United States: Another look at the impact of tariffs on inflation

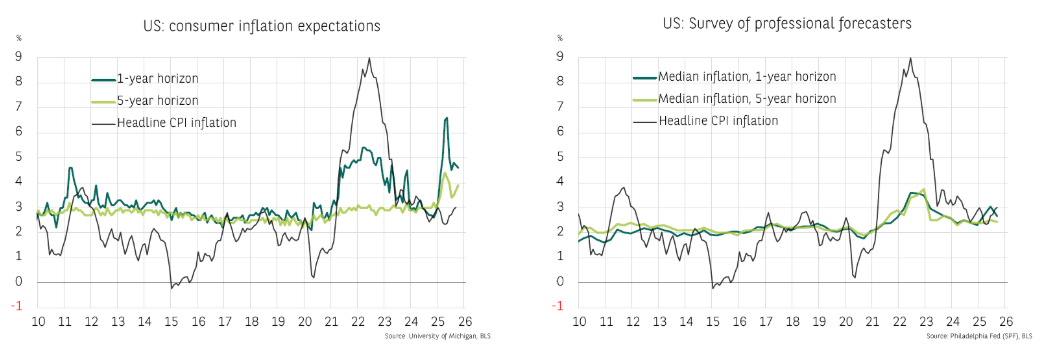

In September, inflation rebounded slightly in the United States, the Eurozone and Japan, while remaining stable in the United Kingdom. In the United States, the inflationary impact of tariffs has so far been contained (see chart of the month). In the other countries, there are positive signs, as inflation expectations are stable at around 2% in the Eurozone, wage growth is moderating in the UK and producer prices are falling in Japan.

In the United States, CPI inflation rose slightly in September (from +0.1 pp to 3.0% y/y), driven by a rebound in the energy component (2.8% y/y; +2.6 pp m/m).

Core inflation, meanwhile, moderated (3.0% y/y; -0.1 pp m/m). Wages have continued to decelerate, and 1-year household inflation expectations have fallen sharply since May (from 6.6% to 4.6%), although 5-year expectations remain high on a historical basis. These developments, combined with the stabilisation of the price pressure index and the slowdown in producer prices (2.6% y/y, -0.5 pp m/m), support the scenario of continued rate cuts by the Fed.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.