The outlook for corporate debt in a rising rate environment

Forgive us our debts

The amount of outstanding debt in the non-financial corporate sector currently sits at an all-time high. With the Federal Reserve set to raise short-term interest rates sharply, it is reasonable to be concerned about the corporate sector's ability to withstand higher rates. Our sense is that because a large share of corporate debt is locked into low fixed-rate financing, there is little cause for alarm over elevated corporate debt levels even in the context of a rising rate environment, at least at this time. For the sake of being thorough however, we present some hypothetical scenarios to analyze the future path of the interest coverage ratio in the non-financial corporate sector in a rising rate environment. We find that even in the scenario in which interest expenses rise the most, the non-financial corporate sector should not experience significant debt serviceability issues, at least through the end of next year.

-

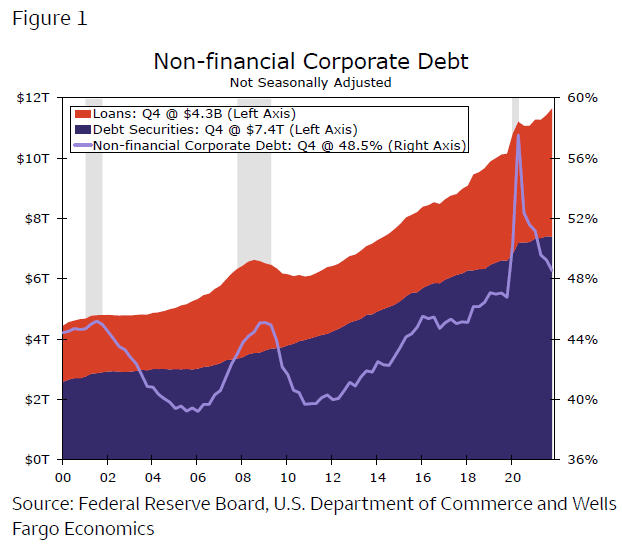

After having nearly tripled from a little over $4 trillion at the turn of the century to nearly $12 trillion today, non-financial corporate debt stands at an all-time high.

-

The Federal Reserve has already raised short-term interest rates twice this year. With more rate hikes seeming all but assured, financial markets have become preoccupied with the implications of monetary tightening for the economy.

-

Thanks to record corporate earnings and low financing costs, the interest coverage ratio in the non-financial corporate sector is at its highest level in at least four decades.

-

With around 70% of corporate debt fixed at low rates, we are not overly concerned at this time about the ability of the non-financial corporate sector to service its debt, even in the face of higher rates.

-

We consider two scenarios regarding the refinancing of maturing corporate debt and what that financing cost might look like in the context of our forecast for interest rates and amid flat corporate earnings over the next few years.

-

Under both of our scenarios, the interest coverage ratio recedes from its current high. But even in the scenario in which interest expenses rise the most, the ratio falls to roughly the midpoint of its range during the prior expansion.

-

There is plenty to worry about these days, but elevated corporate debt does not rise to the top of our list. In our view, non-financial corporate debt is generally manageable for the foreseeable future even if rates rise in line with our above-consensus forecast.

Non-financial corporate debt stands at an all-time high

Let's start with the basics. The amount of debt in the non-financial corporate (NFC) sector has almost tripled from $4.4 trillion at the turn of the century to nearly $12 trillion today (Figure 1). Unlike smaller non-corporate entities, NFC companies can issue debt securities in the corporate bond market, and corporate bonds currently account for around 70% of NFC debt outstanding. This marked increase in the total amount of NFC debt over the past two decades may appear to be troubling, but the size of the U.S. economy has also grown significantly over that period. But even measured as a percent of GDP, NFC debt is higher today than it was prior to the pandemic.

But it is not the outstanding amount of debt per se, or even the debt-to-GDP ratio, that matters for the financial viability of companies. Rather, it is the ability of those companies to service that debt that matters. As shown in Figure 2, the interest coverage ratio, which measures the ability of EBIT (i.e., earnings before interest and taxes) to cover interest expenses, has risen to its highest level in at least 40 years.2 Not only has EBIT risen sharply in the aftermath of the economy's shutdown in Q2-2020, but interest expenses have also receded from their pre-pandemic levels due to the sharp decline in interest rates. In short, most NFC enterprises can easily service their debt at present.

Author

Wells Fargo Research Team

Wells Fargo