US Dollar Weekly Forecast: Further trade diplomacy in the pipeline

- The US Dollar Index reached its third consecutive week of gains.

- Ebbing trade effervescence fuelled the US Dollar’s recovery.

- The Fed left rates unchanged, Powell sounded a tad hawkish.

The US Dollar logged a third consecutive weekly gain, continuing its gradual rebound from mid-April’s multi-year lows. Finally, the US Dollar Index (DXY) managed to advance further north of the key 100.00 level—a psychological threshold that has yet to be convincingly breached.

After shedding nearly 9% from its March peak and briefly slipping below 98.00 last month, the Greenback has clawed back ground in recent weeks. The recovery has been greatly underpinned by a softening tone in US-China trade rhetoric with the immediate results coming as soon as this weekend with a meeting between US and Chinese officials in Switzerland.

This week’s advance was further supported by a rise in US Treasury yields, which hit multi-day highs across the curve in the latter part of the week. While the US Dollar’s upward momentum has been cautious, the yield backdrop has helped sustain the currency’s recent strength, particularly since the Federal Reserve (Fed) kept rates unchanged on Wednesday and Chair Jerome Powell delivered an unsurprising hawkish message.

Trump trade pivot lift the sentiment

There were no fresh tariff announcements from the White House this week, but the trade narrative took a notable turn. Attention shifted to growing speculation that President Donald Trump may scale back his previously announced 145% tariff on US imports of Chinese goods — a significant softening from his earlier hardline rhetoric. In comments ahead of a key gathering on Saturday, Trump suggested that a lower rate, around 80%, “seems right,” hinting at a potential policy pivot.

Adding to the improved sentiment around the US Dollar, Washington and London unveiled a new trade framework on Thursday. Under the deal, the US gains enhanced market access and faster customs procedures for exports to the UK, while Britain receives limited tariff relief on autos, steel and aluminium.

However, market reaction has been measured. Many analysts view the agreement as modest in scope, describing it as a collection of reciprocal carve-outs rather than a meaningful overhaul of trade relations. Crucially, the US will maintain a baseline 10% tariff on most UK goods, reinforcing the notion that tariffs are unlikely to return to pre-"Liberation Day" levels — regardless of bilateral agreements.

The apparent softening of Trump’s trade stance would mark yet another retreat from earlier hardline positions in response to market volatility. In recent weeks, the president has backed away from blanket tariff threats following a sharp equity sell-off, toned down his criticism of Fed Chair Powell, and touted trade wins with Canada and Mexico that later proved to be largely symbolic.

Economists warn that tariffs, even when adjusted, remain a double-edged sword. While initial price pressures may fade, persistent trade barriers risk triggering secondary inflation effects, dampening consumer demand, and slowing broader economic momentum. If downside risks deepen, the Fed may be forced to reassess its cautious, data-dependent policy stance.

The Fed’s steady hand and Powell’s cautious tone

The Fed kept interest rates unchanged on Wednesday, as widely anticipated, but warned of mounting risks to both inflation and employment in the coming months.

In its post-meeting statement, the central bank noted that the economy "continued to expand at a solid pace," while attributing weaker first-quarter growth largely to a surge in imports as consumers and businesses sought to get ahead of newly imposed tariffs.

Speaking at a press conference, Fed Chair Jerome Powell described the US economy as fundamentally sound but acknowledged growing uncertainty. He said future rate decisions would be guided by incoming data with the policy path potentially including rate cuts or an extended pause.

"The outlook could include cuts or holding steady," Powell said, underscoring the Fed's shift to a more flexible stance as trade tensions and global headwinds cloud the domestic picture.

Inflation fears grow as US Dollar slides on stagflation concerns

The US Dollar managed to regain balance in recent sessions, shaking off some stagflation concerns — where weak growth coincides with persistent inflation — offering a temporary lift to investor sentiment. Still, the Greenback remains under pressure, dragged lower by a mix of tariff-related headwinds, slowing domestic momentum, and softening economic confidence.

Inflation continues to run above the Fed’s 2% target, with both CPI and PCE data reinforcing the persistence of price pressures. Complicating the Fed’s policy outlook is a labour market that remains surprisingly resilient, dampening expectations for imminent rate cuts.

Adding to the challenge, consumer inflation expectations have moved higher. The New York Fed’s latest survey showed Americans now anticipate prices rising 3.6% over the next year, up from 3.1% in February — the highest reading since October 2023. Still, longer-term expectations remain well-anchored, pointing to continued trust in the Fed’s inflation-fighting credibility.

Meanwhile, the labour market held firm in April with Nonfarm Payrolls (NFP) revised to 177,000 and the Unemployment Rate steady at 4.2%. However, analysts caution that these figures do not yet reflect the full impact of tariffs imposed following “Liberation Day” — a factor likely to surface more clearly in upcoming data.

For now, the US Dollar remains caught in a volatile crosscurrent of sticky inflation, trade policy uncertainty, and weakening macro fundamentals. As a result, markets are bracing for continued turbulence and a cautious path ahead for the Greenback.

