The weakening of the USD halted, for now

USD’s weakening halted

The USD seems to have stabilised in today’s Asian session, after Monday’s tumbling in the FX market. Market attention now shifts towards the Fed’s interest rate decision which is to be released in tomorrow’s Asian session. The framework surrounding the decision also includes political pressure for the Fed to lower its rates by US President Trump’s Government which tends to weigh on the USD.

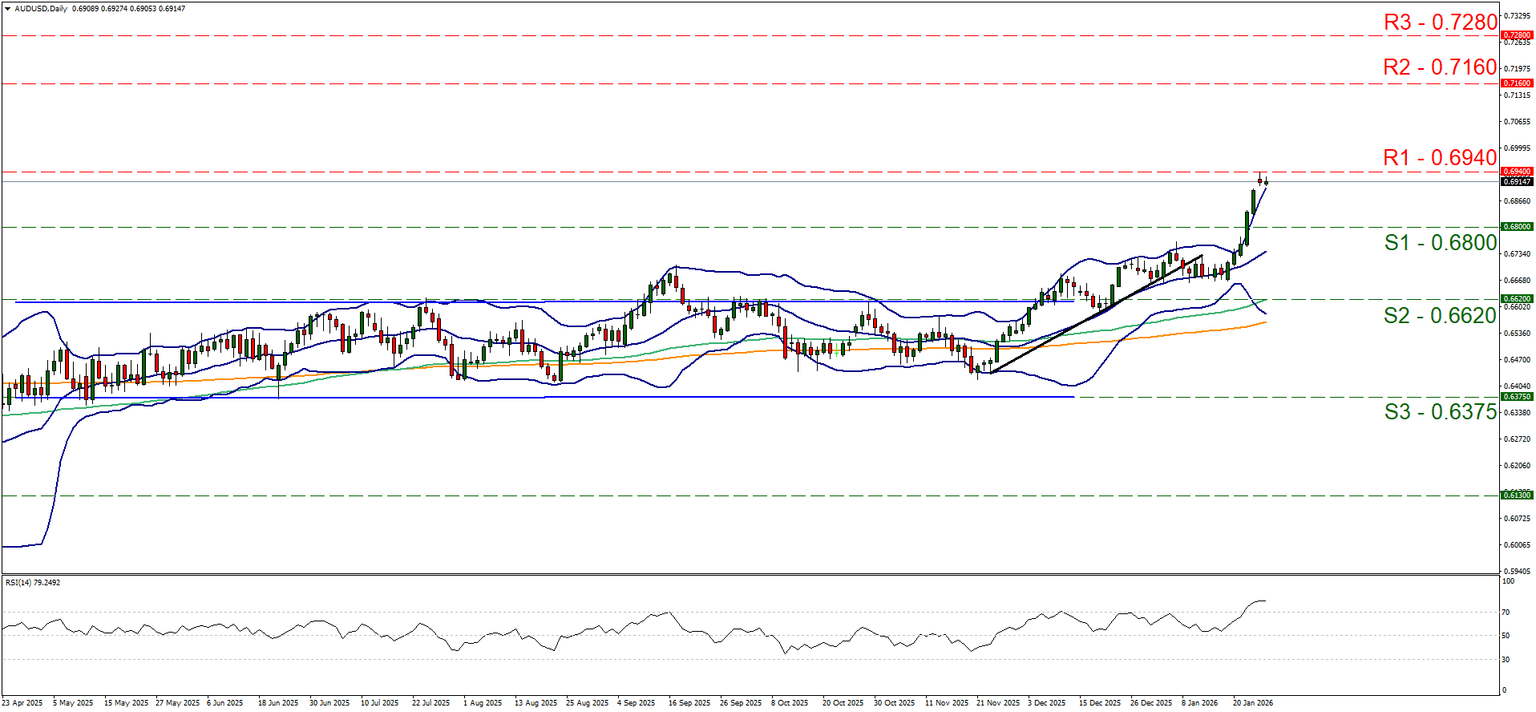

Tesla reports lower European sales, BYD catches up

Tesla’s European sales have reportedly dropped by almost 27% in the past year, signalling a smaller market share in the area. At the same time Chinese competitor BYD seems to be going strong, while Xiaomi’s SU7 electric sedan is reported to be outselling Tesla’s Model 3. The news could weigh on Tesla’s share price, while we also highlight the release of Tesla’s earnings report tomorrow in the aftermarket hours.

