Top Trade Setups in Forex – Risk on Sentiment In Play

A day before, the U.S. stocks recovered a part of sharp losses made last Friday. The Dow Jones Industrial Average rebounded 143 points (+0.5%) to 28399, the S&P 500 added 23 points (+0.7%) to 3248 and the Nasdaq 100 rebounded 134 points (+1.5%) to 9126.

European stocks returned to positive territory, with the Stoxx Europe 600 Index adding 0.3%. Both Germany's DAX and France's CAC rebounded 0.5%, and the U.K.'s FTSE 100 was up 0.6%.

The U.S. government bond prices remained firm, as the benchmark U.S. 10-year Treasury yield was still subdued at 1.520%.

XAU/USD - Safe Haven Fades

The safe-haven-metal prices dropped mainly due to Asian stocks recovered and continue to flash green. As we already mentioned that the Asian stocks trade mostly higher today, with Chinese equities up more than 1%.

The uptick in stocks came despite Hong Kong's report of first death from the coronavirus, the second death outside mainland China from an outbreak that has killed 425 people. On the front of the latest reports, the total death losses have increased to 425, and the number of confirmed cases has risen to more than 20,000 due to coronavirus.

People's Bank of China added the cash supply to support the country's economy, which was damaged by the coronavirus. The China central bank inserted 400 billion yuan ($57 billion) into the banking operation via repurchase agreements. I must say, that's the largest single-day increase in more than a year.

The U.S. Dollar Index, which is usually correlated to gold, soared higher earlier in the day after an essential U.S. manufacturing survey showed a surprise rebound.

On the other hand, an astonishing improvement in U.S. stocks was also poorly reflected in the yellow metal. All three of Wall Street's key stock indexes concluded higher, with the tech-heavy Nasdaq achieving 1.4%.