What’s in store for the Greenback?

All eyes will be on next week’s inflation figures with April’s Consumer Price Index (CPI) and Producer Price Index (PPI) reports set to offer fresh insight into the price dynamics shaping the Fed’s policy outlook. The data could prove pivotal as markets weigh the path forward for interest rates amid persistent inflation and mixed economic signals.

In parallel, a full roster of Fed speakers is expected to keep investor attention firmly trained on central bank rhetoric in the wake of the latest FOMC meeting.

Beyond the Fed, markets will remain sensitive to developments on the trade front — particularly any signs of movement in the US-China negotiations, where progress has remained elusive in recent weeks.

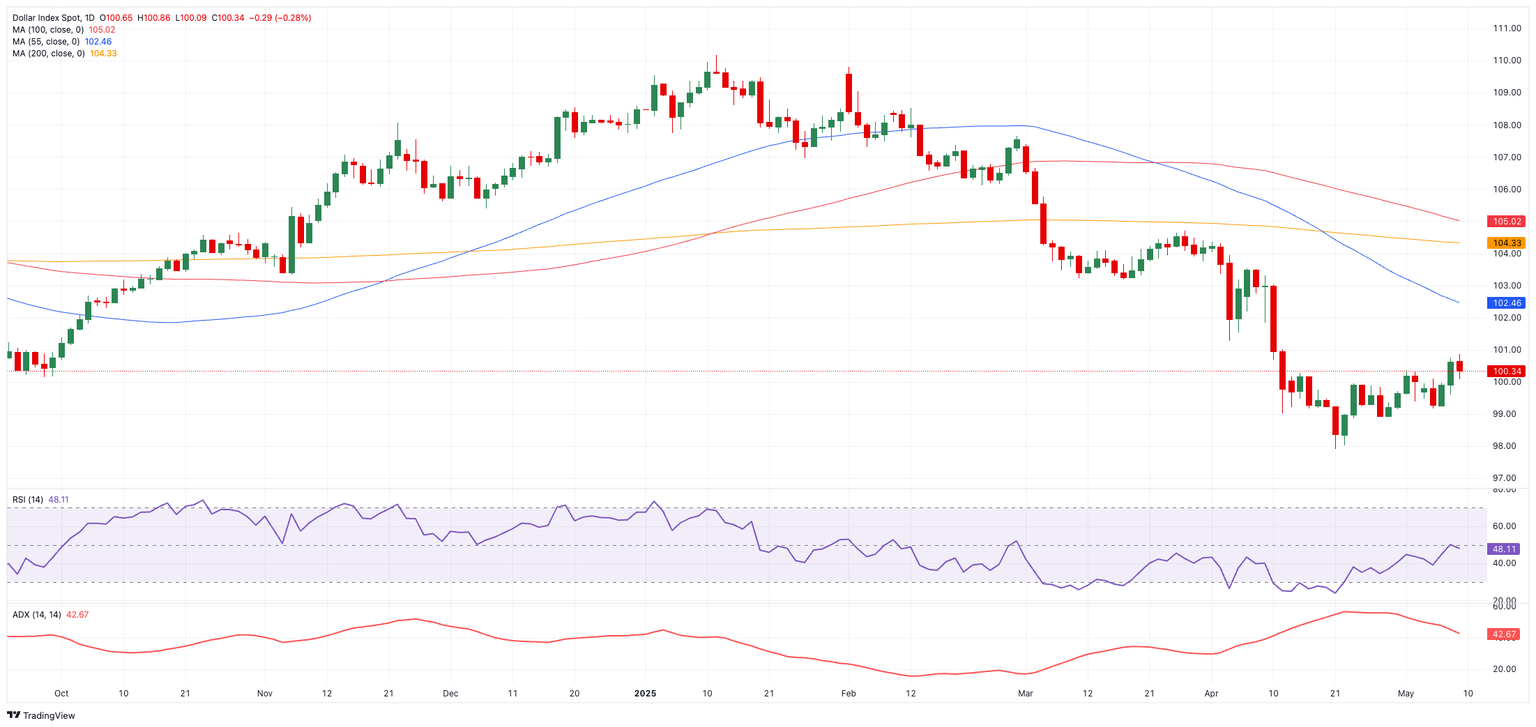

DXY holds bearish bias below key moving averages

The US Dollar Index has continued its steady, if unhurried, recovery.

A sustained break above the psychological 100.00 level could pave the way for a test of the 55-day Simple Moving Average (SMA) at 102.60, followed by the more significant 200-day SMA at 104.30 — just below the March 26 high of 104.68.

However, downside risks remain in focus. A renewed bearish turn could bring the 2025 bottom of 97.92, marked on April 21, back into play, with the March 2022 trough at 97.68 also on the radar.

For now, downward pressure is likely to persist as long as the index remains below both its 200-day and 200-week SMAs.

Momentum signals support the bearish tone: the Relative Strength Index (RSI) has eased to 47, while the Average Directional Index (ADX) has dipped to 45 — still indicative of a strengthening trend.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.