This week's macro events may be spurring investors to hedge

Highlights:

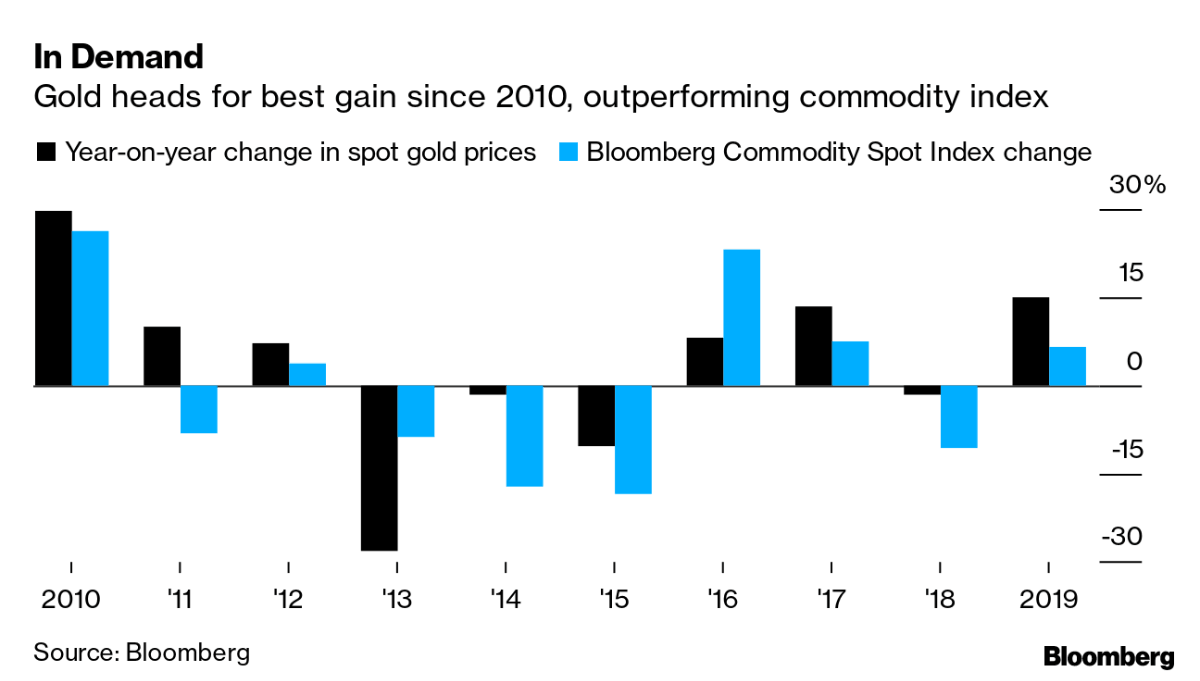

Chart of the Day: Gold is heading for the biggest annual advance since 2010, and gains may spill into the new year. BlackRock remains constructive on bullion as a hedge, while Goldman and UBS see prices climbing to $1,600 an ounce, a level last seen in 2013. Geopolitical and economic risks in the form of the U.S. election and trade tensions, and buying by governments will support gold in 2020.

Futures Summary:

News from Bloomberg:

President Trump will learn what charges he'll face today, when House Democrats reveal two articles of impeachment—one on abuse of power and the other on obstruction of Congress, people familiar said. More articles involving obstruction may follow. Committee leaders will announce the next step at a news conference scheduled for 9 a.m. Follow along with our Impeachment Update.

U.S. stock-index futures fell with European and Asian markets in the countdown to a slew of events, ranging from Fed and European Central Bank meetings to the U.K. election and the tariff deadline. Chinese shares weathered a surge in inflation and a disappointing debut for one of its biggest IPOs in years. The dollar and oil were steady, while Treasuries and gold rose.

Most investors probably just want the year to be over to book their gains—especially now that the Cboe Volatility Index is behaving in a way that's preceded stock losses in the past. Wall Street's "fear gauge" jumped 16% yesterday, while the S&P 500 retreated just 0.3%. And a technical indicator shows it may keep rising. This week's macro events may be spurring investors to hedge.

Deutsche Bank revenue from bond trading is up this quarter, but a mid-term profitability goal looks "more ambitious," given the outlook for interest rates, the bank said at an investor day. Its CEO vowed not to ask shareholders for more money and got some help from the ECB, which cut the bank's capital burden for next year. Citi analysts said last month a capital increase can't be ruled out.

Ted Baker plunged after its chairman and interim CEO quit as the U.K. fashion chain struggles to put a scandal over its founder's workplace behavior behind it. The retailer suspended its dividend as it forecast pretax profit may drop more than 90% this year. Multiple profit warnings have deepened its woes since CEO Ray Kelvin resigned in March after allegations he gave staff unwanted hugs.

Author

Clint Sorenson, CFA, CMT

WealthShield