XAU/USD - Daily Technical Levels

|

Support |

Pivot Point |

Resistance |

|

1576.62 |

1581.48 |

1587.03 |

|

1571.07 |

1591.89 | |

|

1560.66 |

1602.48 |

XAU/USD - Daily Trade Sentiment

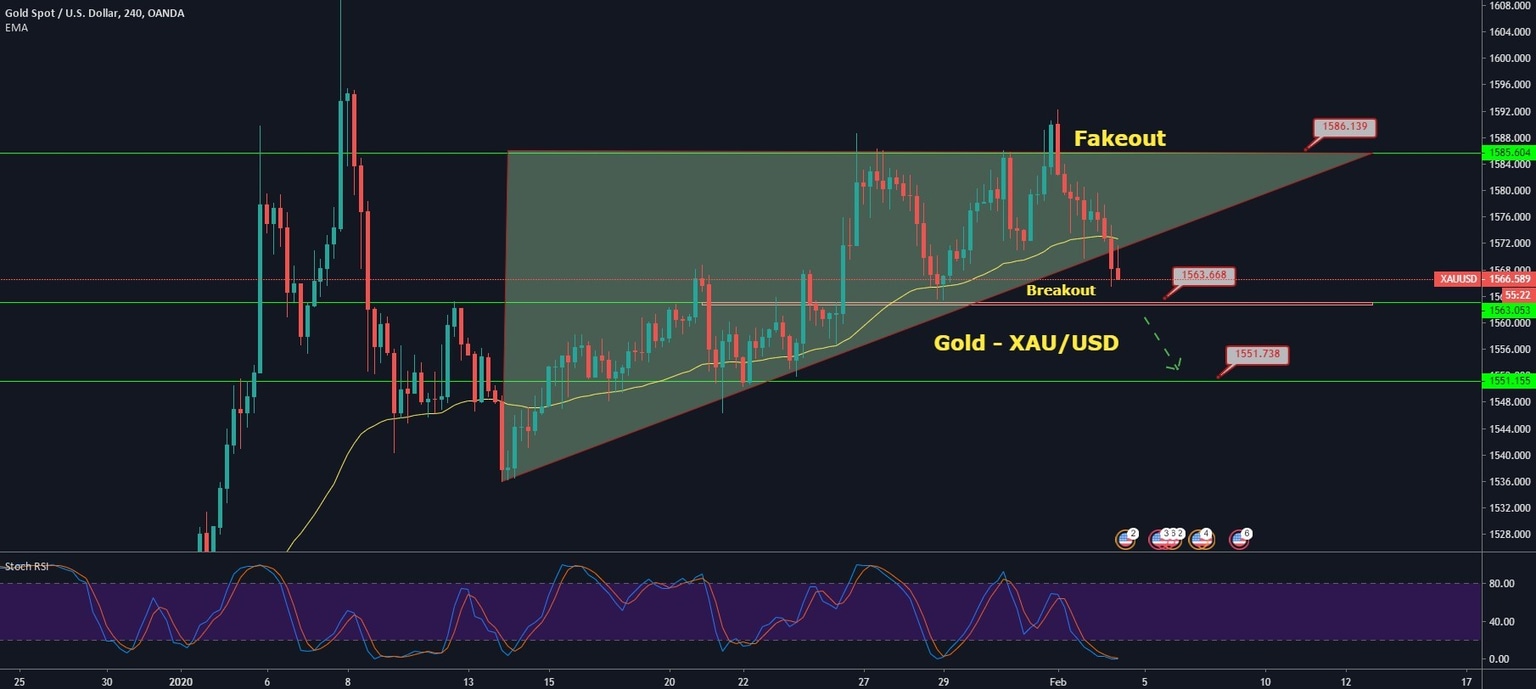

Gold broke the double top resistance level nearby 1,585 levels. However, this appears to be fakeout pattern as gold value has returned beneath 1,585 resistance becomes a support mark. At the moment, the 1,585 level is expected to hold the precious metal bearish. While on the lower side, gold may find support near 1,566 and 1,562 now. Bullish repeal can be seen above the 1,563 level. Consider taking a buying trade above 1,562 today.

USD/CAD - Bullish Channel Continues to Play

The USD/CAD climbed 0.4% to 1.3295. The Markit Canada Manufacturing PMI rose to 50.6 in January from 50.4 in December. The USD/CAD pair eventually broke down of its Asian session sideways phase and renewed daily lows near the 1.3275-70 area in the previous hour.

The pair tried to stretch its recent bullish trend over the 1.3300 round figure level and observed a slight pullback within the early European session on Tuesday. The USD/CAD pair has consumed a portion of the previous session's positive movement to two-month tops and was being pressed down by a goodish recovery in the WTI crude oil prices.

The Canadian dollar slipped to a seven-week low versus its greenback on Thursday as concerns that the coronavirus breakout would harm global economic development, and it may weigh on the price of oil and commodity-linked currencies.

USD/CAD- Daily Technical Levels

|

Support |

Pivot Point |

Resistance |

|

1.3244 |

1.3274 |

1.3316 |

|

1.3202 |

1.3346 | |

|

1.313 |

1.3418 |

USD/CAD- Daily Trade Sentiment

The USD/CAD is trading with a bullish bias at 1.3285, having an immediate resistance around 1.3300.

The USD/CAD is still maintaining the bullish channel that is keeping it supported above 1.3260, along with resistance around 1.3345.

The leading indicators, such as RSI and Stochastics, are holding in the overbought zone, implying substantial chances of a bearish retracement in the USD/CAD. Let's count on taking a sell trade below 1.3310 and bullish above 1.3260 today.

AUD/USD – Triangle Pattern Breakout

The AUD/USD currency pair continues its recovery rally from the multi-month lows mainly due to the RBA decided to keep its benchmark interest rate unchanged during the early Tuesday. As we know, the pair previously dropped due to the threats of the coronavirus outbreak. The AUD/USD is trading at 1.2994 and consolidates in the range between the 1.2981 - 1.3023.

The Reserve Bank of Australia (RBA) meets the most consensus while keeping the benchmark interest rate at 0.75%. Thereby, the RBA leaves the opportunity open for further monetary policy moves, if needed.

On the other hand, the Australian central bank took Bushfires, coronavirus, as temporary burdens on the economy, whereas also saying that it's too early to decide how strong the impact from coronavirus could be.

AUD/USD bounced to 0.6714 after the Reserve Bank of Australia held its benchmark rate at 0.75% unchanged as expected this morning. The central bank said interest rates have "already been reduced to a shallow level," and there are "long and variable lags in the transmission of monetary policy," though "it remains prepared to ease monetary policy further if needed."

AUD/USD - Technical Levels

|

Support |

Pivot Point |

Resistance |

|

0.6682 |

0.6694 |

0.6705 |

|

0.6671 |

0.6718 | |

|

0.6648 |

0.6794 |

AUD/USD - Daily Trade Sentiment

The AUD/USD gained support around 0.6685 and has bounced off to complete the retracement. We can expect AUD/USD to soar until 0.6750, and here it's likely to find resistance, which will be extended by the 50 EMA.

The RSI and Stochastics are staying in an overbought zone, but the bearish trend doesn't seem to stop, and we may see further buying in AUD/USD pair. Let's consider taking buy trades above 0.6690 today.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and