US Oil price outlook: The US take-over and the Venezuela crisis

- US Oil Market Faces New Geopolitical Shock with Venezuelan Intervention.

- Markets See Muted Price Reaction Amid Oversupply, But Long-Term Supply Dynamics Could Shift.

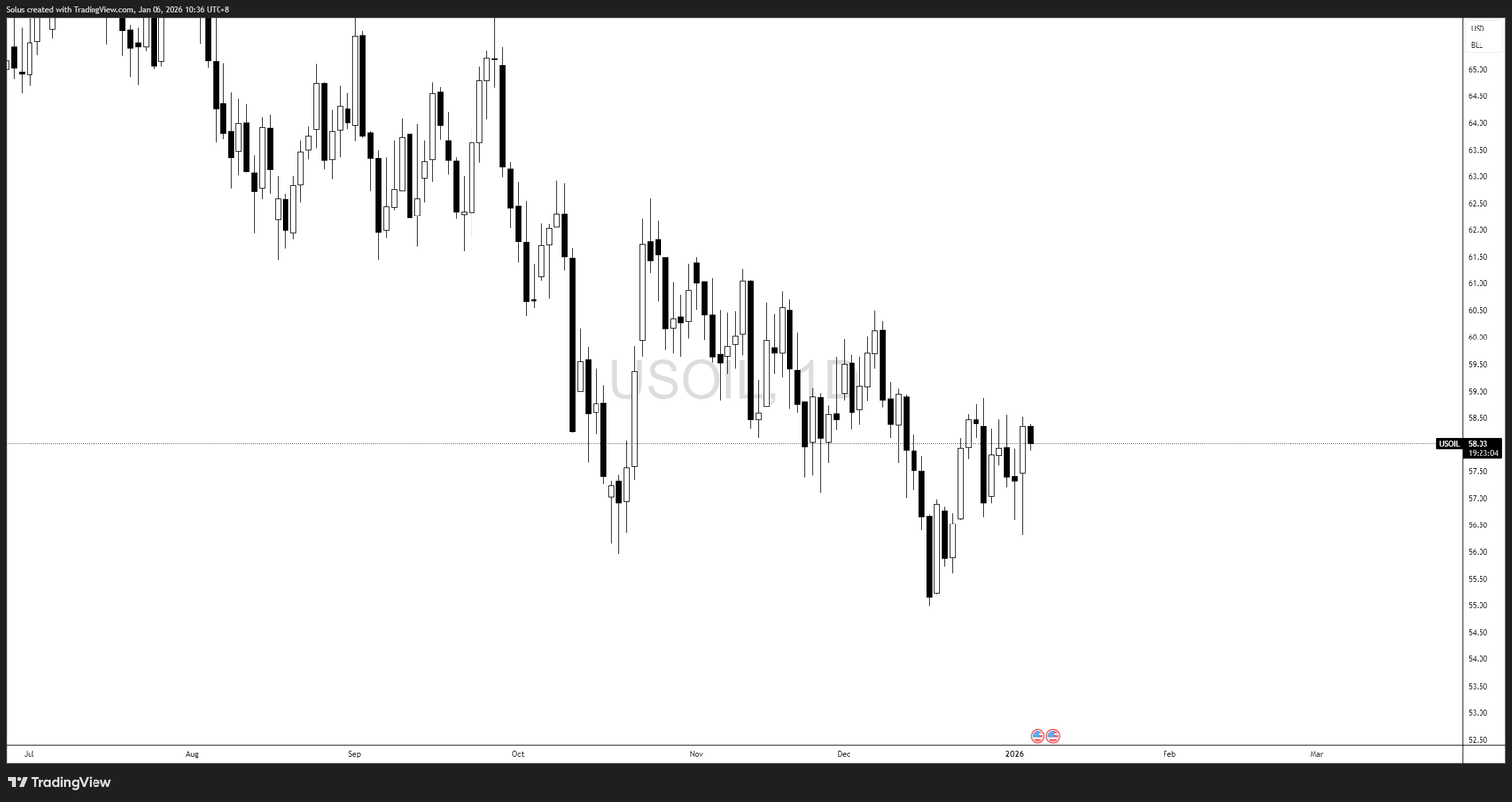

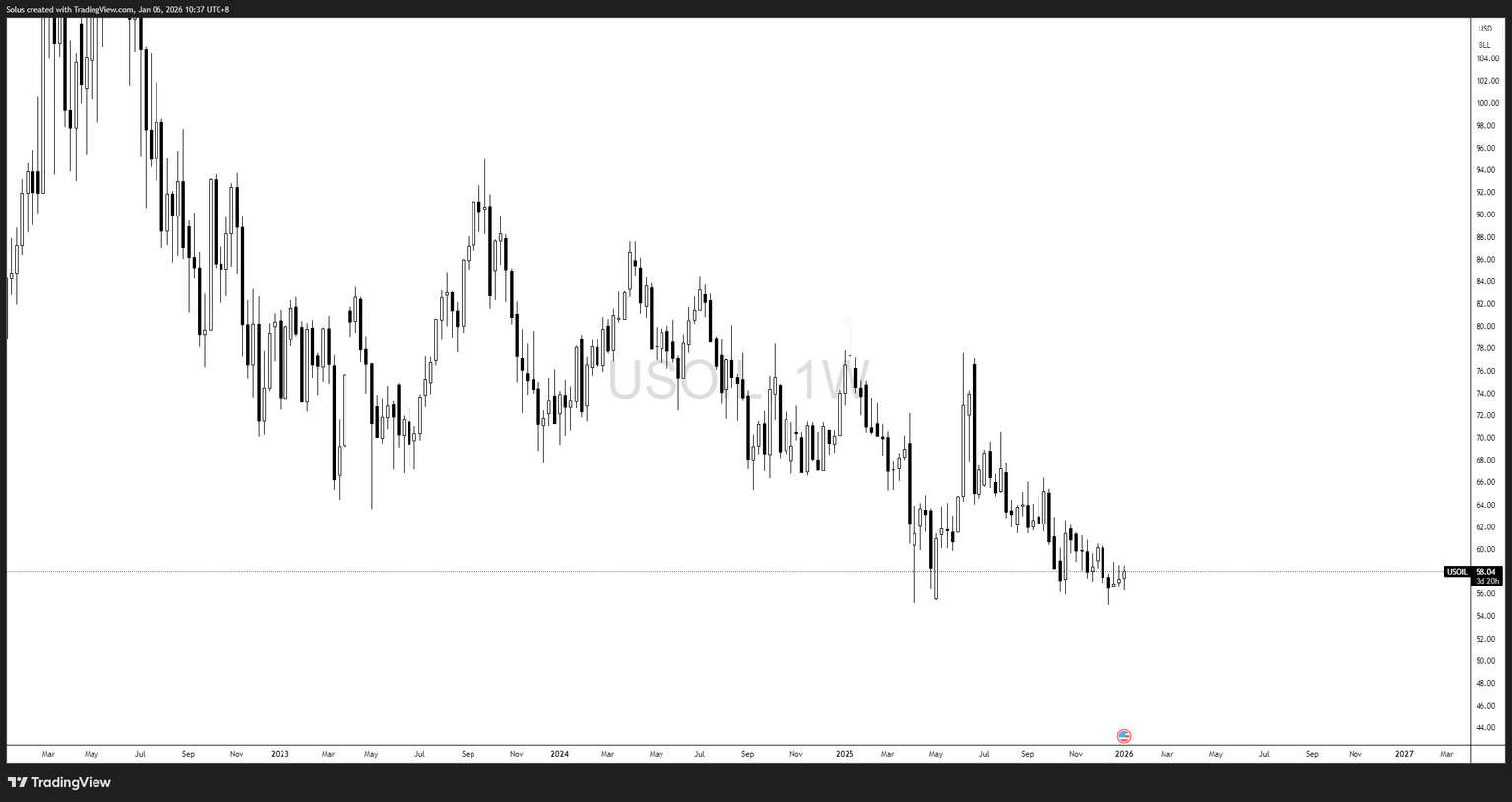

- Short-term choppy trading around $55–$65/bbl; potential for downward pressure if supply increases sustainably.

Oil supply, US action and the Venezuela variable

1. Immediate market reaction

Oil markets initially moved modestly in response to the U.S. military action and capture of Venezuelan President Nicolás Maduro. Traders priced in uncertainty and geopolitical risk, but prices largely remained steady or slightly mixed — with WTI and Brent fluctuating near $57–$62/barrel in early January trading.

While geopolitical headlines often lift oil prices, global oversupply and weak demand fundamentals have muted the market reaction. A significant oil risk premium didn’t materialize because Venezuela’s current output is very low relative to global supply.

2. Venezuela’s Oil output reality

Despite holding the largest proven oil reserves in the world (≈303 bn barrels), Venezuela’s actual production has remained subdued for years due to sanctions, underinvestment, mismanagement, and infrastructure decay. Current production is about 900,000–1.1 million barrels per day, a small fraction (<1%) of total global supply.

3. US control and future output potential

Trump’s administration signaled plans to control and revitalize Venezuela’s oil industry, potentially opening opportunities for U.S. majors (e.g., ExxonMobil, Chevron) to restore production and export capacity. This prospect drove energy stocks sharply higher — particularly refiners and oilfield service companies.

However, analysts emphasize this is a long-term and capital-intensive process that could take years or even over a decade to significantly increase output because of Venezuela’s deteriorated fields and required investments.

4. Oversupply environment

Even before the Venezuela events, global oil markets were facing oversupply pressures.

