Top three trading insights on Discord – European session Premium recap

Do you know FXStreet has its exclusive trader's community on Discord? There, Premium users can contact Analysts Yohay Elam and Tomas Salles directly and ask them any questions related to the markets and trading. Here we offer you a selection of the best three questions and answers during this European session.

Don't miss our traders' Discord community. Subscribe to FXStreet Premium!

1 – USER QUESTION – In the case of EUR/AUD breaking above 1.500, is it reasonable to assume a new upwards move towards 1.5050 and 1.5090 intraday?

ANALYST ANSWER – Yohay Elam:

EUR/AUD looks bullish technically, setting higher highs and higher lows, while trading above the 50, 100 and 200 4h-SMAs and as the RSI is at healthy bullish territory betw0een 50 and 70. It has resistance at 1.0505, the weekly high, and then only at 1.5170 and 1.52. Support is at 1.4970 and then 1.4920. Fundamentally, I think the euro is more vulnerable to eurozone debt issues and the war, while Australia is sensitive to China's covid policies – but China is also supporting the economy. So, I expect fundamentals to eventually turn EUR/AUD down, perhaps today if the mood continues improving.

In general, the aussie is more sensitive to the market mood, rising more against the US dollar when things are optimistic and falling more when the mood worsens, like yesterday. The euro moves more slowly in general.

2 – USER QUESTION – Could you please update on GBP/CHF?

ANALYST ANSWER – Yohay Elam:

GBP/CHF is technically and fundamentally bearish. As mentioned earlier, Brexit worries and weak UK employment data weigh on the pound. The Swiss franc still has a minimal bullish appeal after the hawkish twist from the SNB, while the BOE is seeing inflation as already depressing the economy. Technically, the 4h-chart is decidedly bearish, with the cross failing to break above the 50 and 100 SMAs, and the RSI and MACD leaning lower. Support is at 1.2010, which held the cross up in early June, then 1.1970, which is the monthly low. Resistance is at 1.2075.

-637908022248500748.png&w=1536&q=95)

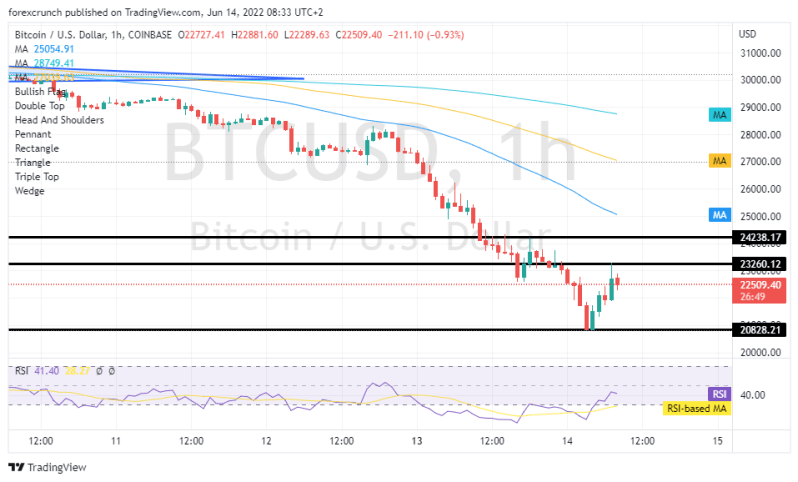

3 – USER QUESTION – BTC/USD dropped to almost 20K. Based on the current market situation, what can we expect for Bitcoin today?

ANALYST ANSWER – Yohay Elam:

Bitcoin is moving with broader markets – just going stronger and in my opinion, looking weaker than stock markets. It is recovering today from the lows below 21K and I see some resistance at around $24.2K, but that could turn into a selling opportunity in my opinion. The issues with Celsius, a company in the crypto space, add pressure on markets in addition to US Federal Reserve fears.

ANALYST ANSWER – Tomas Salles:

The crypto market is under extreme selling pressure. The case of Terra's LUNA and UST opened Pandora's box, exposing vulnerabilities that are impossible to withstand in a market where bears are imposing their law. The crypto market will be under pressure until it proves solid in the face of possible speculative attacks similar to Terra.

The BTC/USD daily range chart offers two possible antagonistic scenarios.

- Bulls can see a possible 'Hammer' building on the daily candles, while the aggressively bearish MACD could quickly turn around, leaving a powerful bullish divergence pattern. This scenario calls for a strong price rally in tomorrow's session.

- Bears may also see their expectations supported by the hourly range chart. There are many hours left to finish the day and what now hints at a 'Hammer' may turn out to be something else. The MACD shows an violent downwards profile, suggesting more price declines ahead.

The solid bearish movement of the last few days has taken the price well off the Bollinger Bands, suggesting a bullish move even as a regression to the averages. The average Bollinger line is at the $29,400 price level, with upwards strenght feasible in the short term. Looking medium-term, bulls need a recovery to the $30,500 price level to be confident that the sell-off is over."

Author

FXStreet Team

FXStreet