US Dollar Weekly Forecast: Trade and the Fed combine to rule sentiment

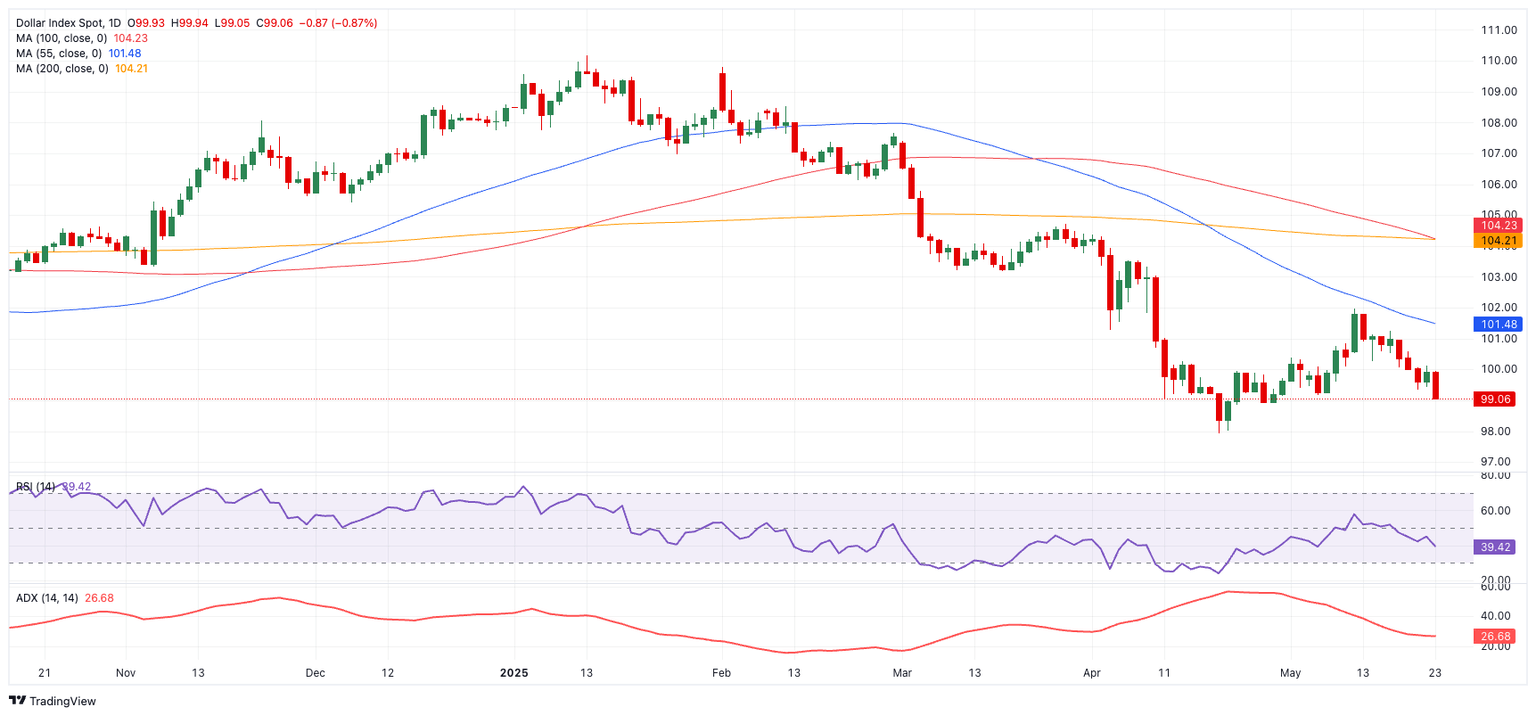

- The US Dollar Index tumbled to three-week troughs near 99.00.

- President Trump’s reignited trade concerns hurt the Greenback.

- Trump threatened to hit the EU with 50% tariffs.

The US Dollar (USD) halted a four-week winning streak, coming under renewed and significant selling pressure to hit fresh three-week lows. The downturn in the Greenback followed a brief rally earlier in the month, when it climbed to within a few pips of the key 102.00 level when measured by the US Dollar Index (DXY).

The Greenback had recovered in recent weeks after plummeting around 9% during its pronounced retracement seen in March-April. A major factor in the recovery was a change in the tone on the trade front surrounding the US and China, which led to a 90-day trade truce between the two economies, propping up the idea that the US economy could escape a recession or even stagflation.

A separate trade deal between the US and the UK had already lifted investor sentiment and given the Greenback a boost. The US-China agreement only added fuel to the rally, reinforcing hopes of easing tensions on the global trade front.

