US Dollar Index outlook: Dollar Index in a quiet mode ahead of key Fed policy decision

US Dollar Index

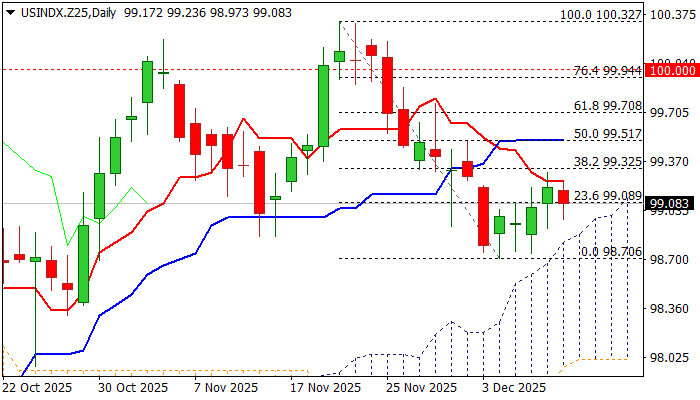

The dollar index – recovery leg from 98.70 daily higher base (the bottom of pullback from 100.32 peak) slows on Wednesday, as traders await the verdict from Fed at the end of two-day policy meeting.

Markets widely expect a 25-basis points rate cut, but focus will be on signals about the central bank’s rate path in coming months.

The Fed projected two rate cuts in 2026 (in September) with main question whether the policymakers will stick to existing agenda or will take more dovish stance and signal stronger policy easing, which is President Trump’s favored scenario, as he is in the process of choosing a successor for Jerome Powell, who is going step down in early 2026.

However, decision of 25-based points rate cut should not be the key market driver, but any surprise from the Fed could spark stronger market action.

More dovish than expected, Fed projections should add pressure on dollar and subsequently boost gold, while opposite effects could be expected in case the policymakers take more hawkish stance.

Technical picture is mixed on daily chart as rising thick daily cloud continues to underpin, but positive impact is countered by strengthening bearish momentum, while MAs are in mixed setup, with immediate action being capped by falling converged 10/200DMA’s for the second straight day.

Res: 99.30; 99.51; 99.70; 100.00.

Sup: 98.90; 98.70; 98.60; 98.31.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.