- OPEC+ has been unwinding production cuts totaling nearly 4 million barrels per day, adding to supply.

- The International Energy Agency projects that supply could exceed demand by millions of barrels per day in 2026 without significant demand growth.

This oversupply backdrop helps explain why prices have not spiked meaningfully on geopolitical news — there’s simply too much oil in inventory relative to consumption.

5. Heavy Crude and refinery implications

Venezuela’s crude is very heavy and high-sulfur, which suits complex U.S. Gulf Coast refineries. If Venezuelan volumes were revived and rerouted to the U.S. market, it could reduce demand for other heavy crudes (e.g., Canadian oil), altering trade flows.

Short-term price outlook

- Price Range: Crude prices likely to remain choppy within the $55–$65/bbl range in the near term due to balanced geopolitical risk and oversupply.

- Downside Bias: Surplus supply and weak demand risk pushing prices lower if Venezuela output remains restricted or increases slowly.

- Upside Risk: Escalation of geopolitical conflict beyond Venezuela, disruption elsewhere (e.g., Middle East), or OPEC+ production curtailments could temporarily lift prices.

Long-term structural themes

Bullish structural scenario

- Venezuelan production and exports recover significantly after U.S. investment and sanction relief.

- Slow global demand recovery (especially from China/India).

- Strained OPEC+ cohesion leads to tighter market balances.

In this scenario, increased long-term supply from Venezuela — combined with rising refining demand for heavier crudes — could eventually support prices even as oversupply persists elsewhere.

Bearish structural scenario

- Oversupply remains dominant due to continued high U.S. shale output and other non-OPEC producers.

- Venezuela’s production grows only marginally due to infrastructure and political constraints.

- Global demand softens or stagnates, reinforcing downward pressure on prices.

This scenario suggests lower crude price norms over the medium term.

Author

Jasper Osita

ACY Securities

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.