UK inflation unchanged at 3.8%, Pound shrugs

The British pound is unchanged on Wednesday, trading at 1.3645 in the European sesison.

UK inflation remains entrenched

Today's inflation report was a dour reminder that UK inflation remains entrenched. CPI for August was unchanged at 3.8% y/y, matching the consensus and its highest level since January 2024. Airfares decreased but this was offset by food and petrol prices. Monthly, CPI rose 0.3%, up from 0.1% in July and matching the consensus.

Core CPI, which excludes volatile items such as food and energy, eased to 3.6% from 3.8%. Monthly, core CPI ticked up to 0.3% from 0.2%.

The inflation report comes just a day before the Bank of England announces its rate decision. Inflation is almost double the BoE's target of 2% and today's release likely means that the BoE will not reduce rates before 2026. The BoE cut rates by a quarter-point in August to 4.0% but will be hard pressed to follow up with additional cuts due unless inflation falls lower.

The inflation data is bad news for Finance Minister Rachel Reeves. Food inflation has risen for five consecutive months and that will put consumers in a sour mood. Reeves will deliver a budget in November and may have to raise taxes to balance the books, which is sure to be an unpopular move.

Fed widely expected to lower rates

The Federal Reserve is virtually certain to lower rates at today's meeting. That would be a significant move as the Fed last cut rates in December 2024. With the rate decision virtually a given, investors will be looking for some clues as to whether the Fed is looking at further rates cuts before the end of the year.

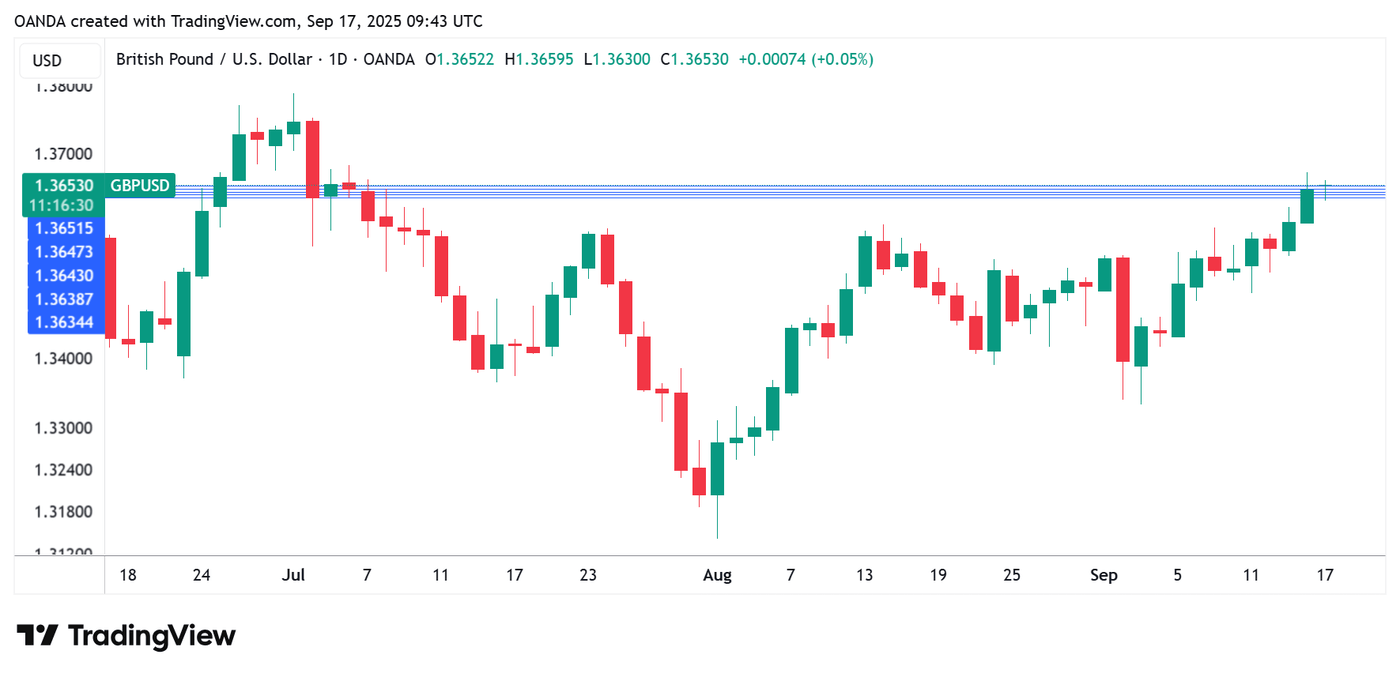

GBP/USD technical

- GBPUSD is testing support at 1.3643. This is followed by support at 1.3638 and 1.3634.

- 1.3647 and 1.3652 are the next resistance lines.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.