US Markit December PMI: Optimism curtailed?

- Manufacturing and services sentiment to fade in December.

- Three month averages for PMI highest in two years.

- New business closures pushing employment and layoffs in opposite directions.

- Dollar punishment over US economic concerns continues.

New pandemic restrictions in several states are taking the positive edge from American business sentiment, but for the moment optimism retains the highest reading in two years.

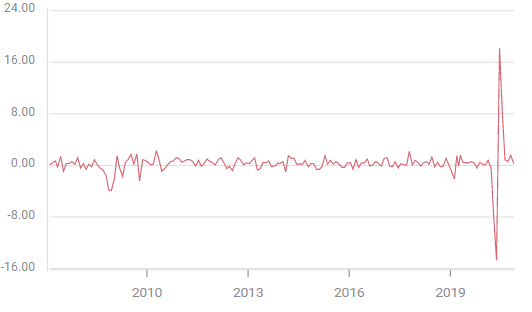

The Markit Manufacturing Purchasing Managers' Index is forecast to slip to 55.7 in December from 56.7 in November. The Services Index is projected to drop to 55.9 from 58.4. The Composite Index was 58.6 in November.

Markit Manufacturing PMI

Manufacturing sentiment has averaged 54.4 for the three months to November, that is its best score since the first half of 2018. Sentiment among services managers was 56.6, its highest reading in five years.

Retail Sales: Growth and Optimism

One of the reasons for business optimism has been the sustained recovery in consumption.

Retail Sales and the Control Group have had an exceptional rebound from the lockdown plunge in consumer activity in March in April.

For the eight months beginning in March sales and control have averaged increases of 0.89% and 1.06% per month. This is higher than the comparable averages from 2019 of 0.46% and 0.51% and suggests that despite the pandemic and media coverage the retail sector is essentially functioning normally.

Retail Sales

One caveat to consumer optimism may have began in October when both major categories of Sales, Retail and Control, missed forecasts: Sales at 0.3% on a 0.5% prediction and Control at 0.1% on a 0.5% estimate.

If the expectations for a 0.3% decline in November Sales and a slight gain in the Control Group to 0.2% are correct it would be further evidence that the fall business closures are reducing consumer spending.

GDP

The healthy growth in consumer activity was the main logic behind the 33.1% annualized growth rate in the third quarter after the plunge of 31.4 % in the second.

Even with the current labor market and consumption figures the Atlanta Fed GDPNow model estimates that the economy is expanding at an 11.2% annualized rate in the final quarter. A GDP new estimate will be issued after the Wednesday's November Retail Sales figures.

Conclusion and the dollar

The shifting fortune of the US economy at the height of the second COVID-19 wave is the chief culprit in the recent dollar decline. Rising Initial Jobless Claims and falling payrolls in November are the primary evidence. If Retail Sales begin to slip, even if they remain positive, the impact on business sentiment and the dollar could make for an unhappy Christmas.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.