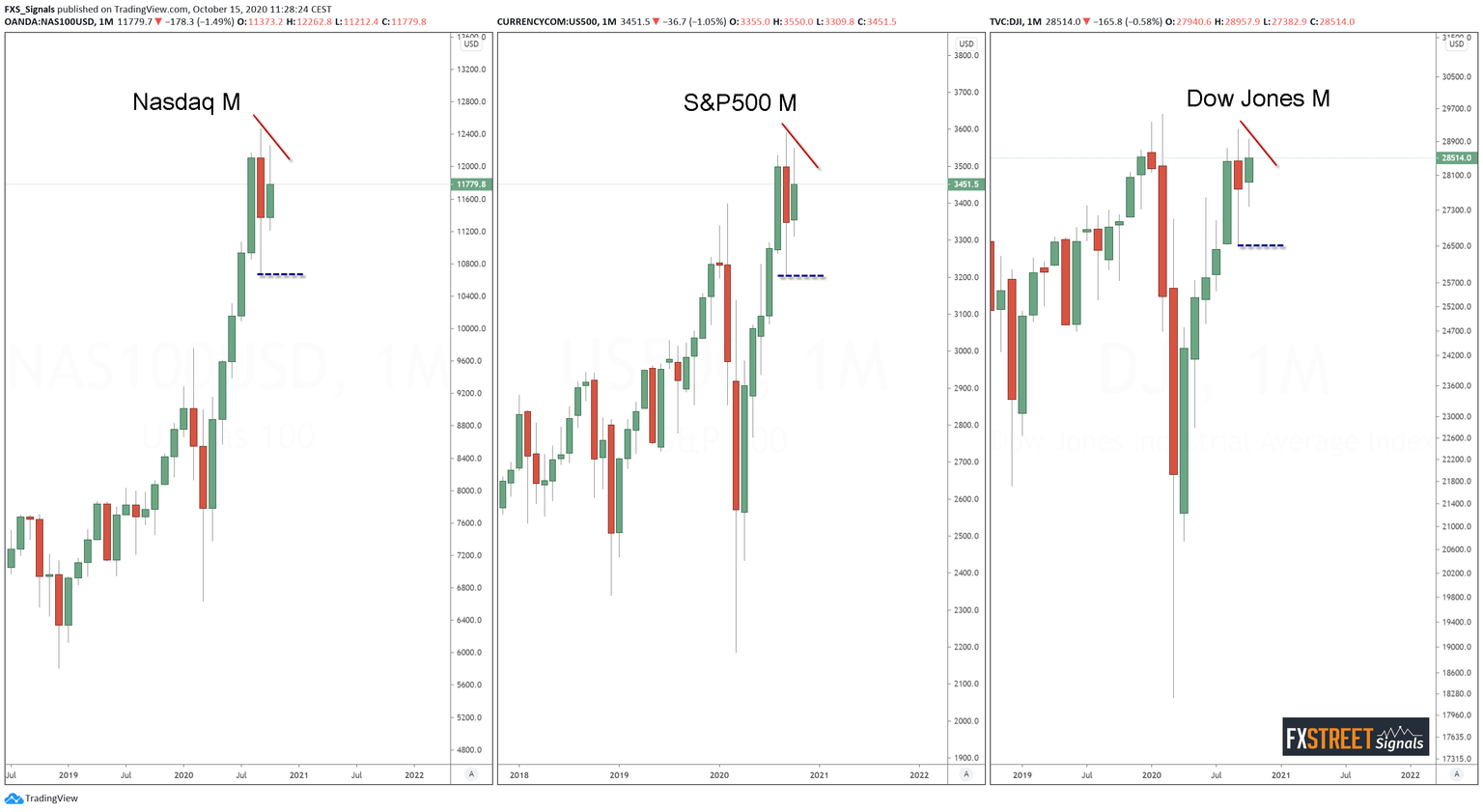

The three benchmark US indices

The three monthly charts depicting the US benchmark indices merits repeating again (we published a similar chart two weeks ago in the FXStreet Signals group) in order to gain a long-term perspective for risk appetite. In our analysis at the beginning of October, the most outstanding signal on these charts were the Japanese reversal patterns emerging on monthly candles.

Against our positioning, all indices recovered and failed to confirm the aforementioned patterns by breaking below the September lows. This means that we are still pending a confirmation which ideally should arrive at -or with- the Oct close. But so far, we can't speak of these patterns being invalidated either. All three indices failed to break above the September high. Remember, an invitation (or lack of confirmation) is a signal in itself. We don't have a signal for a continuation of the bull run either.

Looking at the global MSCI ACWI index, a global equity index set of large- and mid-cap stocks across 23 developed and 26 emerging markets (not shown in this chart) the same message comes across. An offsetting signal, on the other hand, arrives from the Russel 2000, which did violate the September high last week, but meanwhile, it has lost almost 50% of those gains.

We are repeating these updated charts for the benefit of new readers, but also for all of you who have endured JPY longs in the last two weeks, with the detriment of your equities.

For more info on the FXStreet Signals service click here.

Author

Gonçalo Moreira, CMT

Independent Analyst

As a trader in the foreign exchange market since 2005, Gonçalo Moreira honed his analytic and strategic skills through the Chartered Market Technician (CMT) designation.