US Durable Goods Orders April Preview: Jobs should equal spending

- Durable Goods expected to rise 0.8% in April.

- Retail Sales were weak in April after a strong first quarter.

- Nonfarm Payrolls' dismal April result was just 25% of prediction.

- Markets may find some dollar and yield solace in Goods Orders.

Americans reconsidered their retail expenditures in April after a bang-up first quarter and that hesitation may carry over into the smaller category of Durable Goods purchases.

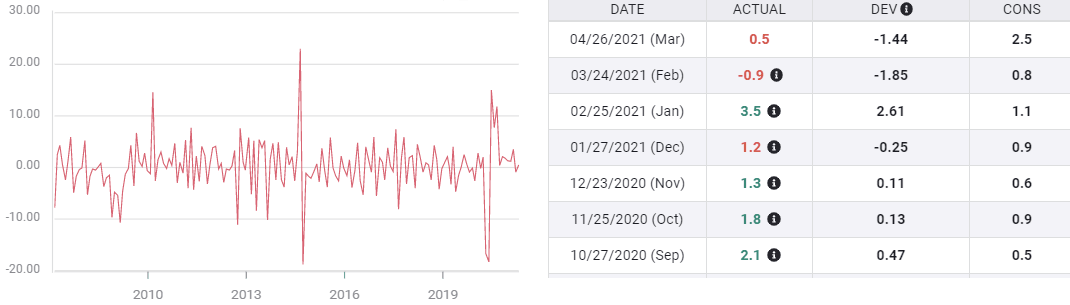

Sales of these goods are expected to climb 0.8% in April after March was revised to 1% from 0.5%. Goods outside of the transport sector are forecast to add 0.7% following March’s adjustment to 2.3% from 1.6%. Nondefense Capital Goods, the business investment proxy, is projected to add 1.5% after March was raised to 1% from 0.9%. Orders ex-Defense increased 1.8% in March, revised from 0.5%.

Durable Goods

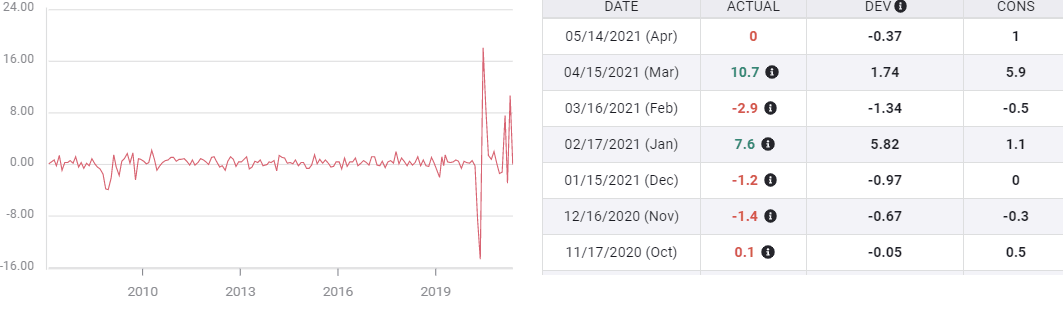

Retail Sales

Retail consumption was very strong in the first quarter rising 5.13% a month as consumers were aided by Washington’s stimulus checks in January and March. The Control Group Category, which mimics the consumer spending component of gross domestic product (GDP) averaged a 3.96% monthly gain for the period.

Retail Sales

FXStreet

Except for the May, June and July rebound from the lockdown collapse, these were the highest quarterly numbers in a generation.

Durable Goods

Durable Goods are a subset of Retail Sales, designated by the US Census Bureau as items designed to last three or more years in normal use. Hair dryers, cars, commercial aircraft and electrical turbines all qualify, though the purchasing and financing considerations are vastly different.

The Nondefense Capital Goods Category gathers business investment spending and is closely watched for its contribution to GDP and for managerial optimism and intent.

The ex-Transport category, also called core durable goods orders, excludes purchases of transportation equipment because of the high value of aircraft, trains and other motive goods.

In practice, the orders of a single firm, Boeing Company of Chicago, can skew the overall Durable Goods category because orders for multiple aircraft are booked in a single month.

Purchases of Durable Goods were more restrained in the first quarter averaging 1.03% a month. Business spending in the Nondefense Capital Goods category was quiet, gaining just 0.23% each month, but that came after a strong second half of 2020 that averaged 1.83%.

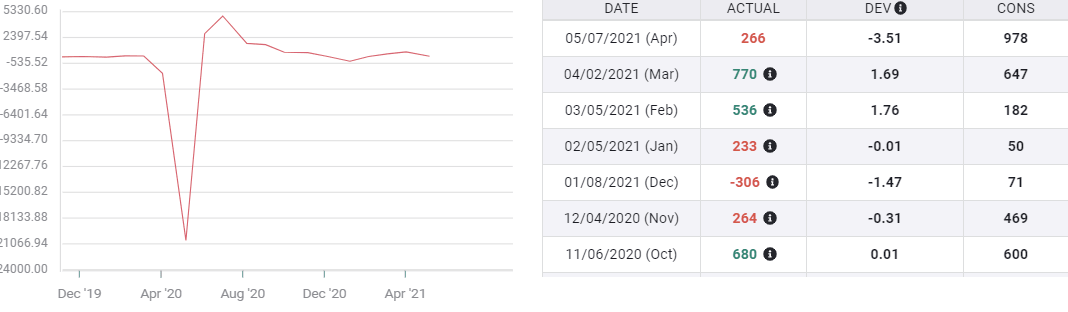

Nonfarm Payrolls

After an excellent first quarter when payrolls rose 513,000 a month, expectations were high on May 7 that April’s Nonfarm Payrolls would top one million. In fact payroll additions numbered just 266,000 and the March total was revised to 770,000 from 916,000.

Most analysis laid the blame on the increased and extended federal unemployment benefits that, for lower paid workers, were the equivalent of their wages without the annoyance of toil.

Conclusion

Durable Goods Orders offer insight into the long-term outlook of consumers and businesses. Because they are bought less frequently, are usually more expensive, and normally have a wider time-frame for replacement, they are a good indication of economic prospects out several years.

An individual might want a new car or a company a delivery truck, but the decisions will depend on employment and sales. When there is a positive view of the economy people invest.

Even though payrolls were disappointing in April, it wasn’t for a lack of offered positions. The Job Openings and Turnovers Survey (JOLTS) listed 8.1 million unfilled jobs in March the most on record. That number can only have gone up in April.

The economy expanded at a 6.4% annualized pace in the first quarter. The rate in the second is estimated to be 10.1% by the Atlanta Fed.

For consumers and businesses the expectations for employment and sales should be very high and that may encourage Durable Goods purchases despite April’s weak Retail Sales.

Currency markets have sold the dollar on poor US consumer numbers. Durable Goods could give that narrative pause.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.