US yields gradually increased across a range of maturities in tandem with the US Dollar's weekly decline. After the Federal Reserve (Fed) lowered interest rates, this gradual but steady increase gained new momentum after the Federal Reserve (Fed) left interest rates unchanged on May 7, with Chair Jerome Powell striking a predictably hawkish tone.

Trump undermines the US Dollar

However, on Friday, President Trump erased much of the optimism that had buoyed the Greenback and global markets following recent positive developments on the trade front, including the US-China trade truce and the US-UK agreement.

Specifically, Trump threatened to impose a 50% tariff on European Union goods starting June 1 and warned that a 25% levy could be applied to all iPhones purchased by US consumers.

On the latter, Trump’s remarks marked his latest attempt to put individual companies under pressure to shift production to the US, following similar actions aimed at automakers, pharmaceutical firms and chipmakers. However, the US currently does not manufacture smartphones domestically.

This latest development stood in sharp contrast to the apparent softening of Trump’s trade stance in recent weeks, which had included a series of tactical retreats from earlier hardline positions. He had backed off sweeping tariff threats following a sharp sell-off in equity markets, toned down criticism of Fed Chair Jerome Powell, and touted trade deals with Canada and Mexico that were later viewed as largely symbolic.

It is worth recalling that even reduced tariffs may have long-term negative effects on the economy. While some of the initial price increases may subside, persistent trade restrictions may still raise prices elsewhere, reduce consumer spending, and impede growth in general. Against this backdrop, the Fed may need to reconsider its current “wait-and-see strategy” if those risks begin to materialise.

Fed remains cautious on rate path

The Fed held interest rates steady on May 7, as expected, but flagged rising risks to both inflation and employment in the months ahead.

In its post-meeting statement, the Fed said the economy "continued to expand at a solid pace," while attributing softer first-quarter growth to a spike in imports, as businesses and consumers moved to front-load purchases ahead of new tariffs.

At his usual press conference, Fed Chair Jerome Powell reiterated his upbeat perception of the US economy and that uncertainty remains elevated. In addition, he once again emphasised that future decisions on rates would depend on economic data.

“The outlook could include cuts or holding steady,” Powell said, highlighting the Fed’s more flexible approach as trade tensions and global risks weigh on the domestic outlook.

Throughout the week, Fed rate setters showed prudence about the bank’s interest rate path, citing omnipresent concerns surrounding inflation, rising trade uncertainty, and an uncertain economic environment. In addition, they called for patience and flexibility as the economic landscape changes, while some of them still see room for cuts later this year.

Raphael Bostic, president of the Atlanta Fed, stated that the central bank might only make one 25-basis-point rate cut this year, pointing to slower-than-anticipated inflationary growth brought on by higher import duties. He pointed out that this outlook is more cautious than the half-point cut that the Fed is expected to make at its March meeting.

Current interest rates are well-positioned to control economic uncertainty, according to New York Fed President John Williams. Monetary policy, according to him, is "slightly restrictive" and ideal for responding to future developments.

Alberto Musalem, president of the St. Louis Fed, warned that the extended uncertainty surrounding Trump administration policies, particularly those related to trade, might weigh economic growth by delaying consumer and business spending.

Beth Hammack of the Cleveland Fed and Mary Daly of the San Francisco Fed, who underlined the difficulty of making monetary choices in the midst of unresolved trade difficulties, called for postponing future policy moves.

Later in the week, Fed Governor Christopher Waller hinted at the idea that interest rate cuts may still be on the cards this year. He argued that investor expectations for more lenient policy remain affected by concerns about the fiscal imbalance and Republican budget ideas.

What’s ahead for the Greenback?

Next week, attention will turn to the release of the FOMC Minutes and the latest PCE inflation data.

As ever, the US Dollar is likely to stay reactive to any trade-related headlines, while remarks from Fed officials will provide additional insight and likely keep markets on their toes.

What’s ahead for the Greenback?

The US Dollar Index (DXY) is expected to keep its bearish bias in place while below both its 200-day and 200-week Simple Moving Averages (SMAs) at 104.16 and 102.87, respectively.

A break above the May high at 101.97 (May 12) could open the door for a move toward the key 200-day SMA, ahead of the weekly high at 104.68 (March 26).

If bears regain control, DXY could initially retest its 2025 bottom of 97.92 (April 21), prior to the March 2022 floor at 97.68.

Furthermore, momentum indicators have now shifted their attention to a renewed bearish momentum. The Relative Strength Index (RSI) has deflated below 40, while the Average Directional Index (ADX) remains elevated near 28, reinforcing the sense of a strengthening trend.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.