US Conference Board Consumer Confidence May Preview: Inflation saps consumer sentiment

- American Consumer Confidence expected to retreat in May.

- Inflation, racing gasoline prices may have undermined optimism.

- Michigan Consumer Sentiment unexpectedly declined in May.

- Retail Sales, Control Group, were weaker than forecast in April.

The US labor market is overflowing with work. In March 8.1 million positions were on offer in the Job Openings and Turnover Survey (JOLTS), the most on record. Unfilled jobs were likely even higher in April as barely one-quarter of the projected million hires took place.

The pandemic is ending. The US has had one of the most successful vaccination campaigns in the world. Lockdowns are over, the economy is expected to soar at 6.5% or more this year.

So why are consumers in a funk?

Consumer Confidence from the Conference Board is forecast to rise to 119.4 in May from 117.5 in April.

The Michigan Survey of Consumer Sentiment dropped to 82.8 in May its lowest reading since February, from 88.3, its best reading since March 2020.

Inflation

As Americans prepare to resume their normal lives they have been confronted with the worst inflation in more than a decade.

Suddenly everything is more expensive. Food, clothing and housing costs have shot higher in the past three months. The Consumer Price Index (CPI) has tripled from 1.4% January to 4.2% in April.

CPI

A combination of factors has driven prices higher.

Shortages have cropped up in manufactured goods as supply chains are creaking under revived demand and many industries and businesses are unable to find workers.

Last year’s demand collapse in the pandemic lockdowns caused prices to tumble as retailers drastically discounted to move merchandise and customers disappeared into their homes.

A year later prices have recovered and the index comparison to March, April and May 2020 has recorded that differential as a bulge in the CPI rate.

However, the base effect, as it is called, is not the only logic behind soaring prices.

Commodities and raw materials are universally more expensive.

The Bloomberg Commodity Index, (BCOM) has climbed 17.3% this year, and 46% since last April’s low. The expected demand surge from a global economic recovery has combined with production delays to produce the highest commodity prices in six years.

Wages are beginning to rise as employers compete for scarce workers.

For many workers on the lower end of the pay scale, the Biden administration’s increased and extended unemployment benefits may have encouraged a delay in returning to their jobs, helping to force wages higher.

These material and wage costs are being passed on to consumers in price hikes.

Gasoline

For most Americans gasoline is a requisite and inelastic good. When fuel prices rise, people do not drive less, they simply pay more to drive as much.

There is little choice about how often to take the kids to school, buy food, commute to work, or the hundred other pursuits of normal life. Driving is an integral part of daily life.

