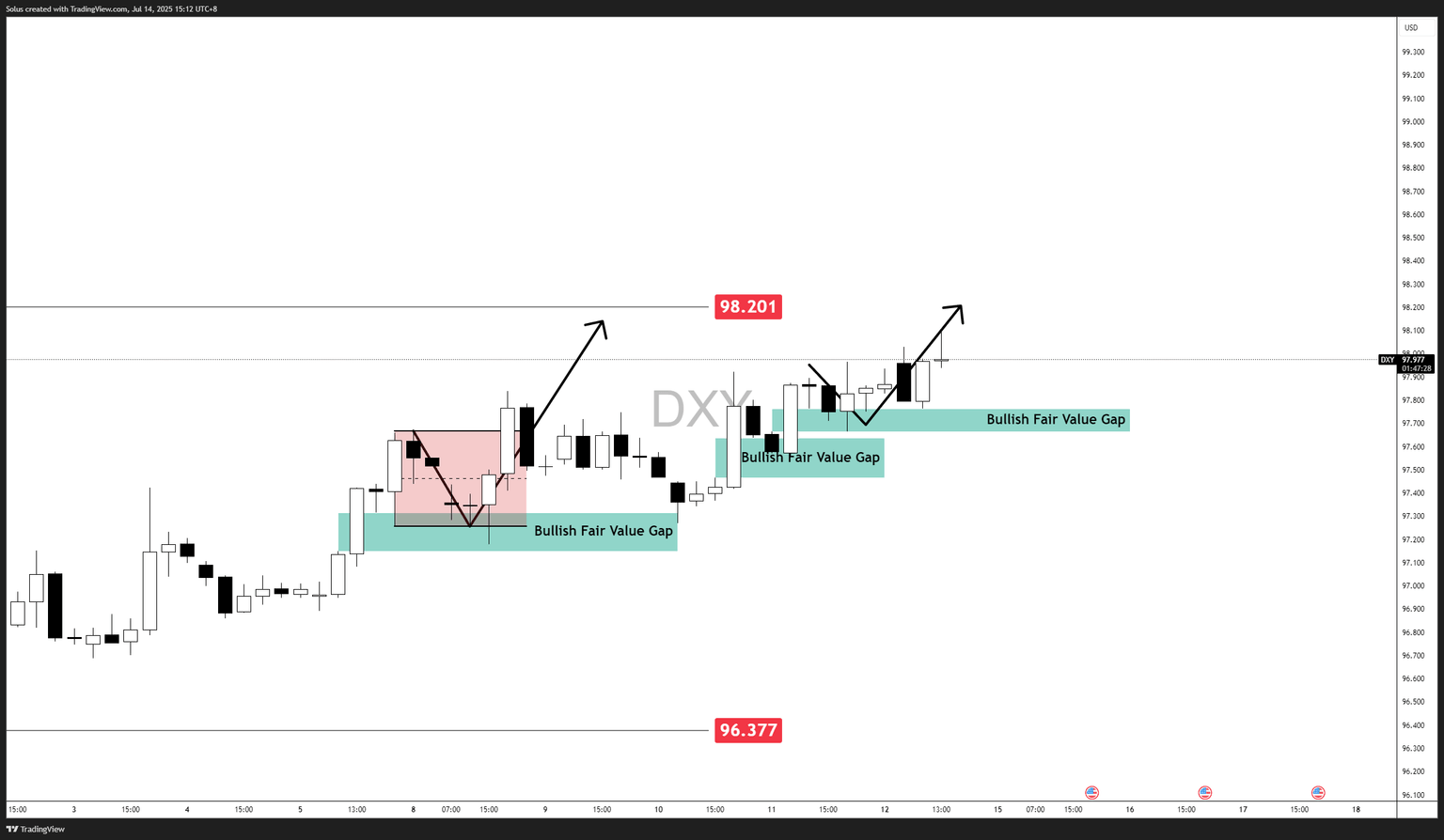

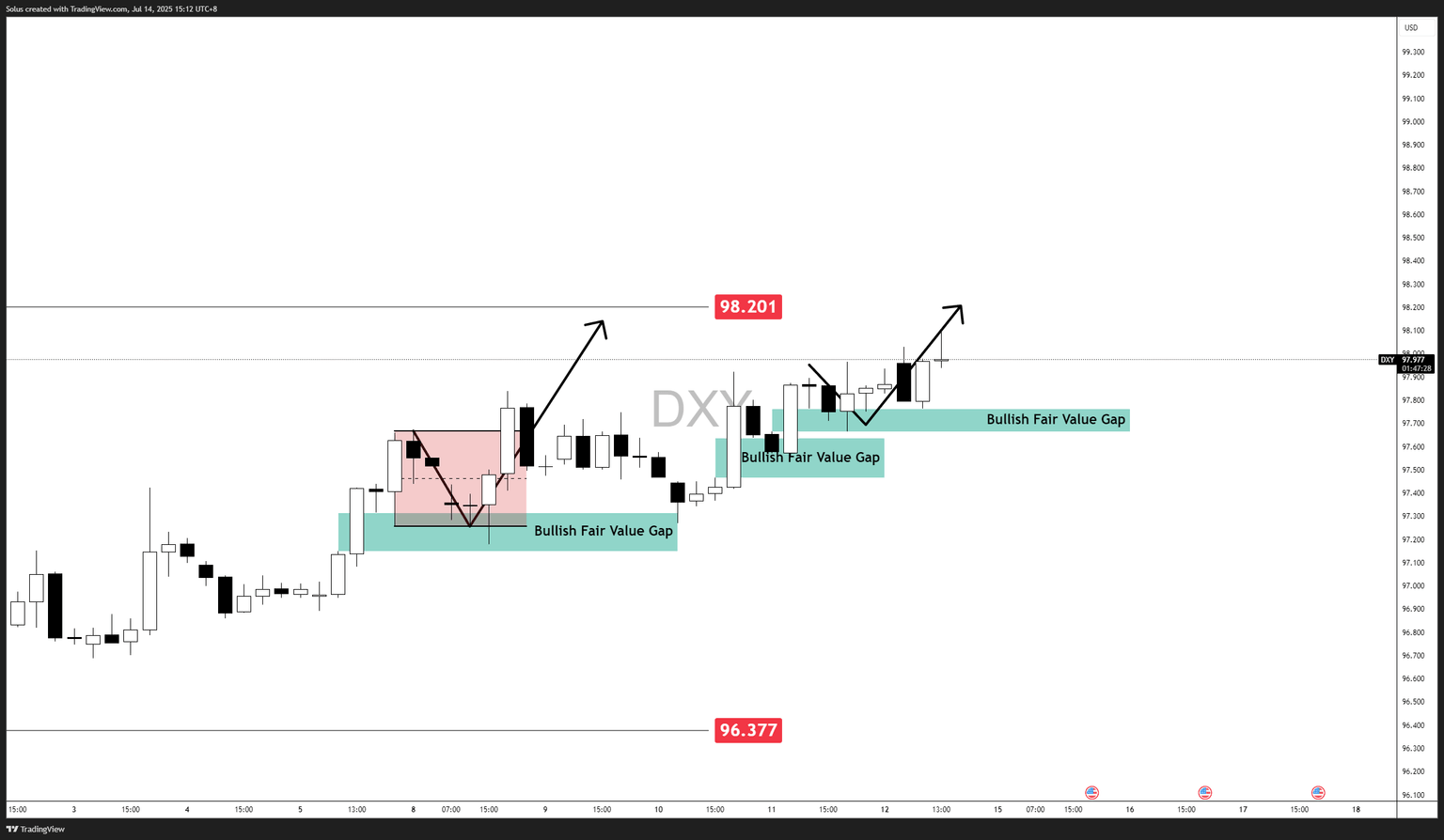

US Dollar forecast: Bullish continuation validated as DXY targets 98.20 breakout

-

U.S. Dollar rallies back above 98.00 as bullish structure holds firm amid global trade tensions.

