US Dollar stabilizes at key supply as CPI becomes the main catalyst

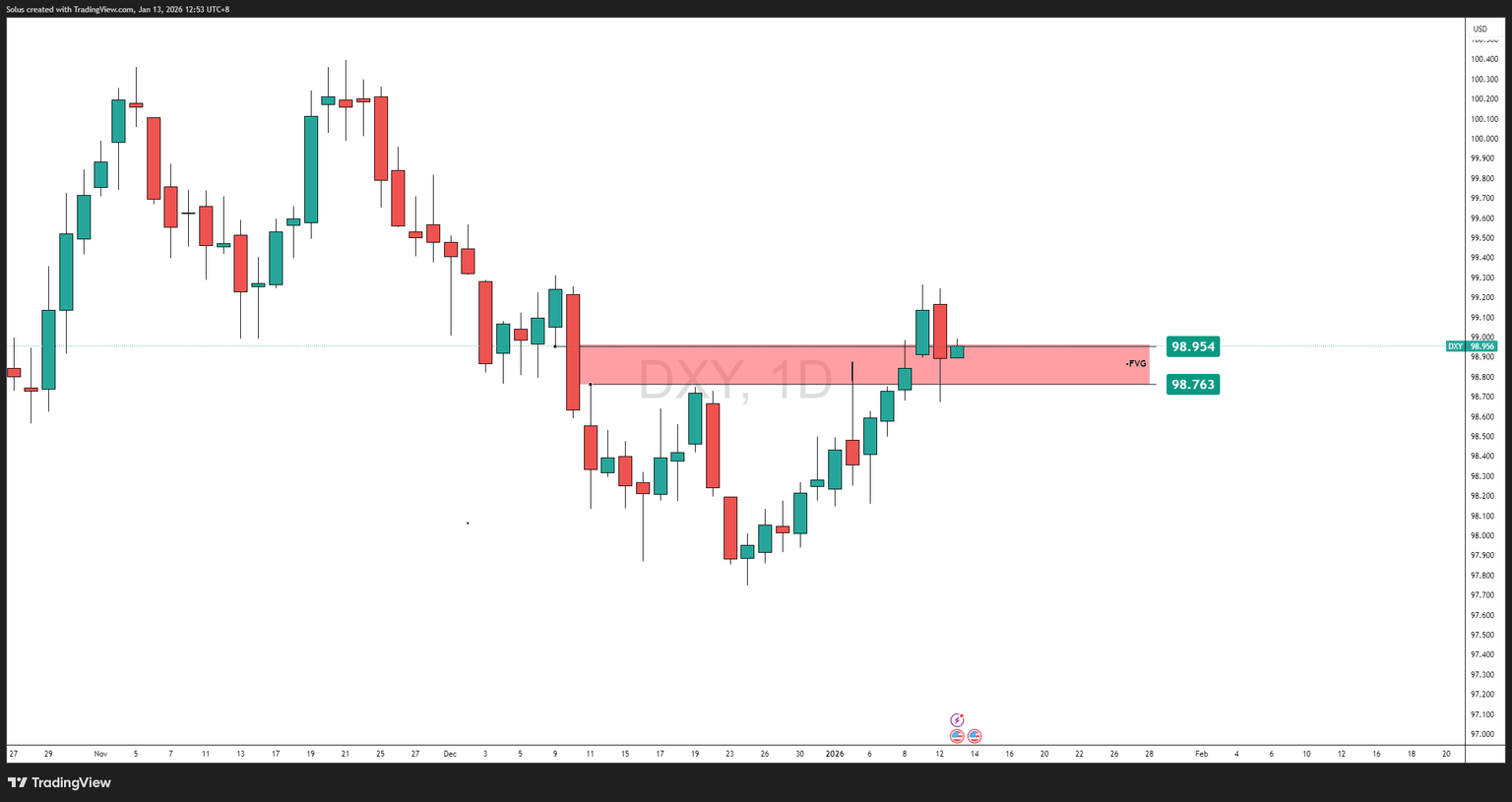

- The U.S. Dollar is reacting from a higher-timeframe fair value gap, signaling active supply and cautious positioning from institutions.

- Incoming CPI data stands as the primary volatility trigger, with inflation outcomes likely to determine whether the dollar reclaims strength or rolls back into discount.

- Dollar structure remains corrective rather than trend-confirming, keeping directional conviction dependent on macro confirmation.

U.S. Dollar market narrative: Compression before expansion

The U.S. Dollar Index (DXY) is currently trading at a technically and fundamentally sensitive zone, where price has rebounded into a daily fair value gap aligned with prior distribution. Rather than signaling immediate trend continuation, current price behavior reflects rebalancing and positioning ahead of a macro catalyst.

