The Risk Of Stagflation, Is It Real And What Is Stagflation? [Video]

![The Risk Of Stagflation, Is It Real And What Is Stagflation? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/financial-figures-7116094_XtraLarge.jpg)

Apple Warns And Markets Fall

Global Stocks fell after Apple warned about the impact of the Coronavirus.

Apple said that it does not expect to meet its second-quarter forecast for revenue due to global supply constraints for iPhones and lower Chinese demand as a result of the coronavirus outbreak.

So far those news are still pointing to temporary disruptions but what if we reach a tipping point where the temporary disruptions turn into more permanent, full-year hits across different industries and countries?

It Is Not Just Apple Warning

South Korea seems to be quite worried about its own economy given the shutdowns in China, which is the first country to cry out out like this. South Korea’s president warned about emergency steps that needed to be taken to prevent a growing crisis in South Korea which is a heavily China-reliant economy.

Even countries that may be considered China’s allies seem to have stopped buying from China for the time being as a Chinese trade Body reports:

China itself remains bullish about a V-shaped recovery

And frankly China needs this recovery because the amount of stimulus may destabilize its financial system if no growth follows which brings us to the topic of stagflation.

What Is Stagflation

In simple terms it is when inflation rises (like asset prices have) while the growth is declining. That has been pretty much the direction of the development globally.

Especially Japan with its Abenomics have clearly shown that the results of flooding the market with liquidity has not led to economic growth. Abenomics have failed Japan, just have a look at the latest GDP or industrial production figures out of Japan.

But central banks continue to provide liquidity which is essentially driving asset prices higher and higher while the economic output is shrinking and voila, here we have stagflation

Why do central banks continue to do so? Because they are badly trying to prevent a crash at all cost as it seems, but can it really be done? The risk of Stagflation is one of the costs they seem to accept thus far.

US Complacency At Record High

In the US none of these issues are considered too much, it seems neither by stock market prices nor by “the people” which could be seen as contrarian indicator:

In fact the government seems to be considering tax incentives for people to buy even more into these stock markets at record valuations and shrinking earnings.

I am sure it is just Uncle Sam looking out for everybody. My apologies but I cannot help it but to be a bit sarcastic about it.

FX

In FX the elevated price of the JPY despite the strong USD with EUR, AUD and NZD heavily losing would not indicate that currencies are pricing out the virus risk.

EUR and GBP both suffer from the EU-UK negotiations looking to be very difficult and may even not lead to any positive result. The French foreign minister Jean-Yves Le Drian, said the UK and the EU 'will rip each other apart' in trade talks. Important standouts on the calendar are the ZEW out of Germany, especially as Germany’s economy appears to be in deep trouble, and the unemployment figures out of the UK which should be closely eyed.

The RBA minutes made it clear that there will be an extended period of lower rates plus it does acknowledge the coronavirus risk to some extent which has been pushing the UAD back lower.

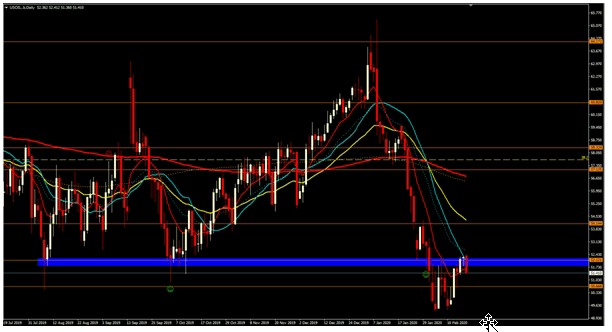

Oil and Gold

Oil is facing strong resistance at the $52 level which was a strong support in 2019 and now might become the most important resistance for WTI which is facing selling pressure after Russia remains reluctant to cut production in coordination with OPEC.

Gold experienced solid gains bringing its price back up close to $1,589 and a a break of the $1,590 resistance level could open the door to trade back within the $1,600 especially considering all the mounting risks.

BTC

After Bitcoin failed to hold within the $10k it found support around $9.5k and reclaimed the $9.7k this morning. While the immediate outlook cannot be called bullish any longer the mid term outlook cearly still is and the present drop could be seen as nothing but a normal correction within the trend up.

Author

Alexander Douedari

Independent Analyst

Alexander Douedari is an Award Winning Hedge Fund Manager and Selfmade 7-Figure Trader. Now Mentor for Students all around the world.