Oil prices fall as increased Kazakhstan production expected

Oil prices dropped yesterday and in today’s Asian session as oil market participants are worried for the increased oil supply from Kazakhstan. The drop was moderated, as strong winter storms are hitting oil production and refineries in the US Gulf region. Kazakhstan is reportedly ready to restart oil production from its largest oil field, as per a statement of its energy ministry yesterday, yet reports also state that oil production volumes are still rather low.

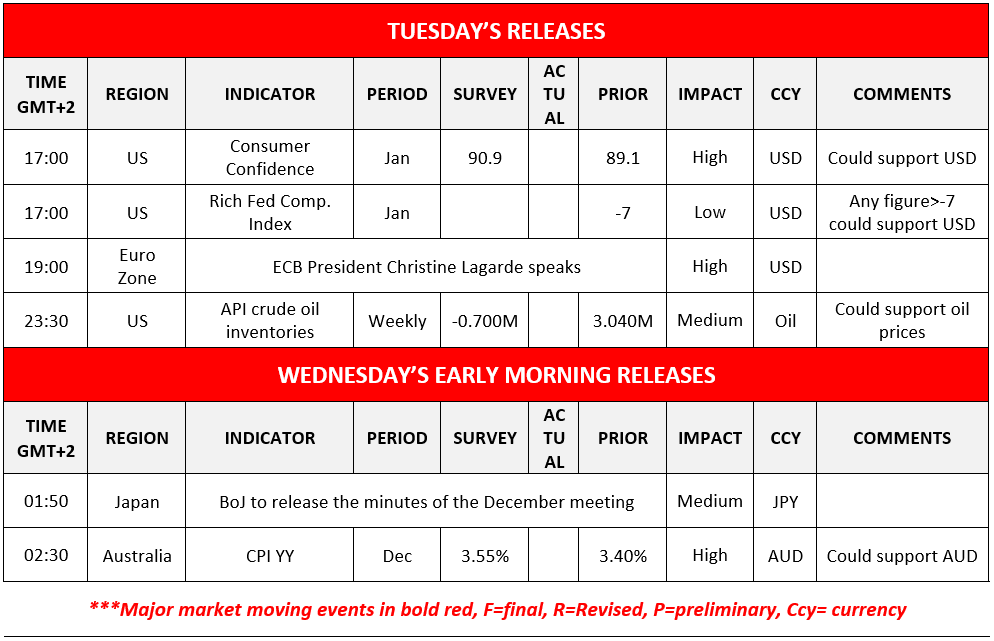

Australia’s CPI December rates due out

In tomorrow’s Asian session, we get Australia’s CPI Rates for December. The rates are expected to accelerate on a year on year basis and a possible acceleration beyond market expectations could provide some support for the Aussie as the market’s hawkish expectations for RBA’s intentions could be enhanced.

Charts to keep an eye out

AUD/USD’s rally seems to have hit a ceiling yesterday at the 0.63940 (R1) resistance line. The bullish outlook is still present yet we highlight that the pair seems to have reached overbought levels given that the RSI indicator is substantially higher than the reading of 70, which may imply that a correction lower is possible. Similar signals are stemming from the price action being above the upper Bollinger band. Should the bulls continue to be in the driver’s seat we may see AUD/USD breaking the 0.6940 (R1) resistance line paving the way for the distant 0.7160 (R2) resistance barrier. For a bearish outlook to emerge, we may see the pair’s price action breaking the 0.6800 (S1) support line aiming actively for the 0.6620 (S2) support level.

Tesla’s share price dropped yesterday after hitting the 452.00 (R1) resistance line on Friday. The company’s share price has been moving in a rangebound motion since the start of the month, between the 452.00 (R1) resistance line and the 417.45 (S1) support line and the RSI indicator is just below the reading of 50, hence we tend to maintain a bias for a sideways motion of Tesla’s share price for the time being. Should the bears take over, we may see Tesla’s share price breaking the 417.45 (S1) support line and open the gates for the 382.85 (S2) support base. For a bullish outlook to emerge, we would require the share’s price to break the 452.00 (R1) resistance line and start aiming for the 473.75 (R2) resistance level.