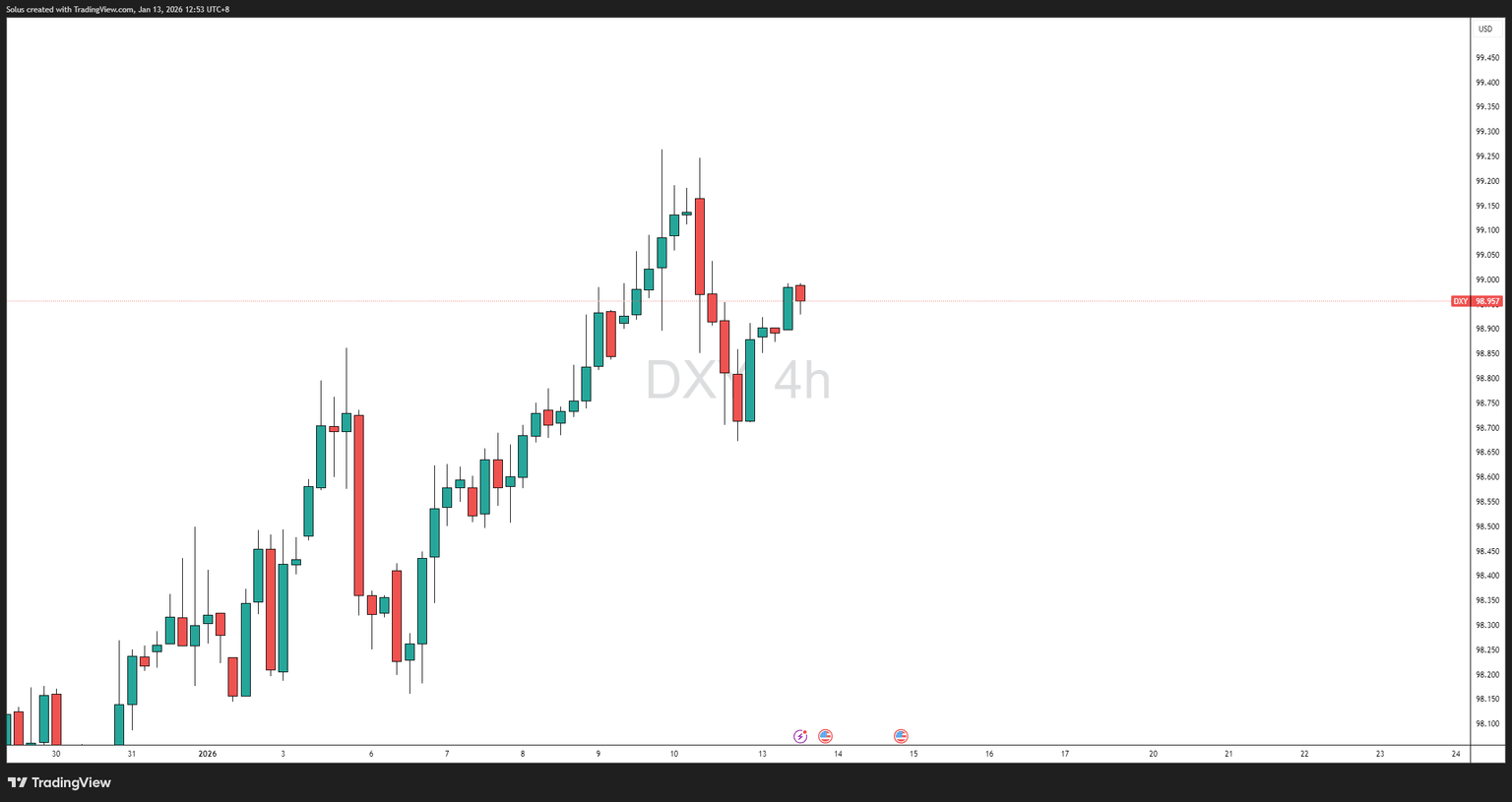

This phase of consolidation suggests that dollar flows are becoming increasingly data-dependent. Momentum has improved from recent lows, but follow-through remains limited—highlighting hesitation among market participants ahead of inflation clarity.

From an institutional perspective, this type of price action typically precedes expansion driven by macro validation, not technicals alone.

CPI as the primary driver of Dollar direction

Why inflation matters for the Dollar right now

CPI remains the most influential variable for the U.S. Dollar, as it directly shapes:

- Federal Reserve rate expectations

- Real yield trajectories

- Capital flows into USD-denominated assets

With the dollar currently trading into supply, CPI acts as the deciding force on whether price can accept above this zone or face rejection back into lower value.

Scenario 1: CPI prints hotter than expected

If inflation data surprises to the upside:

- Rate cut expectations may be delayed

- Real yields could stabilize or rise

- The dollar may hold and expand above the fair value gap, shifting structure toward recovery

In this scenario, acceptance above current levels would signal renewed institutional confidence in USD strength, potentially pressuring gold and risk assets.

