The US dollar was also stronger by 0.31%

Highlights:

Market Summary: Stocks dropped -0.27% yesterday. Volatility, as measured by the VIX index, was up over 6% on the day. The U.S. dollar was also stronger by 0.31%. Interest rates fell -6 basis points on the benchmark 10-year Treasury note. Copper was the worst performing asset class, falling -1.83%.

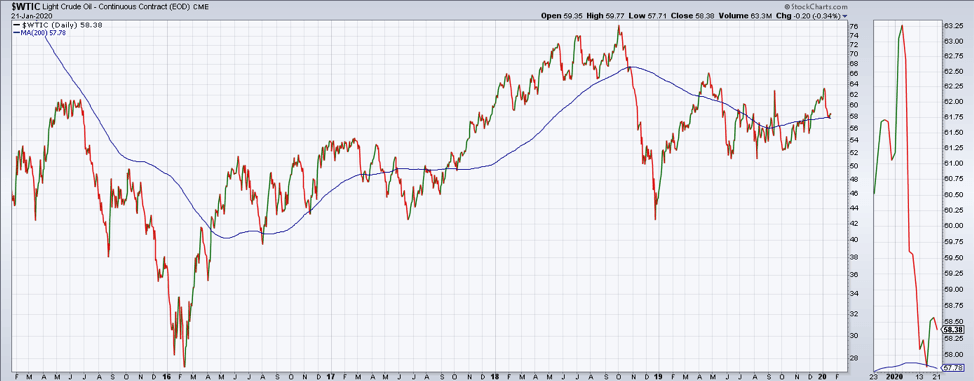

Oil: With threats of a virus epidemic affecting travel, west Texas crude oil dropped -0.34% on the day. Crude oil remains in a positive trend as it is above its 200-day moving average, having successfully tested it as support. Will oil break down here and lead stocks lower? Or is this a small correction before a larger uptrend move?

Momentum: The momentum factor was the top performing factor in U.S. equities yesterday. Momentum (MTUM) is at all-time highs and in a strong positive trend. The last couple of weeks has seen the momentum factor pick up strength on a relative basis versus the S&P 500. In our opinion this could mean that market participants are expecting an economic growth acceleration is underway.

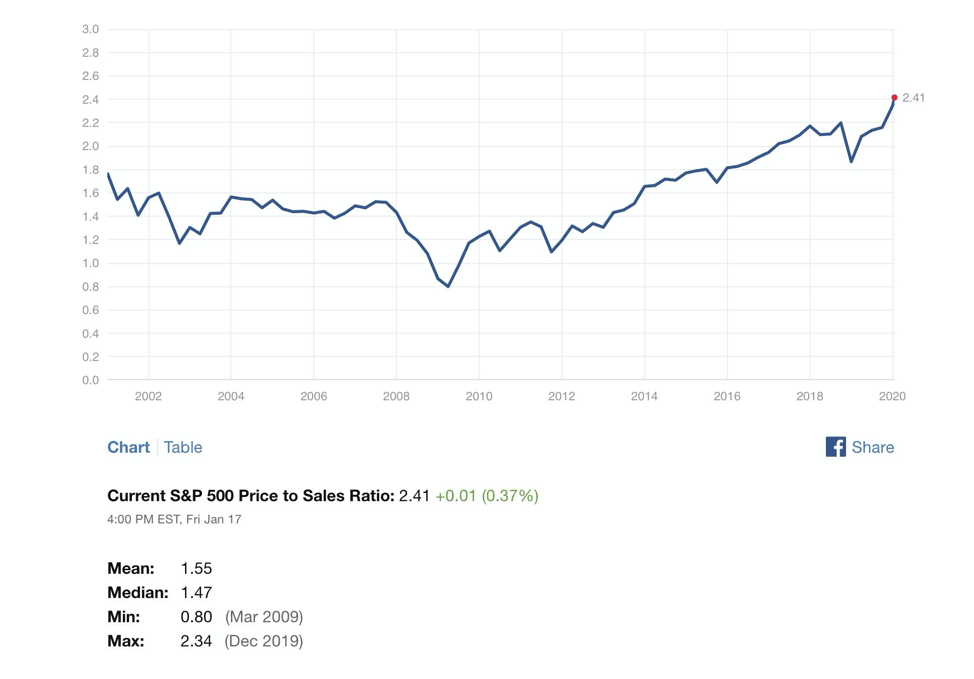

Chart of the Day: Price-to-Sales for the S&P 500: Nothing to see here. If anyone says that markets aren’t highly valued, we have to question what they are looking at. Remember valuations don’t matter anymore, for now.

Futures Summary:

News from Bloomberg:

Markets steadied after China's steps to contain the spread of the deadly coronavirus. U.S. futures rose with stocks in Asia, while European shares were little changed. Oil declined as Goldman said demand concerns over a potential epidemic would counter fears of supply disruptions in OPEC producers Libya, Iran and Iraq. Treasuries nudged up and the dollar was steady.

The virus is "under control" in the U.S., President Trump said at Davos in a Fox Business interview. Hong Kong reported its first case. The death toll rose to nine and the number of confirmed cases increased to 440. The WHO will decide today whether to declare an international public health emergency. Here's a look at why the illness is reviving fears of SARS and how airports and airlines are dealing with the outbreak.

The Senate set the rules for the impeachment trial. Republicans held together behind Mitch McConnell, with all 53 senators voting to shelve 11 Democratic amendments to subpoena new documents and testimony. The trial resumes today and may end next week if no new witnesses are called. Follow the developments with our Impeachment Update and here's a glimpse inside the trial.

Jeff Bezos may have been hacked by the Saudi Crown Prince. Digital evidence suggested the Amazon chief's phone was accessed after an exchange with Mohammed bin Salman on WhatsApp in mid-2018, people familiar said. The new details follow Bezos's dispute with The National Enquirer and Jamal Khashoggi's murder. Saudi Arabia called the reports "absurd."

Day two at Davos: Trump's agenda included breakfast with business execs and talks with the presidents of Kurdistan and Iraq. Treasury Secretary Steven Mnuchin dangled the prospect of retaliatory tariffs on car imports if countries go ahead with digital taxation plans. And Saudi's finance minister said an Aramco international listing is still in the cards. Check out the latest in our Davos Update.

Author

Clint Sorenson, CFA, CMT

WealthShield