UK: Towards a fiscal consolidation which is spread over time but even more constrained than in France

The Spending Review and the GBP 725 billion ten-year infrastructure plan, unveiled on 11 and 19 June, respectively, demonstrate the British government's desire to move away from forced fiscal consolidation. Getting public finances back on track remains a major challenge in the UK, which is constrained by pressure from the bond market, and provides a point of comparison for France. This is against a backdrop of major structural upheaval and growing investment needs. At this stage, we believe that the UK's fiscal consolidation strategy is credible, but the government is walking a tightrope.

Necessary yet difficult consolidation

The challenge of fiscal consolidation has intensified in the UK since the public deficit reached 5.3% of GDP, up by 0.5 points of GDP in the 2024-25 financial year. While debt interest payments as a share of GDP have fallen slightly on the back of lower inflation, to which almost a third of government bonds are indexed, the primary deficit has increased from 1.8% to 2.3% of GDP. With the starting point now lower, the deficit forecasts for 2025 put forward by the government and the OBR last March (3.9% of GDP) seem largely obsolete. The context of weak growth is making it even more difficult for the British government to consolidate its public accounts. In addition, it is constrained by an agenda of costly social measures (support for purchasing power and an overhaul of public services, particularly healthcare) that the Labour Party has committed to taking, partly in order to stem the rise of the Reform UK party.

A better adapted budgetary framework to current challenges

In the short term, the difficult conundrum of reducing the public deficit while increasing investment will only be solved by greater control of current expenditure, since growth in activity will remain limited (1.2% in 2025 and 1.0% in 2026, according to our forecasts) and debt interest payments, as a share of GDP, will remain at a high level.

The Spending Review published on 11 June sets out the first milestone, with significant cuts in current spending in real terms (for the 2025/26-2029/30 period) for the Home Office (-1.7%), the Foreign, Commonwealth and Development Office (-6.9%), and the Department for Environment, Food and Rural Affairs (DEFRA; -2.7%). These falls will be offset by an increase in the ceiling for investment in defence (+7.3% in real terms), energy security and net zero (+ 2.6%) and transport (+3.9%, excluding the High Speed 2 project).

This budgetary strategy can bear fruit. In order to achieve this, the investments targeted by the ten-year investment strategy (construction, transport infrastructure, defence and energy), which have traditionally high fiscal multipliers, must materialise. Furthermore, they must not lead to excessive budgetary slippage.

In this context, the fiscal rules introduced last autumn are even more important. The three main ones are:

- A current budget that is at least balanced by 2029/30 (stability rule);

- A fall, as a proportion of GDP, in public net financial liabilities from 2029/30 (investment rule);

- Certain types of social expenditure must remain below a pre-defined level (social expenditure ceiling).

These rules are restrictive because their pro-cyclical aspect can act as an additional brake on activity. They are nevertheless necessary in order to guarantee a framework for a return to a sustainable path for public finances in the medium term, which is essential to reassure the markets and attract more financing. Last autumn's modification of the public debt target – from net debt to net financial liabilities – which made it possible to incorporate government resources that can be mobilised (in order to better assess the State's real level of solvency) – is a more appropriate measure for reconciling the objectives of fiscal consolidation and productive investment.

How does France compare?

As with the case of the United Kingdom, the budgetary effort required in France is substantial. Primary balances remain well below the levels needed to stabilise debt ratios. We place this level in 2025 at -0.4% of GDP in the UK, i.e. a gap of around 1.5 points of GDP compared with the expected primary deficit. In France, the gap is greater, at 2.8 pp. Thus, the debt ratio will continue to rise in both countries, with the prospect of stabilisation by 2028 for the UK: the debt ratio would then be around 108% of GDP, compared with 101.2% in 2024. In France the debt ratio would stabilise in 2030 at around 120% of GDP, compared with 113.2% in 2024, according to our forecasts.

While greater control of current expenditure is essential, consolidation at breakneck speed could prove counter-productive if it undermines potential growth and competitiveness. Preserving these aspects is vital, given the major technological, climatic and geopolitical changes taking place today, and the increased competition from Asian players, especially China.

The most recent phase of fiscal consolidation in the UK, led by George Osborne in the wake of the 2008 financial crisis, did result in a drastic reduction in the structural deficit (from 6.4% of [potential] GDP to 2.3% between 2010 and 2016). Nevertheless, the scale of this consolidation in a relatively short space of time has contributed to the social challenges that the Labour government is now trying, in part, to address (housing shortages, falling real wages and restoration of public services). It will all be a question of calibration.

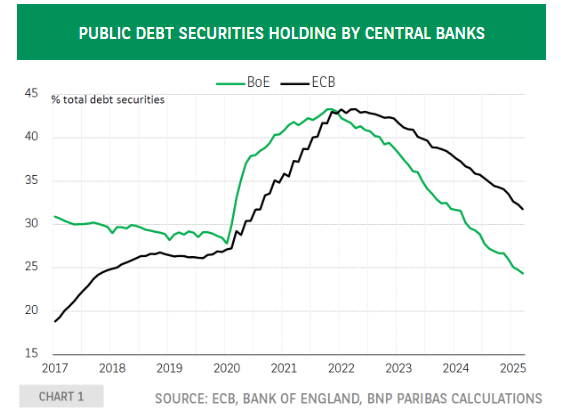

Nevertheless, France has a number of advantages that the UK does not have. Monetary policy is currently more accommodating in the eurozone than in the UK, and should remain so in 2025-26. The United Kingdom suffers from particular structural constraints (sharp rise in wages, higher energy prices, Brexit). France is also benefitting from its integration into the EU and the strengthening of supra-European financing. The UK bond market is also traditionally more exposed to fluctuations in the US markets than countries in the eurozone (see chart 1), which has a greater impact on UK borrowing costs.

Room for manoeuvre to adapt the policy mix

However, the UK does have some room for manoeuvre in order to better adapt its policy mix to the current context:

Monetary lever: the speed and scale of quantitative tightening in the UK has been much more drastic than in the eurozone, mainly due to the BoE's active sales policy (see chart 2). According to some studies, such policies are helping to amplify the rise in bond yields, which could lead the BoE to review the pace of its balance sheet reduction, currently set at GBP 100 billion per year (including active and passive sales). The Bank of Japan has also just taken a decision along these lines.

Liability management: the Debt Management Office could temporarily restructure its debt issuances towards shorter-dated securities, in order to reduce the interest on its issued debt and limit upward pressure on long-term rates. At this stage, the UK's financing needs are largely manageable in the short term, with debt maturities spread over a long period (the average maturity is 13.7 years in June 2025, compared with 8.5 years in France, 7 years in Italy and 7.7 years in Spain).

On a tightrope

When it came to power, the UK Government's fiscal strategy was based on the urgent need to restore public finances. It has since become more flexible in order to reconcile the objectives of fiscal consolidation and productive investment better. The current strategy remains credible, as long as the government intends not to deviate too far from the trajectory established by the fiscal rules – which it has set itself – and provided that the investments have the expected effects on growth. However, the limited and uncertain outlook for growth in 2025-2026 will force the government to make further trade-offs on current spending next autumn. France is facing a similar challenge. The relaxation of the rules of the European Union's Stability and Growth Pact, set in April 2024, are aimed at the same objective – to take better account of growing investment needs in assessing budgetary trajectories – as the fiscal rules set in the United Kingdom, in particular, the debt target. The two governments are therefore walking a tightrope more than ever.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.