Scenario 2: CPI cools further

If CPI confirms easing inflation pressures:

- Dovish expectations would intensify

- Real yields may compress further

- The dollar risks rejection from the FVG, opening downside toward deeper demand zones

This outcome reinforces the broader narrative of USD normalization rather than dominance.

Technical outlook

Price action narrative

Technically, the dollar is trading inside a higher-timeframe fair value gap, an area where supply has historically entered the market. While price has rebounded strongly from recent lows, the move lacks structural confirmation typically associated with sustained trend reversals.

Current candles reflect reaction, not acceptance—a key distinction in institutional trading.

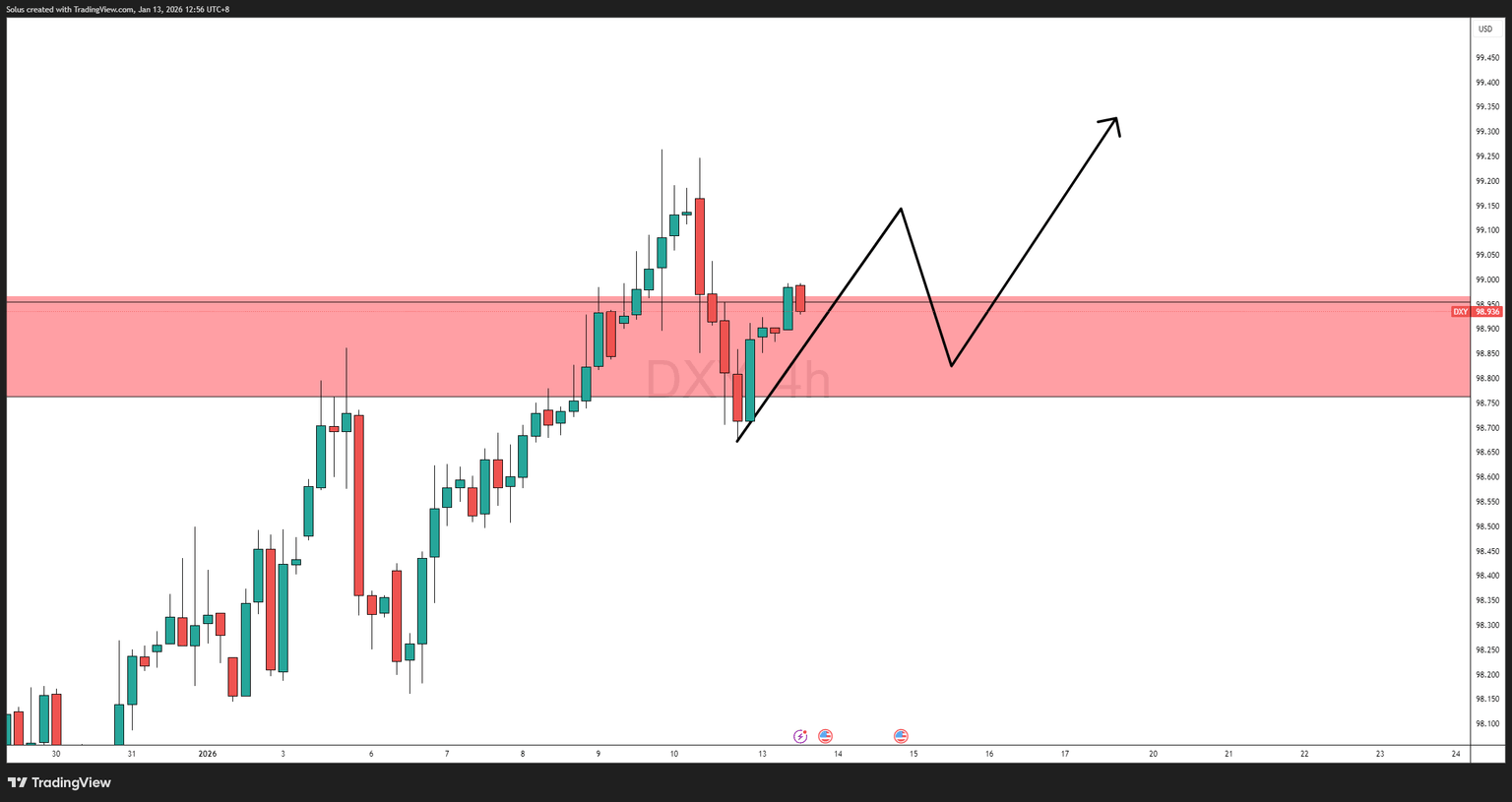

Bullish scenario: Acceptance above supply

Dollar strength remains viable if:

- Price holds above the fair value gap

- CPI reinforces sticky inflation

- Market reprices Fed policy toward patience or restraint

Sustained acceptance above this zone would shift the bias toward a medium-term recovery phase.

