UK GDP Preview: Barrelling toward recession. Pound Sterling set to fall?

- The British economy is set to shrink 0.5% in Q3 2022 vs. +0.2% previous.

- The Bank of England expects the economic downturn to extend well into 2024.

- The Pound Sterling could correct vs. the US Dollar if the UK GDP data disappoints.

The good news is the United Kingdom (UK) economy is not already in recession, although barrelling toward it. The Bank of England (BoE) warned last week that Britain will face its longest recession since records began, with an economic downturn expected to extend well into 2024.

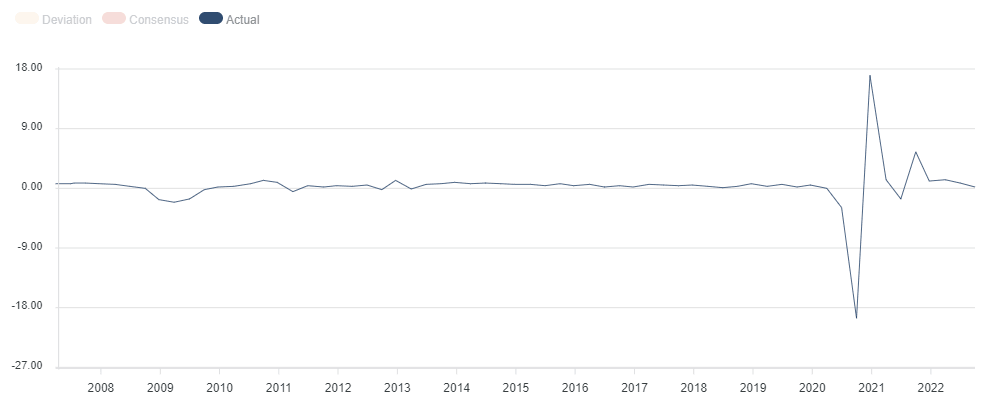

The economy is set to contract by 0.5% inter-quarter in the three months to September. On an annualized basis, the UK Gross Domestic Product (GDP) is likely to have risen by 2.1% in Q3, down by more than double from the 4.4% reported in the previous quarter. The September month GDP is expected to fall by 0.5% vs. -0.3% booked in August. The UK growth numbers are slated for release on Friday at 07:00 GMT.

Britains avoided entering into a technical recession in the third quarter after the UK Q2 GDP growth was revised upwards to 0.2% against the preliminary estimate of a 0.1% contraction. Despite the upward revision to the Q2 economic performance, the outlook appears dire for the United Kingdom amid stubbornly-high inflation, aggressive interest rate hikes and the ongoing squeeze in the households.

Source: FXstreet

The BoE doom and gloom

At its November monetary policy announcement, the BoE raised interest rates by 75 basis points (bps), its largest single hike since 1989, and warned of a protracted recession.

Further, the Monetary Policy Committee (MPC) noted that its updated projections for growth and inflation indicate a “very challenging” outlook for the UK economy as it works toward containing inflation. The bank projected the UK GDP to decline by around 0.75% over the second half of 2022, underscoring the squeeze on real incomes from surging energy prices.

During his press conference, Governor Andrew Bailey pushed back against expectations that rates would climb back up to 5%, levels last seen before the 2008 Global Financial Crisis (GFC).

Last month, the International Monetary Fund (IMF) said that the UK’s "growth is forecast at 3.6 percent in 2022 and 0.3 percent in 2023 as high inflation reduces purchasing power and tighter monetary policy takes a toll on consumer spending and business investment.”

Trading GBP/USD on the UK GDP

The dire economic outlook in the United Kingdom combined with looming uncertainty on the new Prime Minister Rishi Sunak’s fiscal plan keep the upside attempts limited in the GBPUSD pair.

Heading into Friday’s UK GDP showdown, GBPUSD has finally recaptured the 1.1700 barrier, courtesy of the softer Consumer Price Index (CPI) release from the United States on Thursday, which triggered a fresh risk rally-led broad US Dollar sell-off.

A bigger-than-expected quarterly contraction could revive the bearish momentum in the Pound Sterling against the US Dollar, with this week’s support area around 1.1335 back in play.

A minor GDP contraction and or if the data arrives as expected, GBPUSD could still feel the pull of gravity on ‘buy the fact’ trading.

On the other hand, should the UK economy report a surprise expansion for the third quarter, a fresh upswing toward the 1.1750 critical resistance cannot be ruled out.

The reaction to the data could be short-lived in the aftermath of the US inflation data and holiday-thinned light trading in the United States.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.