U.S. Brief, December 03 - Top Trade Setups in Forex - Mixed Risk Sentiment In Play!

Earlier today, Australia's central bank announced its decision to keep its benchmark interest rate unchanged at 0.75% (as expected). The Australian dollar was firmer at $0.6835.

The U.K. like-for-like retail sales fell 4.9% on year in November, according to the British Retail Consortium. The British pound kept trading on the upside, at $1.2939. Meanwhile, the euro was little changed at $1.1076, while USD/JPY regained the 109.00 level rebounding to 109.19. And spot gold was steady at $1,461 an ounce.

XAUUSD - Gold's Descending Triangle Breakout

Gold prices flashing red and representing moderate losses. As of writing, the prices currently trading near the $1,468 range as the United States and China are still in talks for deal or no deal.

Discussions of a possible phase one deal between the world's two largest economies managed the market this morning, pressure on the precious metal that is seen as a safe-haven asset.

It should be noted that the trade deal was still possible by the end of the year, and the phase-one of the agreement was being put to paper, according to Kellyanne Conway, a senior adviser to U.S. President Donald Trump.

Gold prices inched up earlier this morning on the overnight news that U.S. President Donald Trump revived steel and aluminum tariffs on Brazil and Argentina. The move reignited fear of global trade disputes and hampered risk appetite.

There's a better than 50-50 chance that we will get a 'phase one, skinny' deal, mainly due to both presidents, Trump and Xi, need this for domestic political reasons.

-637109950513463286.png&w=1536&q=95)

XAUUSD - Daily Technical Levels

Support Resistance

1455.8 1467.31

1449.15 1472.18

1437.64 1483.69

Pivot Point 1460.66

Gold - XAUUSD- Daily Trade Sentiment

Gold was trading under a solid resistance mark of 1,465 level, which has now been violated amid weakness in the greenback. Gold is now heading north to test the target level of 1,472. The RSI and MACD are in a buying zone, suggesting chances of further buying in gold.

At the moment, gold has formed a long bullish candle, which is one of the signs that bulls are dominant in the market. A slight bearish retracement can be seen in gold around 1,472 to 1,465 before we see further buying.