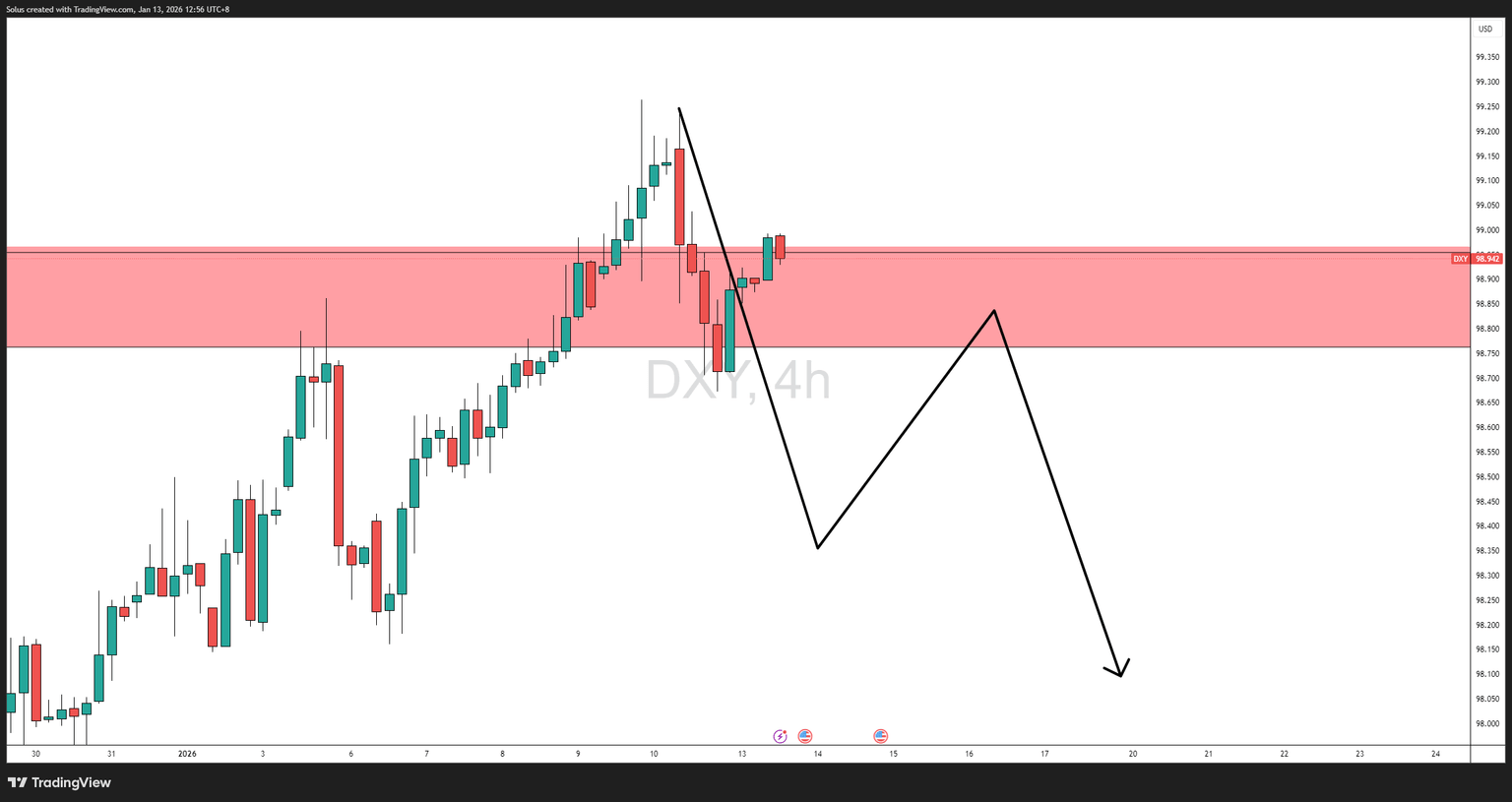

Bearish scenario: Rejection and mean reversion

A bearish continuation unfolds if:

- CPI underwhelms expectations

- Price fails to hold above the FVG

- Liquidity draws price back toward prior demand

In this case, the current rally would be classified as a corrective retracement rather than a trend reversal.

Market implications

- Gold: Dollar rejection favors renewed upside pressure on XAUUSD

- Equities: Softer dollar may support risk assets

- FX Majors: EURUSD and GBPUSD likely respond inversely to DXY acceptance or rejection

Final thoughts

The U.S. Dollar is at a decision point, not a breakout. Price has reached a zone where technical supply and macro uncertainty intersect, making CPI the defining catalyst rather than chart structure alone.

Until inflation data confirms direction, dollar price action should be viewed as positioning and compression, with expansion likely to follow once macro conviction enters the market.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.