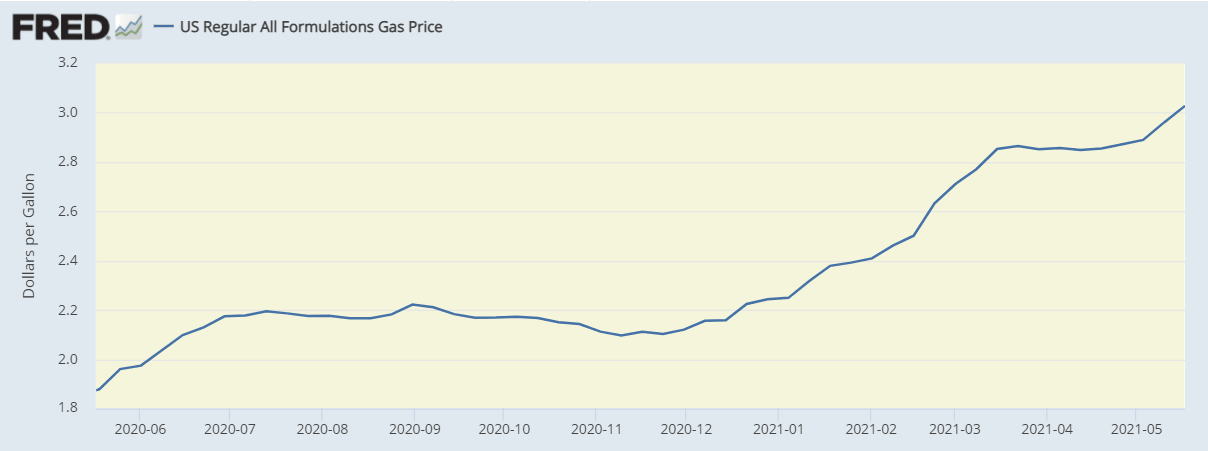

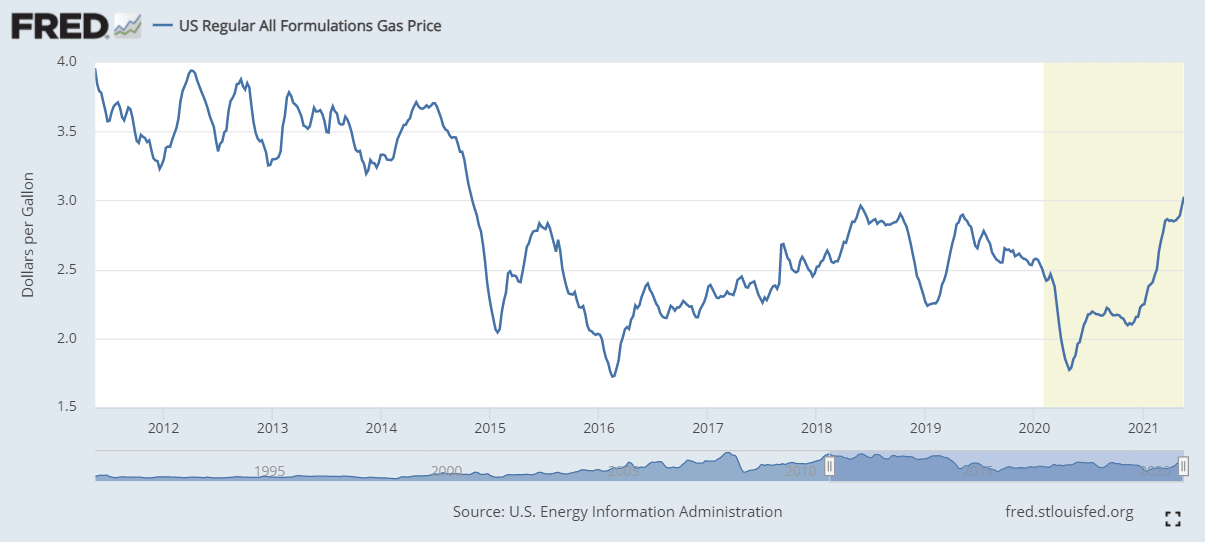

The nationwide average price of a gallon of regular gas has jumped 43% in seven months, from $2.11 on November 2, the day before the 2020 presidential election, to $3.03 on May 17. In the same period the BCOM index climbed 27%.

That difference is an additional tax on consumers.

The higher gas prices are partially due to the Biden administration’s decisions terminating the Keystone pipeline and ending new fracking leases on federal land. North American fracking producers are the swing producers for the global market and eliminating part of this source as demand rises has helped to add a premium to retail costs.

In addition, in the US the vast majority of freight moves by truck. These higher transport expenses are also passed on to the consumer.

Driving costs this Memorial Day weekend, the traditional start of summer in the States, will be the highest since 2014.

Conclusion

The rapid increase in consumer prices, particularly for gasoline, has hit consumer budgets just as they were beginning to recover from the pandemic lockdowns and unemployment.

April Retail Sales were much worse than expected. Overall sales were flat on a 1% forecast. The Control Group, which mimics the consumption component of GDP, fell 1.5%, far more than the -0.2% prediction.

The US economy lives and dies by consumer spending. A prolonged bout of inflation could do serious damage to consumer sentiment and the prospective recovery.

Markets have been focused on US inflation and will not trade the Conference Board number. A weak result will add to the suspicion that the US consumer recovery is not performing as expected.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.