This week we get US CPI tomorrow – Realistically, the pseudo-macro trade situation rules the waves

This week we get US CPI tomorrow and a new University of Michigan consumer sentiment on Friday, although it may be too late to see the China deal effect. Germany reports ZEW tomorrow and Australia reports jobs on Wednesday. The UK reports GDP on Thursday.

Realistically, the pseudo-macro trade situation rules the waves. The problem is that the captain of the ship doesn’t have a compass and is half-drunk most of the time. Trump doesn’t drink but his erratic, chaotic behavior is characteristics of someone who does. Some folks think he is losing his marbles. He clearly can’t answer questions like whether he has to obey the Constitution and what does the Declaration of Independence say, and has only word salad about the obviously photo-shopped finger tattoos of the guy he sent to a foreign prison.

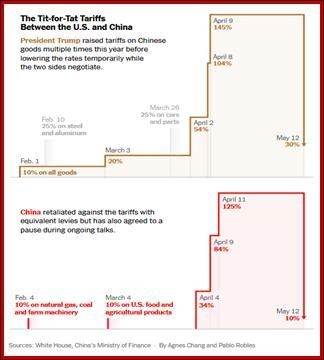

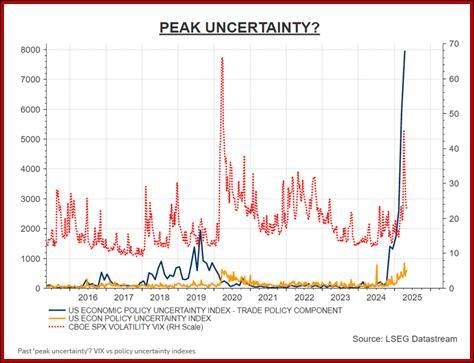

At a guess, it was TreasSec Bessent who saved the day on the China trade agreement, not yet a deal and only a 90-day reprieve but perhaps the beginning of the end. The UBS CIO told Reuters "Our view has been that peak uncertainty over trade has passed." It’s not over with twists and turns to come, but April market pressures point to more productive acts.

Reuters author Dolan doesn’t buy it. “The past two months have been sobering in that regard as recession fears ramped up, business and household confidence plummeted, annual stock market forecasts were slashed and fears of foreign investor flight mounted.

And few if any investors are confident about the eventual economic and inflation fallout from a global trade reset.”

Here’s the kicker: “Panic mode may have subsided. Outsize bets on the next direction seem brave at best.”

We still have a plateful of negatives—some companies refusing to project earnings. Consumer and small company gloom. Expectations of inflation and recession. And so on. Even if Q2 delivers a rebound, as the Atlanta Fed GDPNow projects, the effects of this trade crap can have long-lasting effects we can’t foresee. The best we can hope for it Bessent keeping Trump on the back foot, at least when it counts.

But don’t forget—tigers and stripes.

We guess Bessent, as a savvy hedge fund manager, could see the train coming down the tracks at 90 miles per hours and talked Trump into the 90-day pause. Now consumers can have dolls for Christmas. But Dolan is right—it’s not over by a long shot.

It should fo without saying that this daily on-again/off-again results in trendless charts and trend-following chart-readers are defeated by it.

Tidbit: The latest legal tap-dance from The White House is invoking suspension of habeas corpus (holding a body without charges) because the US is being invaded. The Trumpies say anyone here illegally is “invading.” This is ridiculous but you never know, the courts may side with it.

We’re not going into the historical cases. We were taught in 8th grade social studies that suspending habeas corpus during the Civil War was wrong. Now they want to come after the guy who mows your lawn. The US is not being invaded. The lawn guy is not an invader. Didn’t they find a lot of undocumented aliens at Mar-a-Lago during the first term? It’s kind of funny when the 8-year old with his mom is labelled an enemy invader. Also stupid.

Forecast

It should go without saying that this daily on-gain/off-again results in trendless charts and defeats all chart-readers. We think Trump will not stop disrupting the norms, laws and common sense of the workings of the world. The dollar will fall again.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat