US dollar holds steady ahead of US nonfarm payrolls

The Japanese yen declined against the US dollar even after Japanese household spending data. According to the country’s statistics bureau, household spending in the country rose by 0.9% in December after dropping by 1.8% in the previous month. This increase was better than the expected decline of 1.9%. The spending fell by 0.6% on an annualised basis. Earlier numbers from Japan showed that the country is struggling because of the recent state of emergency decisions. For example, the services PMI dropped to 47 in January. However, according to media reports, there are signs that many businesses are starting to reopen.

The Australian dollar declined slightly against the USD after the Australia Industry Group (AIG) services PMI data. The study found that the services PMI rose from 52.9 in December to 54.3 in the previous month. Further data by the statistics bureau showed that the country’s retail sales dropped by 4.1% in December leading to an annualised increase of 2.5%. Economists polled by Reuters were expecting overall sales to rise by 6.0%.

The US dollar is holding steady ahead of the nonfarm payroll numbers scheduled for later today. The dollar index has risen to 91.57 and is up for the past five consecutive days. In general, economists are expecting the NFP to come in at about 50,000. They also see the average hourly earnings rising by 5.1% and the unemployment rate remaining unchanged at 6.7%. The US statistics bureau will also publish the December trade numbers.

EUR/USD

The EUR/USD declined ahead of the NFP data. It is trading at 1.1956, which is the lowest it has been since December 1. On the four-hour chart, the price is still below the 15-day and 25-day moving averages. It is also slightly below the Ichimoku cloud and the dots of the Parabolic SAR. Therefore, the trend will likely remain bearish if the price is below the middle line of the Bollinger Bands.

USD/JPY

The USD/JPY pair rose to an intraday high of 105.53 after Japan’s household spending data. On the four-hour chart, the price is at the same level as the upper side of the Bollinger Bands. It is also above the 25-day and 15-day exponential moving averages while the RSI and MACD have continued rising. Therefore, the upward trend will likely continue in the near term.

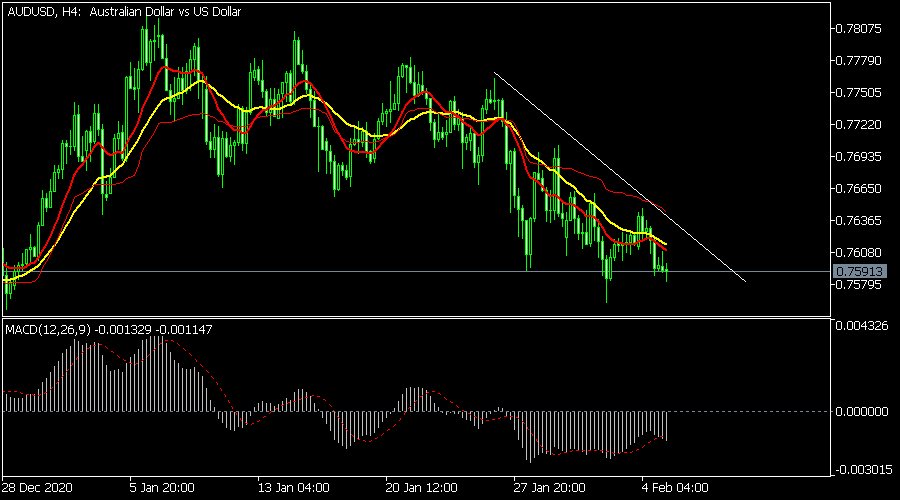

AUD/USD

The AUD/USD price dropped slightly after the country’s retail sales numbers. It is trading at 0.7590, which is slightly above this week’s low of 0.7565. On the four-hour chart, the pair is below the descending white trendline. It is also below the variable index dynamic average while the MACD is below the neutral line. Therefore, the pair will likely continue falling as bears target the next support at 0.7500.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.