US housing prices jump the most in more than three decades

Global developments

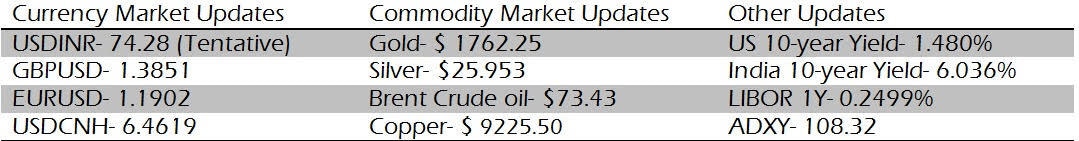

US consumer confidence rose to the highest since Feb'20 (i.e. before the pandemic started) as the economy is reopening and normalcy is being restored. This sets the tone well for ADP today and NFP on Friday. US 10y yield is lower at 1.48%. Inflation expectations are a tad lower. US Dollar has strengthened particularly against commodity currencies. Crude prices have eased ahead of the OPEC+ meeting on 1st July. It will be interesting to see if they announce an increase in production from August onwards. The market is anticipating a 0.5mbpd increase.

Domestic developments

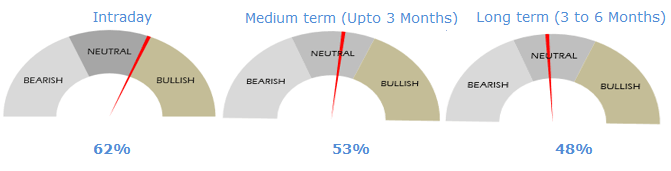

Equities

Domestic Equities saw some profit-taking. Pharma stocks led the gains while commodity-linked stocks underperformed. US equity indices ended the session flat. Asian equities are trading with modest gains.

Bonds

Rates rallied with 3y and 5y OIS at 4.80% and 5.40% respectively. 10y SDL cut-offs inched higher with cut-offs coming in around 6.90%. Corporate bond spreads too have widened, especially in 3-5y space. 3y AAA NBFCs are trading around 5.70% and 5y around 6.30%. These seem to be attractive points on the curve at this point.

USD/INR

USD/INR traded a narrow 10p range again yesterday. We may see the sideways price action continue till the US jobs report on Friday. The last day of June over the First day of July points (which would be cash-tom today) have been well behaved this time around. 1y forward yield continues to hover around 4.40%.

Strategy: Exporters are advised to cover a part of their near-term exposure between 74.00-74.50. Importers are advised to cover through options. The 3M range for USDINR is 72.50 – 75.50 and the 6M range is 73.00 – 76.50.

Author

Abhishek Goenka

IFA Global

Mr. Abhishek Goenka is the Founder and CEO of IFA Global. He pilots the IFA Global strategic direction with a focus on relentlessly improving the existing offerings while constantly searching for the next generation of business excellence.