US retail sales and bank earnings help boost stocks

US markets have hit record highs once again, with a positive outlook from the banks coupled with strong economic data. Treasury yields have slumped despite this economic outperformance, helping to lift precious metals and tech stocks.

- US financials continue to impress on strong trading revenue and lower debt provisions

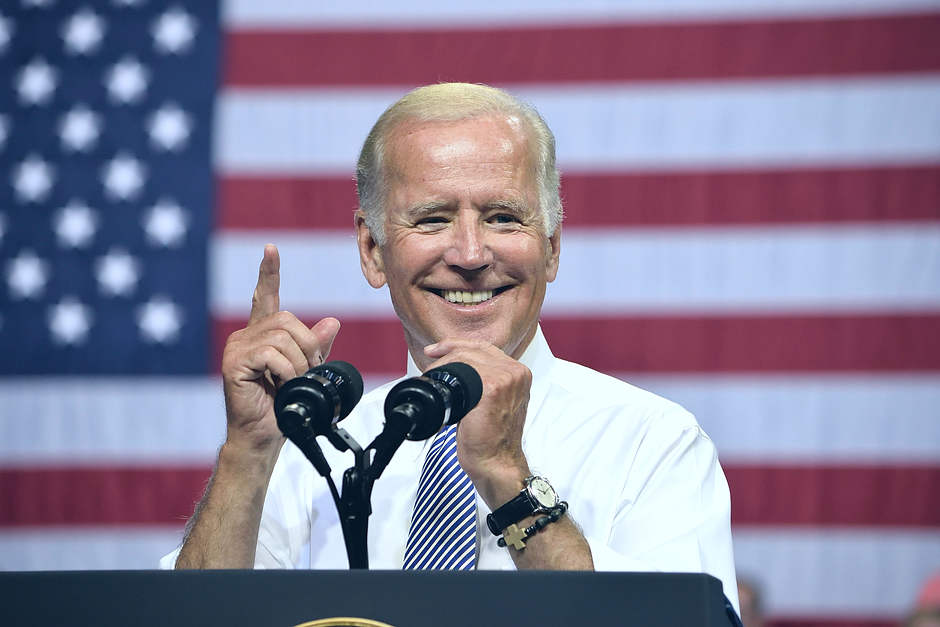

- Retail sales jump after Biden coronavirus support package

- Falling yields help boost tech and gold

Another day of impressive banking earnings has helped boost US markets today, with earnings season bringing a renewed sense of optimism for markets. Bank of America and Citigroup followed the trend set by Goldman Sachs and JP Morgan Chase, with write-downs on bad debt provisions and impressive trading revenues helping to bolster profits. Certainly todays earnings will provide a boost to banks in the UK, with the actions from Rishi Sunak likely to help FTSE financials similarly draw funds from the huge provisions set aside for bad loans that have failed to materialise. The impressive 9.8% US retail sales figure for March highlights the benefits of Joe Biden’s $1.9 trillion coronavirus support package with a fresh raft of direct payments helping to drive renewed consumer spending.

Rather predictably the prospect of a sharp rise in spending helps bolster support for stocks like Amazon and Apple, but we are also seeing strength for the likes of Visa and Mastercard as transactions ramp up across the economy. Despite the sharp rise in retail sales, we have seen the 10-year US Treasury yields tumble into a one-month low. Evidently, the economic strength highlighted by the retail sales and jobless claims figures are perceived to be a fleeting stimulus response rather than the beginning of the big post-covid economic resurgence.

Today’s decline in Treasury yields heralds a shift towards growth stocks and away from value, with UK-listed airlines on the back foot despite hopes of an impending reopening of the skies. Meanwhile, the decline in yields come to the benefit of precious metals, with gold surging into a fresh seven-week high today.

Author

Joshua Mahony MSTA

Scope Markets

Joshua Mahony is Chief Markets Analyst at Scope Markets. Joshua has a particular focus on macro-economics and technical analysis, built up over his 11 years of experience as a market analyst across three brokers.