$U: Uranium participation corporation ramping up

Uranium Participation Corporation (UPC) is a holding company which invests its assets long- term in the uranium, both in form of uranium oxide and uranium hexafluoride. Founded in 2005, UPC has its headquarters in Toronto, Canada. One can trade it under the ticker $U at the Toronto Stock Exchange. Investors in shares of UPC possess, therefore, an indirect interest in physical uranium owned by UPC. Currently, we see the ongoing price appreciation within the energy commodities like oil, gas, coal and others. Consequently, uranium is expected to turn higher after 13 years of weak prices as well. Besides the market correlation, the pattern of UPC supports the bullish view. Therefore, investors in the energy sector obtain a high reward diversification opportunity by investing in an uranium pure player UPC .

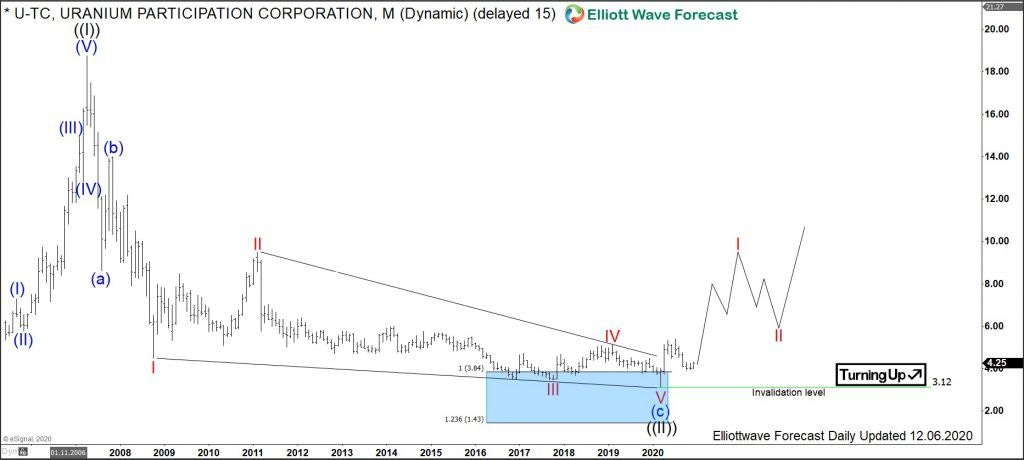

Uranium Participation Corporation Monthly Elliott Wave Analysis 12.14.2020

The monthly chart below shows the UPC shares $U traded at Toronto Stock Exchange. First, the stock price has developed a cycle higher in black wave ((I)) of grand super cycle degree. It has printed the all-time highs on April 2007 at 18.76. From the highs, a correction lower in black wave ((II)) has unfolded as an Elliott wave zigzag pattern. It has printed an important bottom on March 2020 at 3.12.

From March 2020 lows, a new cycle in wave ((III)) has already started and should extend towards 18.76 highs and beyond. Then, the target for wave ((III)) will be towards 21.85-33.43 area and even higher.

Uranium Participation Corporation Daily Elliott Wave Analysis 12.14.2020

The Daily chart below shows the $U shares price action in more detail. From the March 2020 lows at 3.12, the stock price has advanced in the wave ((1)) of the red wave I towards 5.35 highs on May 2020. From there, a pullback in wave ((2)) has unfolded as an expanded flat (A)-(B)-(C) towards 3.93 lows in October 2020. To be noted, expanded flats are 3-3-5 structures where waves (B) produce a new high above the top of the previous cycle. Indeed, the blue wave (B) of black wave ((2)) has exceeded the wave ((1)) highs by printing a new high at 5.39.

From the 3.93 lows, a new cycle in wave ((3)) of I has started. It can bring the prices towards 6.16-7.54 area and even higher. At current price levels, investors in uranium prices have a good opportunity to enter the market with a great potential to the upside.

Author

ElliottWaveForex.com Team

ElliottWaveForex.com

ElliottWaveForex.com provides technical analysis of currency markets from a pure Elliott Wave perspective.