this week.

From Monday to the Asian open on Thursday the dollar is lower against the sterling and Canada, higher versus the euro and flat in the USD/JPY and AUD/USD. All of the changes are a matter of a few points except the pound which has gained almost a figure.

Equities were likewise unimpressed. Through Wednesday the S&P 500 had lost 0.6%, the Dow had gained 1% and the tech-centred Nasdaq was down 3.2%.

Treasury yields were treading water also. The 10-year shed 4 basis points on the week to close at 1.58% on Wednesday. The 2-year return was unchanged from its 0.16% open on Monday and the 30-year was off 4 basis points of yield to 2.26%.

10-year Treasury yield

CNBC

Conclusion

Markets are waiting for the US Nonfarm Payrolls report on Friday. With almost one million new hires expected and some softening in the manufacturing indexes and two of the four services indexes there might seem to be potential for a substantial miss.

Several factors make that unlikely.

First, while the Employment Index for manufacturing did fall 4.5 points in Apri to 55.1, it remains solidly in expansion. Executives cited in the report noted that inability to find sufficient skilled workers and shortages in material and parts were the reasons behind the employment changes, not the lack of work. Orders are at an exceptionally high level as businesses and consumers recover from the pandemic inhibitions.

Second, business employment optimism rose in the service sector which is about 85% of US economic activity.

Third, GDP grew at a 6.4% annualized rate in the first quarter, the best in a generation. The Federal Reserve expects that pace through the end of the year. While the Atlanta Fed's early second quarter estimate of 13.6% is probably too high, a substantial acceleration in growth is not out of the question.

Fourth, inflation gains indicate not only a base effect from last year’s lockdowns but a quickening of commodity prices and consumer demand. If employers have to raise wages to secure workers that, and the gradual end of unemployment benefits, will draw people back into the labor force.

The US economy is booming. One wonders how long the Federal Reserve can deny reality.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.