-

Risk-off tone and institutional positioning reinforce demand for USD despite looming deficit concerns.

-

DXY eyes a breakout toward 98.20–98.50 as multiple Fair Value Gaps act as bullish springboards.

US Dollar pushes to 98 level

Over the past week, the U.S. dollar index (DXY) has regained ground—edging higher toward 98—driven primarily by fresh tariff threats from the Trump administration targeting Canada, the EU, and Mexico. These developments have supported the dollar's safe‑haven appeal amid global uncertainty, even as U.S. fiscal pressures weigh on sentiment.

The bullish traction is still in-tact with the greenback bouncing from the 97.20–97.30 fair value gap levels and now approaching the near the 98.20 level. The bounce follows renewed tariff threats from President Trump, reigniting trade uncertainty with Canada, Mexico, and the EU. Investors are rotating capital into the dollar as a defensive hedge.

Relevant news and market impact

1. New tariff threats bolster the Dollar

-

President Trump’s announcement of 35% tariffs on Canadian exports and up to 30% tariffs on the EU and Mexico starting August 1 triggered a modest but clear uptick in the DXY.

-

Investors interpreted these threats as U.S. leveraging geopolitical economic advantage, reinforcing the dollar’s safe‑haven allure .

2. Emerging markets benefit from Dollar weakness

-

With the dollar’s early‑year decline, emerging market currencies and equities have risen sharply. Analysts see further opportunity ahead if the dollar trend continues.

3. De‑Dollarisation debate intensifies

-

Commentaries and central bankers are increasingly vocal about long‑term risks to the dollar’s dominance, citing the surge in global U.S. deficits and erratic policy as catalysts for structural change.

High‑impact forex factory events

Upcoming red‑folder USD releases to monitor carefully (per Forex Factory’s impact coding) :

-

U.S. CPI & PPI: strong data could strengthen the dollar further, while weak prints may reverse recent gains

Bullish scenario playing out: Fair value gaps validated, 98.20 in sight

The U.S. dollar is actively unfolding the bullish scenario forecasted last week. In US Dollar Forecast: Bullish Target Hit, Can the Dollar Push to 98 or Break Below 97?, we outlined two directional possibilities. The bullish path is now playing out with key validation:

-

Multiple Bullish Fair Value Gaps (FVGs) are holding cleanly.

-

Structure remains bullish after sweeping the 97.20 lows early last week.

-

Price has reclaimed the 97.70–97.85 zone, which is now acting as a platform for continuation.

-

Current resistance to break: 98.201 – if price closes above, momentum could stretch to 98.50 and even toward 99.00.

Technical outlook

Price is forming a clear series of higher lows and bullish FVG retests, confirming a short-term upward trajectory. Price currently sits at 98.04, just shy of the resistance marked at 98.201.

Bullish scenario: FVG respect and breakout toward 98.50–99.00

-

Three consecutive Bullish Fair Value Gaps (FVGs) have formed and held:

-

-

1st FVG: 97.150–97.316.

-

2nd FVG: 97.467–97.637.

-

3rd FVG: 97.664–97.765.

-

-

Price is pushing above previous swing highs, confirming structural intent.

-

If 98.201 breaks and holds, targets extend toward:

-

-

98.50.

-

99.00.

-

Another round of strength for dollar is a higher inflation print on Tuesday as markets await consumer price index print.

Bearish scenario: Rejection at 98.20 and breakdown toward 97.30

-

If 98.20 fails to break convincingly, we may be witnessing distribution at premium pricing.

-

Signs to watch:

-

-

Rejection candles near 98.20–98.30.

-

Breakdown through 97.85–97.70 FVGs.

-

-

If broken:

-

-

First target: 97.30.

-

Below that: 96.377 becomes open liquidity.

-

A tamed down inflation could lead to a dovish fed which could pull the greenback for a deeper pullback, or even a downside continuation.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.