Trump's need for adulation outweighs his COVID-19 concerns

Trump is ready to hit the road, Covid-19 or not.

Trump thrives on praise and adulation. He can wait no longer to have his rabid supporters once again cheering at big rallies.

Please note Trump Says He’s Ready to Hit the Road.

Mr. Trump told reporters at an event with business executives on Wednesday that he plans to travel to Arizona next week and Ohio soon after that. “We’re going to start to move around,” he said, adding that he hopes to start holding campaign rallies again.

The president, who before the pandemic regularly traveled on weekends to his Florida resort, Mar-a-Lago, and held campaign rallies around the country, has made no secret of his eagerness to get back on the road. “I’ve been in the White House now for many months,” he said. "And I’d like to get out—as much as I love this, this is the most beautiful house in the world.’

He said he wanted to see a “good old-fashioned, 25,000-person rally” without social distancing. “I can’t imagine a rally where you have every fourth seat full, every six seats are empty for everyone that you have full,” he said. “That wouldn’t look too good.”

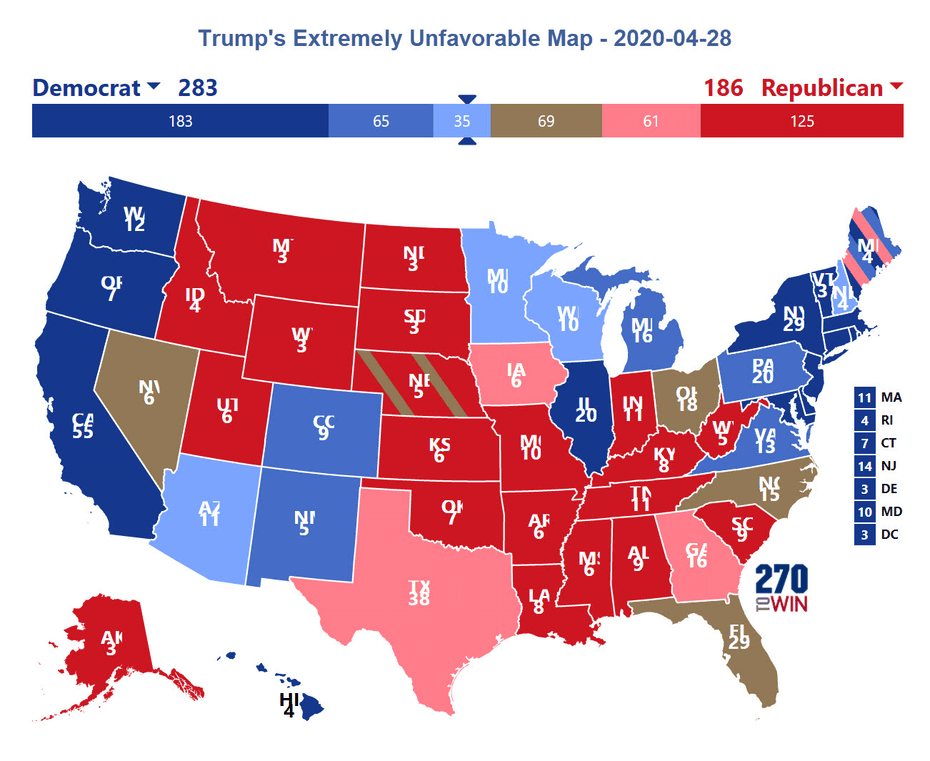

Extremely Difficult Setup for Trump to Win in November

How can that possibly matter?

— Mike "Mish" Shedlock (@MishGEA) April 29, 2020

Sure - Trump's core is more rabid than Biden's.

But Sanders could say the same thing.

The election will not be won by the rabid fans, but rather the swing voters.https://t.co/EWsZ497s9E https://t.co/gZwXVYs6WK

Trump faces a huge uphill battle at this point. It's an Extremely Difficult Setup for Trump to Win in November.

Note that Fox News gives Biden an 8-point lead in Michigan. This is despite (or because) of soaring Michigan unemployment, perhaps as high as 30%.

For details, please see For details, please see Over 25% of Michigan Workforce Filed For Unemployment.

Yet, Despite Massive Unemployment, Michigan Disagrees With Trump.

Governor Gretchen Whitmer, a Democrat, has a Covid-19 approval rating of 57%. Liberate Michigan, Liberate Minnesota, and Liberate Virginia backfired.

I discussed the above Tweets in Huge Battle Over Covid-19 Tests and Trump's Liberation Tweets.

Words of Caution

It's not impossible for Trump to win in November, but it is difficult.

These polls are early. November is still 6 months away but the election map, Trump's handing of Covid-19, the recession, and the thought of 4 more years of Trump to swing voters all weigh against Trump.

This is Not 2016

Finally, this is not 2016. Many swing voters gave Trump a nod in in 2016 simply because they despised Hillary.

Many of those same swing voters have had enough of Trump's divisive treatment of allies, his belittling of everyone but himself, and his handling of Covid-19.

Counterproductive Adulation

The amusing thing ais how counterproductive this plan is.

Adoring fans and big rallies will not win Trump the election in November.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc