US Retail Sales December Preview: Sales will track job losses

- Sales expected to be flat in the holiday shopping season.

- Control Group forecast to improve to 0.2% from -0.5%.

- Target reported strong sales in November and December.

- Payroll losses in December may have curtailed spending.

Americans are normally among the most optimistic of people but the long pandemic year of 2020 capped by job losses in December may have finally dented consumers' habitual ebullience.

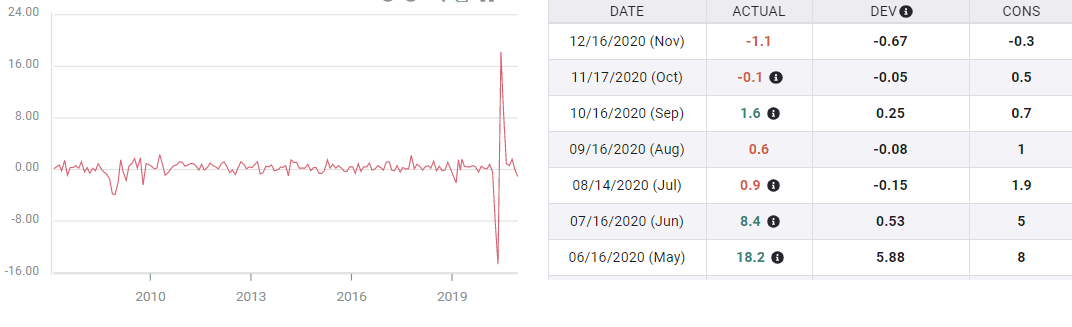

Retail Sales are forecast to be flat in December after falling 1.1% in November and 0.1% in October. Control Group Sales are are predicted to climb 0.2% after falling 0.5% in November and 0.1% in October. Sales ex-autos are projected to decline 0.1% in December following drops of 0.9% in November and 0.1% in October.

Retail sales and the holiday season

After the unprecedented 22.9% plunge in consumption during the lock down months of March and April, sales recovered 26.6% in May and June. In the five months since sales have been essentially normal, averaging 0.38% a month.

The holiday selling season has over the years expanded to three months, November, December and January. Stores offer discounts early in November, last minute deals in December and the January white sale tradition goes back to the 1950s.

Over the past ten years sales have been negative in December twice, in 2018 and 2014. The entire three-month period has been negative three times in a decade, 2018, 2014 and 2013.

The danger this year is that many retail stores are at the edge of failure after a year of pandemic closures, reduced traffic and burgeoning on-line competition. It is unknown how many will close if the holiday season is weak.

Retail Sales

Target sales

The discount chain Target reported that comparable sales in November and December rose 17.2% from a year earlier. Receipts at the company's stores climbed 4.2%, the firm's online sales more than doubled at 102%.

Target is one of the stores that has has benefited from the pandemic. Its 1,900 locations have remained open throughout and its vast array of goods has made it a single source for consumers of items that normally would have been purchased in several places.

Because of its unusual position Target's success is likely not predictive of retail sales or of the overallsector.

Retail sales and employment

Retail Sales are a bellwether for consumer outlook but they are also an indicator for hiring in the sector.

The potential fall in consumption could not happen at a worse time for the retail industry. Many stores depend on the November and December holiday season for most or all of their annual profits and January sales to move excess merchandise.

If sales are disappointing or the entire three-month period is negative, with many stores at their failure point after a year of government mandated closures, another round of layoffs and unemployment is inevitable.

NFP and Initial Claims

Hiring faltered in November falling to 336,000 from 610,000 in October, leaving 44% of the 22.16 million payroll losses in April and May still unemployed. The rise in Initial Jobless Claims from a 740,000 average in November to 837,000 in December did predict the retreat of payrolls, which shed 140,000 last month.

Claims were on par at 790,000 in the first week of January but the jump to 965,000 in the following week, January, 8 brings them to the highest total for in five months. If claims continue at this level further payroll losses are very likely.

Initial Jobless Claims

Conclusion and the dollar

The series of lockdowns and closures begun in November and esclated in December have sent the labor market into reverse. Consumer sentiment has also stalled well below its range of the last four years. Layoffs and a bitter election are a poor inspiration for a expansive consumer.

The dollar has been supported by rising US interest rates. The 10-year Treasury closed at 1.129 on Thursday. With a massive stimulus package on its way from Congress December's Retail Sales will not make more than a ripple.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.