US consumer in retreat, Wall Street disconnect is severe

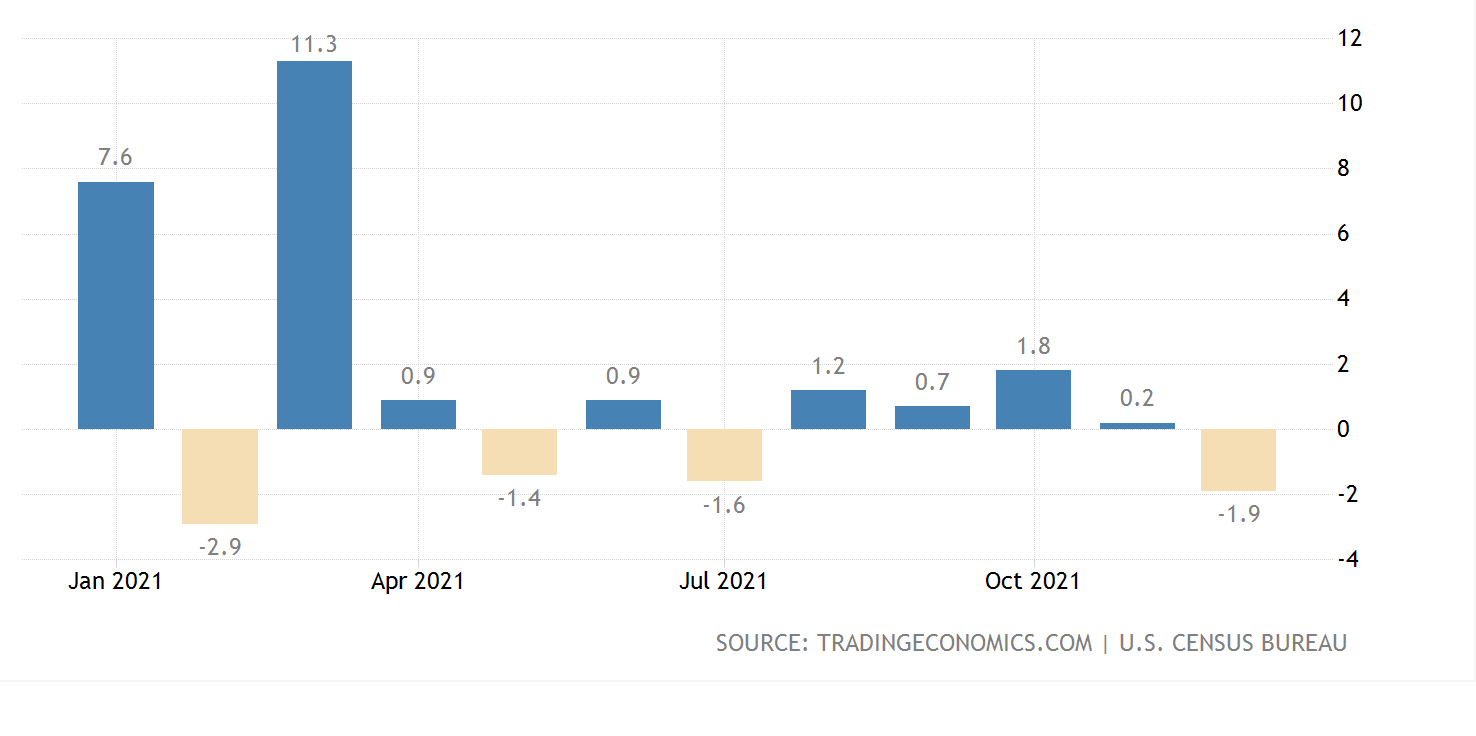

US retail sales collapse

Consumer sentiment at 10-year lows

What is not clear here?

The real US economy is in dire straits.

While Wall Street talks everything up?

US retail sales collapse

Are they tipping over to lockdown levels again?

US consumer sentiment

Back at GFC levels. This is a disaster.

China new home prices

The game is up. No more get rich quick and easy.

Property investors will have to roll up their sleeves and work a lot harder from now on. Permanently.

Germany rebounds

Though only a partial rebound and Germany is again beset my a fresh Covid wave. Nonetheless, the tortoise that is Europe is returning to some form of new normal.

US500 daily chart

This is the deer caught in headlights stuff. The market is frozen just for a moment, before I believe, yes, you guessed it, a resumption of downward pressure. Wall Street bullish sentiment has no basis in Main Street reality.

AUS200 daily chart

Australian market is in all kinds of trouble even if it hasn't figured out the local reality yet. Seeing very sharp declines ahead.

Australian dollar daily chart

Looking particularly dangerous as all of the past month has been merely a consolidation phase before the overall macro-downtrend resumes toward 65 cents.

All the best.

Author

Clifford Bennett

Independent Analyst

With over 35 years of economic and market trading experience, Clifford Bennett (aka Big Call Bennett) is an internationally renowned predictor of the global financial markets, earning titles such as the “World’s most a