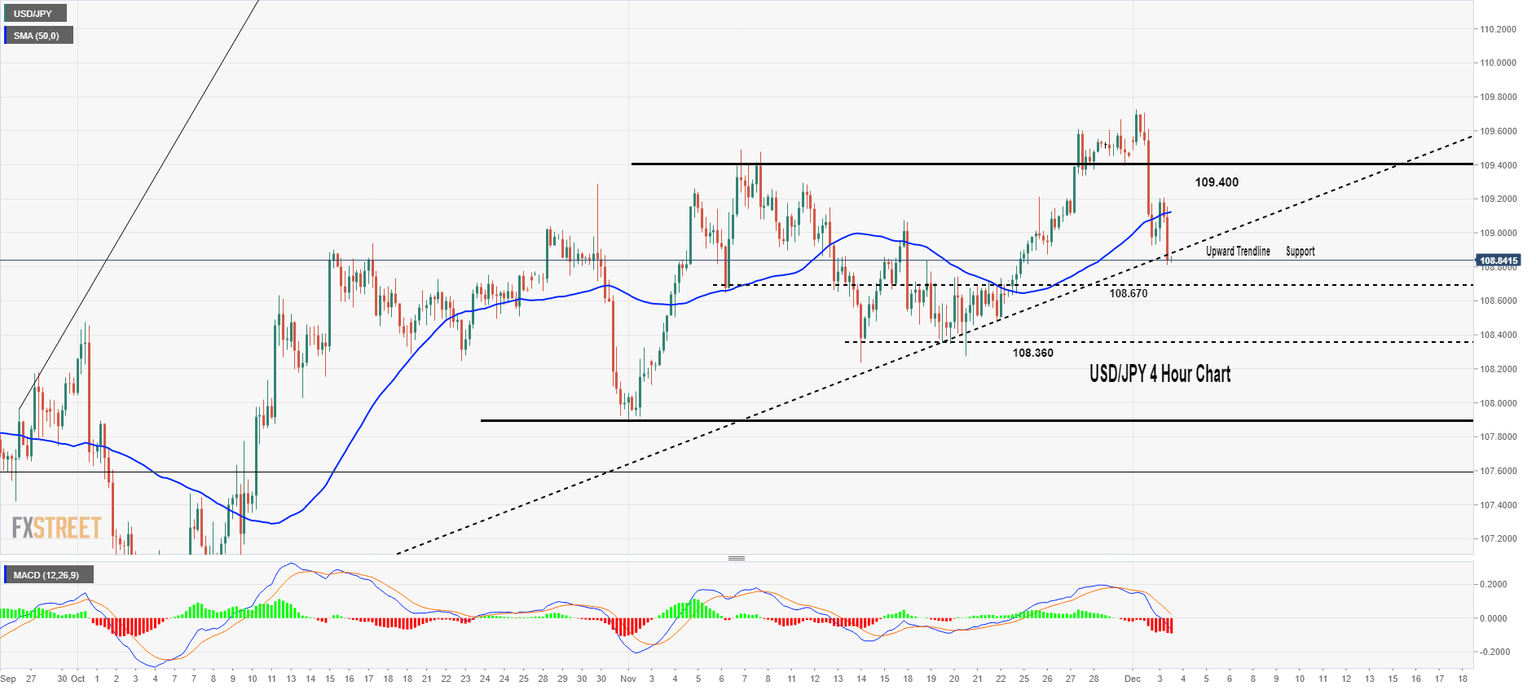

USD/JPY - Retracement Before Bullish Bias

The USD/JPY pair was closed at 108.97 after placing a high of 109.726 and a low of 108.924. Overall the movement of pair remained Strongly Bearish that day.

At 4:50 GMT, the quarterly Capital Spending from Japan showed growth to 7.1% against the expectations of 5.1% and gave strength to the Japanese Yen. The release of Final Manufacturing PMI from Japan at 5:30 GMT also supported Yen when it showed growth to 48.9 against the expectations of 48.6 for the month of November.

The Stronger than expected PMI from Japan and weaker than expected PMI from America moved USD/JPY prices in a downward direction with a high velocity and gave a robust Bearish candle for the day.

This news, after the latest Trump's approval to the Hong Kong Human Rights & Democracy Act to be a law, gave trade-deal uncertainty a boost. The increased risk weighed on U.S. dollars and hence, added in the downward direction of USD/JPY on Monday to place a low of 108.92.

USD/JPY - Daily Technical Levels

Support Resistance

108.7 109.48

108.42 109.98

107.65 110.76

Pivot Point 109.2

USD/JPY - Daily Trade Sentiment

The USD/JPY pair, which was trading bullish lately, has now taken a bearish turn to trade at 108.7850. As we know, the bearish movement has come in response to a weaker dollar amid worse than expected manufacturing PMI data.

Besides, the safe-haven appeal has triggered over the U.S China Trade war. The USD/JPY pair is now testing the upward trendline support around 108.80. Below this, the next support can be found around 108.650. That's where we may see traders entering for the bullish trades today.

AUD/USD – Descending Triangle Violates

The AUD/USD was closed at 0.68176 after placing a high of 0.68258 and a low of 0.67615. Overall the trend for AUD/USD prices remained Strongly Bullish that day. Aussie remained supported on Monday and held to its modest recovery gains to place a high near 0.680 level. After dropping to the fresh 6-weeks low on Friday, the pair AUD/USD managed to gain traction at the starting day of the new month.

The key factor that increased the demand for China-proxy Australian Dollar on Monday was the unexpected expansion in the Factory activity of China for the month of November.

The Caixin Manufacturing PMI from China at 6:45 GMT showed growth in manufacturing activity in November at the pace of 51.8 from expected 51.5.

However, the gains remained under pressure due to Trump's approval of the Hong Kong bill in favor of protestors, which escalated the trade tensions. Trade uncertainties increased after the comments from U.S. Commerce Secretary Wilbur Ross told media that Trump would not back out from increasing tariffs in December if China would not sign the Phase-one deal by then.

After the release of U.S. Manufacturing PMI, the pair AUD/USD was again supported to move in an upward direction. The ISM Manufacturing PMI from the U.S. showed a drop in manufacturing activity to 48.1 against the expectations of 49.2 in the month of November and weighed un U.S. dollars on Monday.

At 5:30 GMT, the closely watched Building Approvals from Australia for the month of November came in as unfavorable -8.1% against the expectations of -1.0% and weighed on Aussie. The Company Operating Profit for the quarter also showed a drop to -0.8% against the expectations of 1.0%. The ANZ Job Advertisements came in negative as -1.7% from Australia. At 10:30 GMT, the Commodity prices for the year showed a drop to -5.0%.

-637109951924434999.png&w=1536&q=95)

AUDUSD - Technical Levels

Support Resistance

0.6785 0.6839

0.6752 0.6859

0.6699 0.6913

Pivot Point 0.6806

AUDUSD - Daily Trade Sentiment

Technically, AUD/USD has recorded the overbought zone to consolidate around 0.6855. On the 4-hour time frame, AUD/USD is expected to display retracement unto 23.2% level of about 0.6835, 38.2% Fib mark of 0.6820, along with the resistance of about 0.6865 today.

The plan is to catch a quick sell under 0.6860 level until the next support mark of 0.6820.

All the best for the New York session!

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and