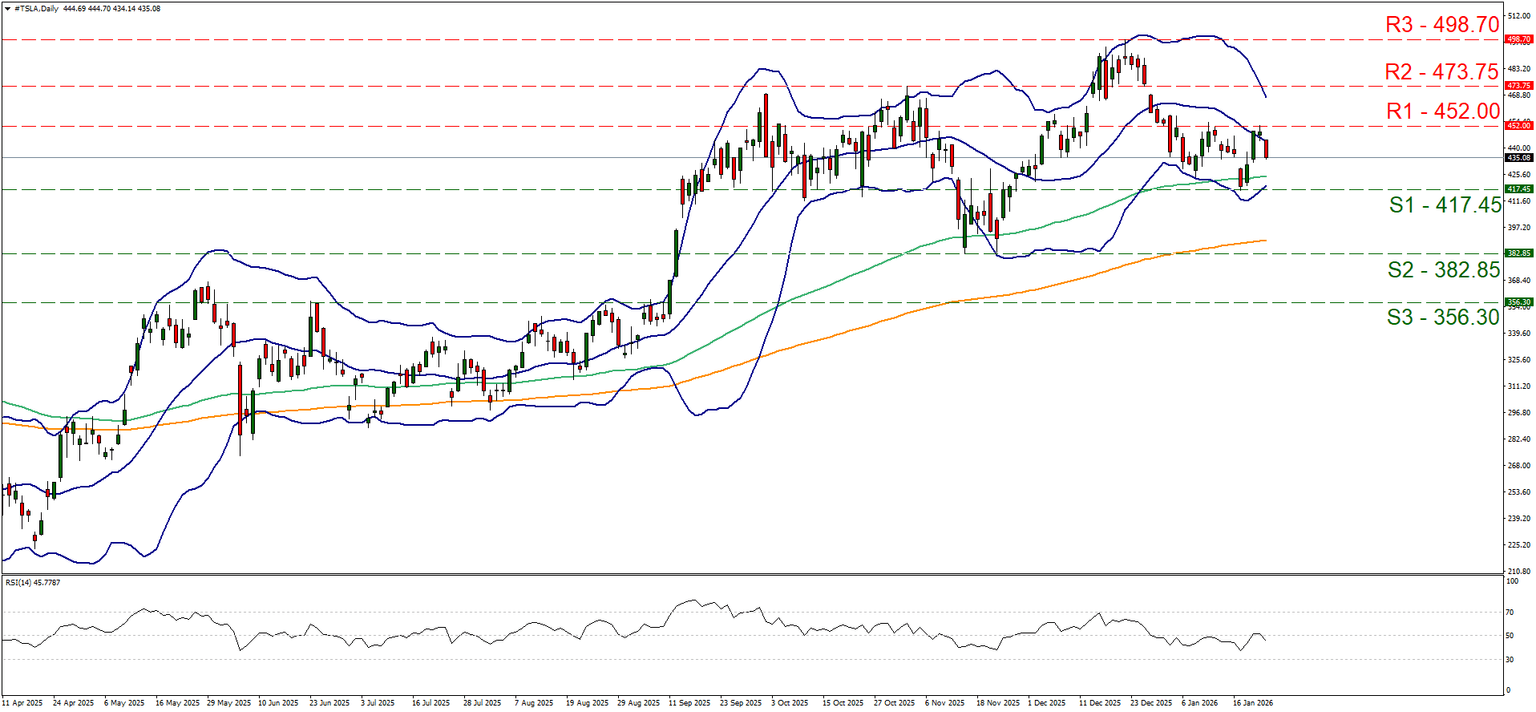

Other highlights for the day

Today we get from the US the consumer confidence for January and the Richmond Fed Composite index for the same month and later on the US API weekly crude oil inventories. On a monetary level, we note that ECB President Christine Lagarde speaks. In tomorrow’s Asian session, Australia’s CPI rates for December and in Japan, BoJ is to release the minutes of the last meeting.

Calendar follows

AUD/USD daily chart

- Support: 0.6940 (S1), 0.7160 (S2), 0.7280 (S3).

- Resistance: 0.6800 (R1), 0.6620 (R2), 0.6375 (R3).

TSLA daily chart

- Support: 417.45 (S1), 382.85 (S2), 356.30 (S3).

- Resistance: 452.00 (R1), 473.75 (R2), 498.70 (R3).

Author

Peter Iosif, ACA, MBA

IronFX

Mr. Iosif joined IronFX in 2017 as part of the sales force. His high level of competence and expertise enabled him to climb up the company ladder quickly and move to the IronFX Strategy team as a Research Analyst. Mr.