US balance of trade improves the most on record (guess what that means)

Consumers throw in the towel. Recession is imminent.

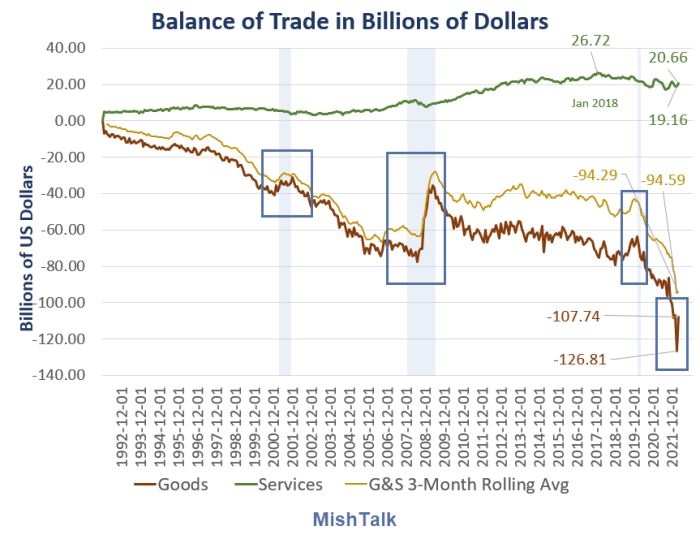

Balance of Trade data from Commerce Department, chart by Mish

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the Goods and Services Deficit was $87.1 billion in April, down $20.6 billion from $107.7 billion in March, revised.

Goods and services details

- April exports were $252.6 billion, $8.5 billion more than March exports.

- April imports were $339.7 billion, $12.1 billion less than March imports.

- The April decrease in the goods and services deficit reflected a decrease in the goods deficit of $19.1 billion to $107.7 billion and an increase in the services surplus of $1.5 billion to $20.7 billion.

- Year-to-date, the goods and services deficit increased $107.9 billion, or 41.1 percent, from the same period in 2021.

- Exports increased $151.3 billion or 18.8 percent. Imports increased $259.2 billion or 24.3 percent.

- Three-Month Moving Average goods and services deficit decreased $0.3 billion to $94.3 billion for the three months ending in April.

- Average exports increased $8.3 billion to $243.2 billion in April. Average imports increased $8.0 billion to $337.4 billion in April.

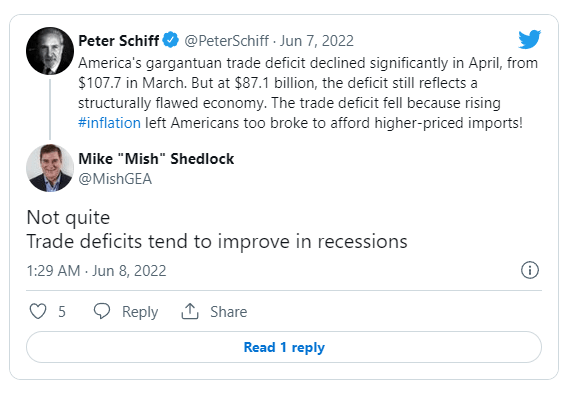

Inflation or recession?

Given the strength of the dollar, imports are relatively cheap, especially compared to Japan and Europe.

Rather, this is a sign consumers are on a general buyer's strike. And that happens in recessions as the lead chart shows.

Target warns second time of weaker profit, bloated inventories, and slumping demand

Target said inventory rose 43% as demand for outdoor furniture, small appliances and some electronics declined faster than expected.

Note that Target Warns Second Time of Weaker Profit, Bloated Inventories, and Slumping Demand

And weakness is not just in consumer goods.

New home sales plunge 22.5% in April,16.6% from deep negative revisions

New home sales have peaked this cycle and the bottom is nowhere in sight.

For discussion, please see New Home Sales Plunge 22.5% In April, 16.6% From Deep Negative Revisions.

Recession is immanent.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc